Sales Transactions

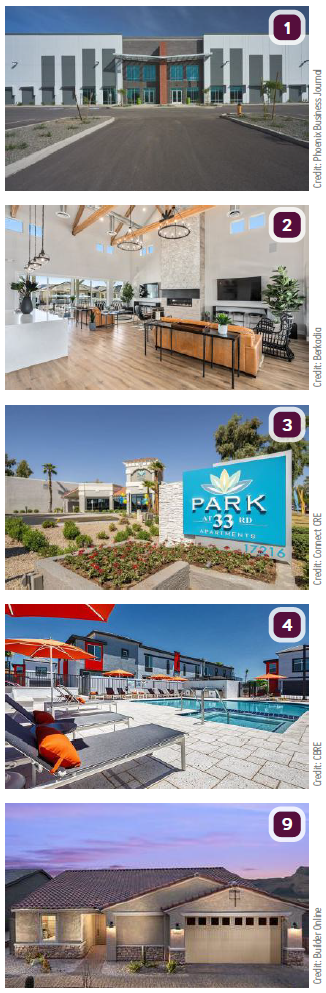

1. JLL Income Property Trust bought the Lotus Project, a four-building, 474KSF, Class A distribution center complex in Chandler for $91M, from Conor Commercial Real Estate. JLL Income Property Trust is calling the development the Southeast Phoenix Distribution Center.

1. JLL Income Property Trust bought the Lotus Project, a four-building, 474KSF, Class A distribution center complex in Chandler for $91M, from Conor Commercial Real Estate. JLL Income Property Trust is calling the development the Southeast Phoenix Distribution Center.

2. Logan Capital Advisors purchased The Bungalows on Jomax, a 141-unit garden-style, horizontal, low density, single-family and build-for-rent community at 27441 N. Black Canyon Highway, Phoenix, for $42M, from Bungalows on Jomax, LLC. Senior Managing Directors Mark Forrester and Ric Holway, Senior Director Dan Cheyne and Director Andrew Curtis of Berkadia’s Phoenix office completed the sale on behalf of the seller. Managing Director Jeff Stuart of Berkadia’s Seattle office secured $25.2M in permanent acquisition financing for the property on behalf of the buyer.

3. SAM Residential Group purchased Park at 33rd, a two-story 224-unit multifamily property near 35th Avenue and Bell Road, Phoenix, for $41M. Cliff David of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller, KA Capital, and procured the buyer.

4. Luna Bear ARA Residences LLC purchased Ara Residences, a newly constructed, 50-unit townhome community at 3220 N. 38th Street, Phoenix, for $22.05M. Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke of CBRE in Phoenix represented the seller, ARA Residences, LP, and the buyer.

5. Langley Properties acquired 709 acres of land at SEC of Arizona Farms and Felix roads in Florence, for $21.7M, from Sunbelt Holdings. Nate Nathan of Nathan & Associates acted as the broker for both the buyer and seller. The buyers intend to finish the entitlement process for a large master-planned community.

6. Goodyear 10 & 303 LLC acquired 138.96 acres of land at the SEC of North Citrus Road and I-10 in Goodyear for $16.5M, from Roles Inn of America. The seller brokers were John Finnegan and Ramey Peru of Colliers International. The buyers intend to use the land for the Innovation Centre project, a master planned employment hub with office, commercial, retail, light-industrial and entertainment uses.

7. JEN Partners and TerraWest Communities purchased 197 acres at the NEC of Schnepf and Combs roads in San Tan Valley for $16.4M, from Wales Ranch LLC, marking the first step toward nearly 2,000 new homes planned there. Nate Nathan of Nathan & Associates Inc. brokered the land deal, along with his team David Mullard and Casey Christensen. Ashton Woods will be purchasing all of the lots from JEN Partners and will be responsible for all development activities.

8. APT Capital Group purchased INDI Tucson, a 93-unit, four-building apartment complex at 1920 N. First Avenue, Tucson, for $8M, from a California-based private investment group. ABI Multifamily’s Alon Shnitzer, Rue Bax, John Kobierowski, Doug Lazovick, and Eddie Chang represented both parties in the sale.

9. Mattamy Homes purchased a 22-acre portion of the Gladden Farms master-planned community in Tucson, for $7.5M. The neighborhood planned for the site will be known as Glenmere at Gladden Farms.

10. K Hovnanian Homes acquired 80 partially finished lots at the NWC of Higley Road and Hunt Highway near Queen Creek for $5.8M, from Wayne DeStefano. The lots are part of the planned Santanilla community.

11. 133 acres at the NEC of Broadway and Rooks roads, Buckeye, traded hands for $4.655M in a related sale between two entities tracing to David Fretz — The Tyson Family and Friends LLC and the Tyson Family LP.

12. 155.53 acres of agricultural land at the SEC of Apache and Beloat roads, Buckeye, sold for $4.185M. The buyer was Uppal Land LLC and the seller was WJW Hindman 2005 LLC.

13. The M. Steven and Kathleen Davidson Family Trust purchased the Coronado Hotel Apartments, an 11.3KSF, 30-unit multifamily facility with an additional ground floor commercial space at 402 E. 9th Street, Tucson, for $3.6M, from Carbon Cabo, LLC. Allan Mendelsberg, Principal, and Conrad Martinez, Multifamily Specialists with Cushman & Wakefield | PICOR, represented both parties.

14. An undisclosed buyer purchased +/- 28.60 acres at the SWC of Pima and Via Dona Roads, Scottsdale, for $3.1M. Howard Weinstein and Patty Lafferty of The Land Agency represented the undisclosed sellers.

14. An undisclosed buyer purchased +/- 28.60 acres at the SWC of Pima and Via Dona Roads, Scottsdale, for $3.1M. Howard Weinstein and Patty Lafferty of The Land Agency represented the undisclosed sellers.

15. Dash Investments, LLC purchased Casa Grande Village Apartments, a 35.5KSF, 52-unit apartment complex at 5950 S. Park Avenue, Tucson, for $2.85M, from RM Jak Properties, LP. Allan Mendelsberg, Principal, and Conrad Martinez, Multifamily Specialists with Cushman & Wakefield | PICOR, represented both parties.

16. Garrett Walker/Landsea Homes acquired 36 lots at the SWC of Verrado Way and Yuma Road, Buckeye, from Builder Capital for $2.466M. The lots are part of Sundance Parcel 48.

17. The Kemper & Ethel Marley Foundation bought 138 acres at the NWC of Turner Road and Southern Avenue for $2.337M from B Bar G Farms. The vacant land is zoned for a proposed planned community called Silver Rock in the City of Buckeye. No plans have been provided at this time.

Lease Transactions

18. Sam Levitz Furniture Company leased 59.7KSF of retail space located at 300 S. Toole Avenue in Tucson, from Levin Family Limited Partnership. Greg Furrier, Principal, and Retail Specialist with Cushman & Wakefield | PICOR, represented the tenant. Jesse Blum with CBRE, Tucson, represented the landlord.