Sales Transactions

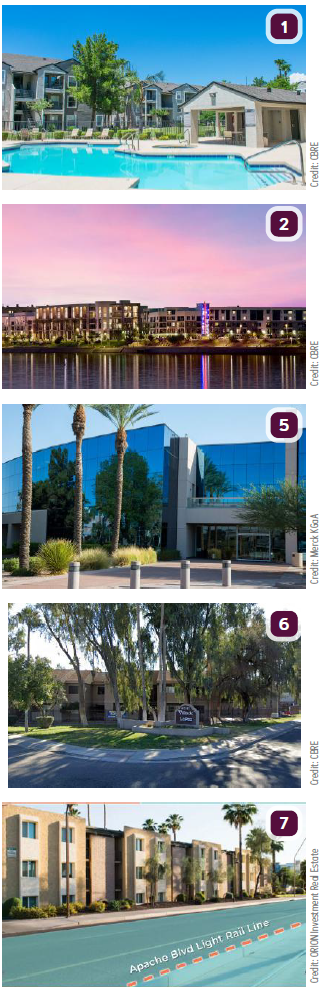

1. Millburn & Company purchased Heritage at Deer Valley, an 832-unit multifamily community at 3010 W. Yorkshire Drive, Phoenix, for $178.5M. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter and Matt Pesch of Phoenix Multifamily Institutional Properties represented the seller, Priderock Capital Partners. The transaction represents the highest sale price for a single multifamily community in Phoenix history.

1. Millburn & Company purchased Heritage at Deer Valley, an 832-unit multifamily community at 3010 W. Yorkshire Drive, Phoenix, for $178.5M. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter and Matt Pesch of Phoenix Multifamily Institutional Properties represented the seller, Priderock Capital Partners. The transaction represents the highest sale price for a single multifamily community in Phoenix history.

2. Oxford Properties Group purchased Ten01 on the Lake, a 523-unit multifamily community at 1001 E. Playa del Norte Drive, Tempe, for approximately $146M. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter, and Matt Pesch of Phoenix Multifamily Institutional Properties represented the seller, a global real estate investment manager.

3. Tides Equities purchased the 374-unit, Crosswinds apartment community at 868 S. Arizona Avenue, Chandler, for $54.25M, from Emma Capital Investments. Brad Cooke, Cindy Cooke, Matt Roach and Chris Roach of Colliers International in Arizona handled the sale transaction.

4. Held Properties, Inc. purchased the Raintree Corporate Center I, a 149.4KSF, Class A office project at 15333 N. Pima Road, Scottsdale, for an undisclosed amount. Newmark Knight Frank’s Executive Managing Director CJ Osbrink cooperated with Co-head of U.S. Capital Markets Kevin Shannon, Executive Managing Directors Ken White, Sean Fulp, Brunson Howard and Paul Jones and Senior Managing Director Rick Stumm to represent the seller, ViaWest Group. The buyer was self-represented.

5. Merck KGaA, Darmstadt, Germany, a leading science and technology company, announced an investment of $22M at its site in Tempe. The company previously leased the 95KSF from Lexington Tempe L.P. As part of this transaction, Merck KGaA, Darmstadt, Germany acquired Lexington’s ground leasehold interest in the facility, which is located within the Arizona State University Research Park.

6. WhiteHaven Capital purchased Villa De La Paz, a 104-unit apartment complex at 6041 W. Thomas Road, Phoenix, for $16M. CBRE’s Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke represented the buyer and the private sellers, Cornelius Covaci and Daniela F. Covaci. Financing was arranged through CBRE Capital Markets.

7. ORION Investment Real Estate represented the undisclosed buyer and seller in the sale of Sunset Villas, a 63-unit multifamily community at 1415 E. Apache Boulevard, Tempe, for $8.1M.

8. The Carlyle Group Inc. purchased the 178-site Mesa Sunset RV Resort, 9252 E. Broadway Road, Mesa, for $7.75M, from Silver Sands Acquisitions LLC. Derek Harris, founder and principal of Harri5, represented the buyer, while Ross Cooper, owner of New Horizons Realty, represented the seller.

9. Gibralter Holdings LLC purchased a 3.15-acre site at 1760 W. Irvington, Tucson, for $3M. The site is fully entitled for a three-story, 100KSF building with 1,200 units. Bill Alter of Rein & Grossoehme Commercial Real Estate, LLC represented the undisclosed seller. The new facility will be managed by Life Storage.

10. BYPG Holdings LLC was the successful bidder in a recent land auction. The buyer purchased 26.216 acres of State Trust Land at SWC of Hunt Highway and Roberts Road in San Tan Valley, for $2.35M.

10. BYPG Holdings LLC was the successful bidder in a recent land auction. The buyer purchased 26.216 acres of State Trust Land at SWC of Hunt Highway and Roberts Road in San Tan Valley, for $2.35M.

11. River People LLC, a group of local investors managed and operated by Rick Volk of Volk Company, purchased the three-building, 39.4KSF former Banner-University Medical Center Tucson Campus at 655 E. River Road, Tucson, for $2.045M. Pat Williams, Vicki Robinson and Chris Comey of JLL – Jones Lang LaSalle Phoenix represented the seller and the investors were self-represented.

12. A joint venture between Barker Pacific Group (BPG) and Artemis Real Estate Partners (Artemis) has acquired three, newly built, climate-controlled self-storage properties in Gilbert and North Phoenix. The Class-A facilities total 234.4KSF and feature 2,189 storage units.

Lease Transactions

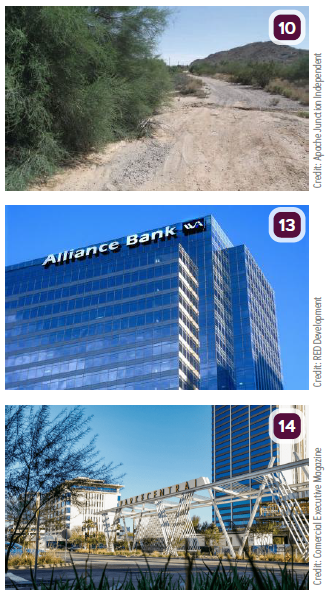

13. RED Development announced that Western Alliance Bank is once again expanding its foothold at CityScape Phoenix after signing a lease to add an additional 46.3KSF to its existing headquarters. While the changes brought Western Alliance Bank’s headquarters to approximately 155KSF across six floors, this latest milestone will also create 110 new seats to accommodate new part-time, remote and contract employees, as well as offering meeting rooms.

14. RadNet, Inc., a national leader in providing high-quality, cost-effective, fixed-site outpatient diagnostic imaging services, has signed a new lease for a 24KSF space in the Strauss Building at Park Central. Plaza Companies and Holulaloa Companies are the developers for Park Central.