Sales Transactions

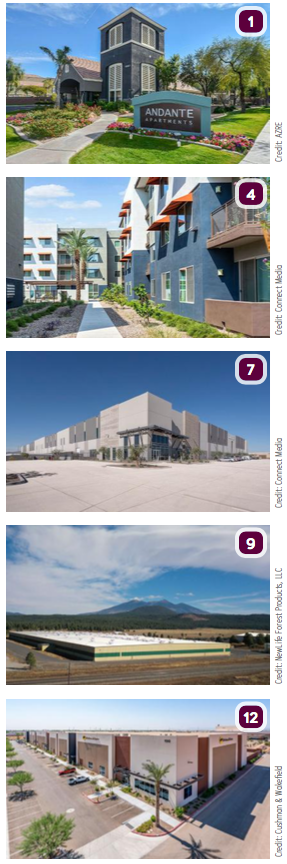

1. MG Properties purchased Andante Apartments, a 576-unit, 32-building complex at 15801 S. 48th Street, Phoenix, for $145.25M, from Security Properties. CBRE Capital Markets financed $99.5M in new Fannie Mae debt.

1. MG Properties purchased Andante Apartments, a 576-unit, 32-building complex at 15801 S. 48th Street, Phoenix, for $145.25M, from Security Properties. CBRE Capital Markets financed $99.5M in new Fannie Mae debt.

2. Equity LifeStyle Properties purchased the Dolce Vita multifamily residential complex for $90M, from Northwestern Mutual Life Insurance Co.

3. Bluerock Real Estate purchased Cielo on Gilbert, a 432-unit apartment complex at 1710 S. Gilbert Road, Mesa, for $74.25M. The seller was Capital Real Estate.

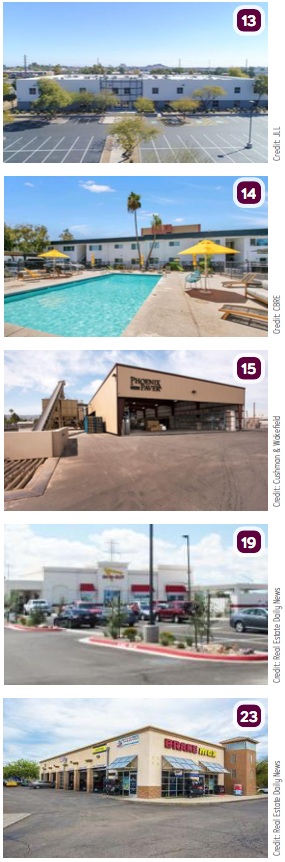

4. A group of investors that included Keller Investment Properties’ Scott Keller purchased Metro 101 Apartments, a 259-unit multifamily community at 2157 E. Apache Boulevard, Tempe, for $69M, from a group including an affiliate of Southwest Next Capital Management. Prime Finance Partners provided $48.3M in new debt for the deal.

5. Barbara Novogradac purchased Lumina on 19th Apartments, a 488-unit multifamily residential complex at 1905 W. Las Palmaritas Drive, Phoenix, for $60M. The seller was Tides Equities.

6. KA Capital LLC purchased Maryland Meadows Apartments, a 364-unit complex at 6444 N. 67th Avenue, Glendale, for $57M. The seller was Raymond Kao.

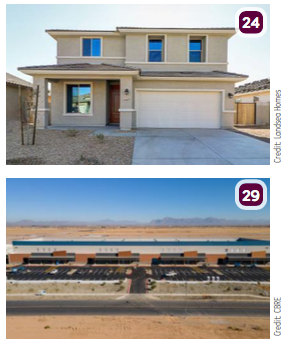

7. KKR acquired PV303 West II, a 263KSF industrial distribution property at 17017 W. Indian School Road, Goodyear, for $43.2M, from developers Provident Real Estate Ventures and Merit Partners. Cushman & Wakefield’s Will Strong, Greer Oliver, and Connor Nebeker-Hay brokered the deal.

8. Cohen Asset Management purchased the Riverside Industrial Center, a 376.8KSF industrial building at 51st Avenue and Buckeye Road, Phoenix, fully leased to Vital Pharmaceuticals, the maker of Bang Energy drinks, for $39.1M. Tom Storey of Gantry arranged the financing for the building sale, a 12-year, $21.6M acquisition loan with Nationwide Life Insurance.

9. Good Earth Power AZ and its operating entity, NewLife Forest Products has acquired a large-scale, 425KSF industrial manufacturing facility at 14005 W. Old Highway 66, Bellemont, for an undisclosed amount. The new facility will produce 120 million board feet per year of lumber in addition to engineered wood products and will begin late March.

10. Colrich Group, Inc. purchased HUE97 Apartments, a 184-unit multifamily property at 9736 E. Balsam Avenue, Mesa, for an undisclosed amount. NorthMarq’s Phoenix investment sales team of Trevor Koskovich, Bill Hahn, Jesse Hudson and Ryan Boyle, represented the buyer and seller, Dominium Group, Inc. NorthMarq’s San Diego debt and equity team of Steve Hollister and Aaron Beck financed the acquisition with a $32.1M Freddie Mac loan.

11. MBRE Healthcare purchased the 35.7KSF Arizona Spine & Joint Hospital at 4620 E. Baseline Road, Mesa, for $25M, from Hammes Co.

12. GID Industrial purchased a new, 135.7KSF light industrial building at 196 S. McQueen Road, Gilbert, for $23.2M. Executive Managing Director Will Strong, Associate Greer Oliver, and Analyst Connor Nebeker-Hay of Cushman & Wakefield’s National Industrial Advisory Group represented the seller, SunCap Property Group, who developed the building in 2019 as part of their 62-acre Gilbert Spectrum Business Park. Chris McClurg & Ken McQueen of Lee & Associates provided leasing advisory.

13. A charitable foundation purchased the Broadway Business Center, a two-building, 137KSF office property at 3925 and 3945 E. Broadway Road, Phoenix, for $18.55M. JLL’s Brian Ackerman and Ben Geelan represented the seller, G2 Capital, and procured the buyer.

13. A charitable foundation purchased the Broadway Business Center, a two-building, 137KSF office property at 3925 and 3945 E. Broadway Road, Phoenix, for $18.55M. JLL’s Brian Ackerman and Ben Geelan represented the seller, G2 Capital, and procured the buyer.

14. A private capital investor purchased 454 West, an 80-unit multifamily property at 454 W. Brown Road, Mesa, for $15.1M. Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke of CBRE in Phoenix represented the buyer and the seller, 454 West Brown Apartments LP.

15. An individual investor with the surname Wilcox, purchased the Phoenix Paver company headquarters and production facilities totaling 73KSF, at 515 & 545 Elwood Road (Plant One), 301 Elwood Street (Plant Two and Headquarters), 101 W. Elwood Street (Plant Three), and 314 W. West Road (Warehouse Facility and Future Plant 4), for $14M. Bob Buckley, Tracy Cartledge and Chris Hollenbeck of Cushman & Wakefield’s Capital Markets in Phoenix represented Phoenix Paver. Subsequent to the sale, Phoenix Paver signed a long-term lease for the entire properties.

16. Cypress West Partners acquired La Cholla Medical Plaza, a 66.3KSF, two-story medical office property at 6130 N. La Cholla Boulevard, Tucson, and Rancho Vistoso Urgent Care, a 50KSF building at 13101 N. Oracle Road, Oro Valley, for $12.77M. The seller was Healthpeak Properties.

17. Crescent Acquisitions, LLC purchased 8.605 acres of land at 1801 N. Pecos Road, Gilbert, for $7.496M. NAI Horizon’s Lane Neville and Logan Crum represented the seller, Gilbert Growth Properties. The buyer was self-represented.

18. The Wright-Pantano LLC purchased a 7.8KSF retail center at 1785 W. Valencia Road, Tucson, for $3.544M. The center is occupied by Go Wireless, Pizza Patron, Nationwide Vision and Great Clips. Terry Dahlstrom of VOLK Company represented the seller, Steamroller LLC. Volk Company’s Brenna Lacy and Kevin Volk will continue to handle the leasing.

19. In-N-Out Burger Corporate purchased the recently constructed, 3.8KSF In-N-Out Burger at 1100 W. Irvington Road, Tucson, for $3.5M, from Irvington Interstate Partners, LLC.

20. Vault at Old Vail Road, LLC purchased a self-storage building at 7475 E. Old Vail Road, Tucson, for $3.2M. NAI Horizon’s Denise Nunez and Victoria Filice, represented the buyer. The seller, America’s Best Self Storage, LLC, was self-represented.

21. A private investor purchased Garden View, a 15-unit apartment property at 3120 E. Paradise Lane, Phoenix, for $2.175M. Paul Bay, vice president investments in Marcus & Millichap’s Phoenix office, had the exclusive listing to market the property on behalf of the seller, a limited liability company. James Crawley, investment associate in the firm’s Phoenix office, procured the buyer.

22. A private investor purchased Venture on 66th, an eight-unit apartment building in Old Town Scottsdale for $2.1M. Neighborhood Ventures, Arizona’s first real estate crowdfunding company, was the seller.

23. 6055 Jenna Nicole, LLC purchased a single-tenant, 5.5KSF BrakeMAX at 6055 W. Jenna Nicole Lane, Marana, for $2.06M. CBRE’s Nancy McClure in Tucson, along with Philip D. Voorhees and Jimmy Slusher in Newport Beach, Calif. represented the local private seller. The buyer was represented by Danny Gardiner and Chad Tiedeman, Phoenix Commercial Advisors.

24. Landsea Homes announced the acquisition of 1,067 finished single-family homesites at Eastmark in Mesa and El Cidro in Goodyear. Green Court at Eastmark consists of 133 finished lots and Auto Courts at Eastmark consists of 90 finished lots, all part of Landsea Homes’ Performance Collection. The El Cidro community consisted of 844 lots.

24. Landsea Homes announced the acquisition of 1,067 finished single-family homesites at Eastmark in Mesa and El Cidro in Goodyear. Green Court at Eastmark consists of 133 finished lots and Auto Courts at Eastmark consists of 90 finished lots, all part of Landsea Homes’ Performance Collection. The El Cidro community consisted of 844 lots.

Lease Transactions

25. NAI Horizon’s Isy Sonabend and Drew Eisen represented the landlord, IOV 2600 McDowell, LLC in a 124-month industrial lease for 47.9KSF at 2600 W. McDowell, Phoenix. The tenant, Bragg Crane was represented by Chris McClurg with Lee & Associates.

26. NAI Horizon’s Jay Olson and Rick Foss represented the tenant, Carter Architectural Panels, Inc. in a 63-month industrial lease for 15KSF at 7925 E. Ray Road, Mesa. The landlord, DM Landing 303 Sub, LLC was represented by Alex Wentis with CBRE Industrial Properties.

27. NAI Horizon’s Chris Gerow, Shelby Tworek, Gabe Ortega and Patrick Anthon represented the landlord, AERI Paradise Hills, LLC in a 120-month retail lease for 13.6KSF at 10654 N. 32nd Street, Phoenix. The tenant, UJ Santee, LP was represented by Jennifer Hill with Diversified Partners.

28. NAI Horizon’s Matt Harper, CCIM, represented the tenant, Stepping Stone Adult Development Center, LLC in a 66-month retail lease for 11.8KSF at 12228 N. Cave Creek Road, Phoenix. The landlord, Hampton Plaza, LLC was represented by Kyle Davis with CPI.

29. CBRE announced that Skybridge Arizona has preleased its first hangar to a private jet operator in Mesa. CBRE’s Jackie Orcutt, Kevin Cosca and Pete Wentis represented the developer, Skybridge Arizona in the 10.3KSF lease transaction.

30. NAI Horizon’s Jeff Adams represented the tenant, PPE Engineering, LLC in a 63-month industrial lease for 10.2KSF at 1130 W. Alameda Drive, Tempe. The landlord, Icon Owner Pool 1 West/Southwest, LLC was represented by Evan Koplan, Jackie Orcutt, Serena Wedlich and Jonathan Teeter with CBRE Commercial.

NEWS TICKER

- [September 12, 2025] - Tempe DRC Recommends Approval for 72-Unit Live-Work Development

- [September 12, 2025] - Input Prices Up 0.2% in August

- [September 12, 2025] - Arizona Projects 09-12-25

- [September 10, 2025] - Goodyear Seeking Developer for Ballpark Village Mixed-Use

- [September 9, 2025] - Opus Group Planning 300KSF Industrial Park Near Sky Harbor

- [September 9, 2025] - Multifamily Development Planned in Tucson’s Miracle Mile

- [September 9, 2025] - Construction Employment Down for Third Straight Month

- [September 9, 2025] - Industry Professionals 09-09-25