Sales Transactions

1. Amazon Data Services purchased two parcels in Laveen from IDM Companies for $277.3M. IDM had previously completed multiple rezonings to allow for future industrial development along the Loop 202 South Mountain Freeway in Laveen’s “technology corridor”. The two parcels of land near 63rd Avenue and Dobbins Road total more than 200 acres.

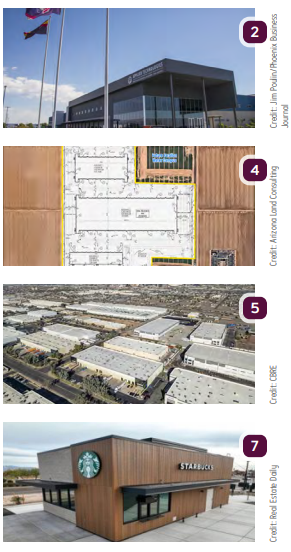

2. American Leadership Academy purchased a 225.9KSF charter school campus in Mesa for more than $80M. The 2022 campus was built by Schoolhouse Development on 22.2 acres at 7726 E. Pecos Road. The purchase was financed by $201.6M in revenue bonds originating from the Pima County Industrial Development Authority.

3. Bridge Partners purchased the 120-unit Ponderosa Park multifamily property in Flagstaff for $28.1M. The seller of the 103.6KSF property at 1201 E. Ponderosa Pkwy. was Keller Investment Properties. Steve Gebing, Cliff David and Hamid Panahi of Institutional Property Advisors represented the seller and procured the buyer. IPA’s Brian Eisendrath, Cameron Chalfant, Jesse Zarouk, Jake Vitta and Tyler Johnson secured the financing.

4. Arizona Land Consulting has closed on a $20M acquisition in Buckeye. The property is located on W. Southern Avenue and S. Rooks Road, totaling 131 acres of land zoned for industrial purposes. The property is equipped with a Certificate of Assured Water Supply, allowing it to be subdivided into multiple facilities.

5. CBRE negotiated the $17.5M sale-leaseback of the MarLam Industries Manufacturing portfolio, two buildings that total approximately 106.2KSF, in Phoenix to a joint venture led by Wentworth Property Company. The adjacent buildings sit at 2425 S. 10th St. and 834 E. Hammond Lane. CBRE’s Geoffrey Turbow, Anthony DeLorenzo and Matt Pourcho represented MarLam.

6. Wildflower Apts, LLC purchased Wildflower apartments, a 28-unit apartment complex at 2850 N. Alvernon Way, in Tucson. The property was purchased from Aim Higher Properties, LLC for $2.5M. Allan Mendelsberg and Joey Martinez with Cushman & Wakefield | PICOR represented both parties.

7. A Starbucks at 1610 W. St. Mary’s Road in Tucson sold in a net lease sale for approximately $2.5M. The 1KSF building is at the NWC of St. Mary’s and Silverbell. The buyer/investor was 1610 St Mary’s LLC. The seller was Holland Real Estate, LLC, which was represented by Marcus & Millichap’sChristopher Lind, Mark Ruble and Nicholas Christifulli.

Lease Transactions

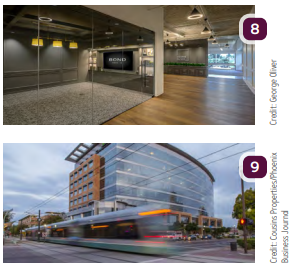

8. George Oliver has secured a string of new leases at Bond, its office redevelopment nearing completion in the heart of the Camelback Corridor. The seven leases total nearly 65KSF for the 287KSF building at 3200 E. Camelback Road, on the NEC of Camelback Road and 32nd Street in Phoenix. New leases include:

- Industrious, which leased 23.8KSF with an early 2025 move-in date;

- Falvey Insurance Group, which leased 13.2KSF with a move-in scheduled this fall;

- GHD, which currently occupies its 10.7KSF lease;

- WFG National Title, which currently occupies its 8.8KSF lease;

- Terram Lab, which leased 3.5KSF with an early 2025 move-in date;

- A Scottsdale-based financial services firm, which leased 2.7KSF with an early 2025 move-in date; and

- Southwest Value Partners, which will commence a lease in Q2, 2025.

Bond’s remaining availability ranges from 70KSF to 3.6KSF with new spec suites being delivered in Q2 2025. Ryan Timpani and Brett Thompson of JLL are the exclusive leasing brokers.

9. Logan Simpson has leased 14.2KSF at the Gateway Center, 222 S. Mill Ave. in Tempe. The company was represented by Mike Gordon and Sydney Setnar of JLL. Owner Cousins Properties was represented by Bryan Taute and Will Mask with CBRE Group Inc.