Sales Transactions

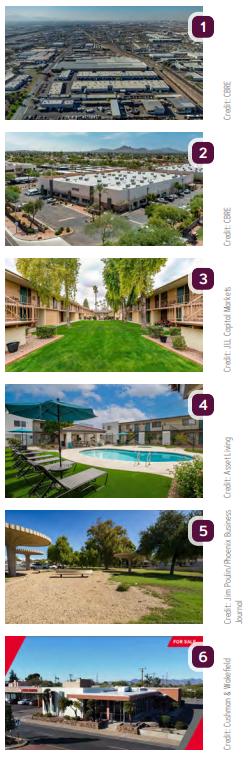

1. BKM Capital Partners purchased a portfolio of eight light industrial parks totaling 889.4KSF across 46 buildings in Phoenix and Tempe for $167.85M. CBRE represented the seller, an affiliate of Equus Capital Partners Ltd. The portfolio consists of:

- Elwood Industrial Park at 4202 E. Elwood St.,

- Roeser Commerce Center at 3702 E. Roeser Road,

- Buttes Business Center at 2105–2231 S. 48th St.,

- Expressway Corporate Center at 3015, 3101 – 3131 S. Park Dr., 3010, 3110 and 3120 S. Potter Dr., 2307 and 2315 W. Fairmont Dr.,

- Harl Industrial Park at 7425 S. Harl Ave.,

- Mineral Road at 1520 W. Mineral Road and 6900 S. Priest Dr.,

- Priest/Excel Business Park at 1302 W. 23rd St. and 2121–2127 S. Priest Dr. and

- Tempe Commerce Center at 124-125 and 136 W. Orion St., 6100 S. Maple Ave., 6105 and 6125 S. Ash Ave.

2. A private investor purchased a two-building, 124.3KSF flex industrial office portfolio at 950 and 960 W. Behrend Dr. in Phoenix’s Deer Valley submarket for $22.5M. The buildings sit on 7.2 acres in the North Loop 101 Business Center. The space includes a mix of leased flex, lab and office uses. CBRE represented the seller, Regent Properties.

3. JLL Capital Markets announced the sale of two garden-style apartment communities, totaling $20.65M across the Phoenix metropolitan area. The transactions include the $10.7M sale of Maryland Greens, a 78-unit community in Phoenix, sold by Maryland Green Multifamily, LLC to Neighborhood Ventures, and the $9.95M sale of The Rio, a 44-unit community in Mesa, sold by Capital Allocation Partners to White Haven. JLL represented both buyers and sellers in the acquisitions. The JLL Capital Markets team was led by Brian Smuckler and Derek Smigiel.

4. Ascendant Capital Partners purchased Casa Del Coronado, a 208-unit apartment community at 201 & 251 W. Blacklidge Dr. in Tucson, for $17.7M. The 110.2KSF complex includes a mix of one- and two-bedroom units as well as studios. Ready Capital C was the seller.

5. RN Properties the Park LLC, an entity connected to The Moreno Companies, purchased a 1.5-acre parcel along Camelback Road in Phoenix for $11M. The seller was JPMorgan Chase Bank. The site, located at 4401 E. Camelback Road, includes a pocket park and is adjacent to a commercial center also owned by the buyer.

6. Union Hospitality Group acquired the 6.2KSF former Chase Bank building at 2465 N. Campbell Ave. in Tucson for $2.4M. The seller was JPMorgan Chase Bank NA. Cushman & Wakefield | PICOR brokered the transaction. Greg Furrier and Natalie Furrier represented the buyer, while Dave Hammack represented the seller.

7. Casa Estrella del Norte, an apartment community at 1601 N. Oracle Road in Tucson, was purchased by Oracle Ventures, LP, for an undisclosed amount. Jefferson Capital Property Holdings, LLC sold the 196-unit apartment complex, which was fully vacant at the time of sale.

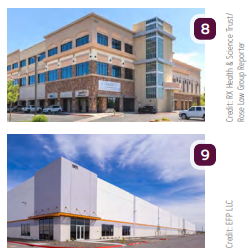

8. San Tan Commons at 3345 S. Val Vista Dr. in Gilbert was recently purchased by RX Health & Science Trust. The 88.5KSF acquisition was sourced off-market for an undisclosed price. The new landlord is represented by CBRE Inc.’s Philip Wurth for leasing inquiries.

Lease Transactions

9. EFP LLC signed a lease for 173KSF at The Confluence, located at 1371 S. Sunland Gin Road in Casa Grande. The deal fully leases the two-building, 21-acre speculative industrial development by Opus, which delivered the project in late 2023. EFP already occupies the first building and will expand its foam molding and distribution operations into Building B in early 2026.