Sales Transactions

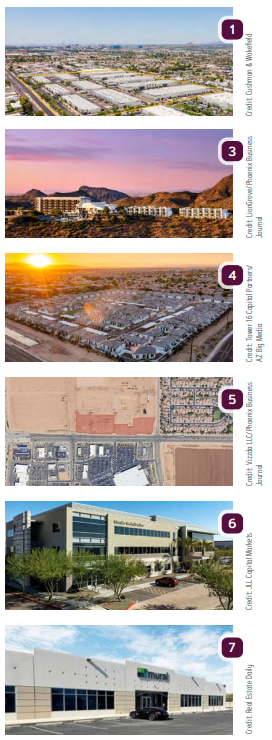

1. Cushman & Wakefield advised the sale and acquisition financing for Broadway 101 Commerce Park, an 809.2KSF multi-tenant industrial park spanning 11 buildings across 53 acres in Mesa. The sale set several local records including: the largest Phoenix industrial sale in 2024, the largest legacy industrial sale in Phoenix history, and the largest single transaction for an industrial park in Phoenix’s southeast Valley. CIP Real Estate purchased the property for $168.3M. The seller was Canyon Partners Real Estate LLC. C&W’s Will Strong, Michael Matchett and Molly Hunt represented the seller. The firm’s Mike Haenel, Andy Markham, Phil Haenel and Justin Smith also provided local advisory and were retained by the buyer to continue leading leasing for the project.

2. CBRE’s Rusty Kennedy and Joe Cesta, along with Cooper Fratt, John Westler, Tanner Ferrandi and Mike Parker, represented Trammel Crow Company and CBRE IM in the $83M sale of Akimel Gateway in Chandler to EastGroup Properties, Inc. The 519.1KSF industrial park sits on 38.8 acres at 17500 S. 40th St.

3. The Adero Scottsdale Resorthas been sold for $57.5M to LionGrove. The 177-room property is in Scottsdale near the border with Fountain Hills. Marriott approved LionGrove to continue operating the property under its flag. The property was owned by Palisades Resorts LLC until entering receivership in late 2023.

4. Tower 16 Capital Partners purchased the 167-unit Yardly McDowellmultifamily property for $46.5M. The apartment complex is located at 91st Avenue and McDowell Road. Tower 16 will oversee asset/construction management. Cushman & Wakefield will operate as a third-party property manager. Northmarq’s Jesse Hudson and Trevor Koskovich represented the seller.

5. Curbline Properties Corp. purchased seven acres of the Prasada Northproject for $32M. The project, located at Loop 303 and Waddell Road, is currently under development by SimonCRE. Curbline’s newly purchased area is set to contain 34KSF of retail space with around 12 tenants. The sale was an off-market transaction.

6. JLL Capital Markets announced it completed the $30M sale of Chandler Medical Pavilion, a fully leased outpatient medical building totaling 65.9KSF in Chandler. JLL’s Medical Properties Capital Markets team represented the seller, a partnership between Unbound Development and Webb Investments, and procured the buyer, Montecito Medical Real Estate. The property is located at 1125 S. Alma School Road.

7. Cushman & Wakefield | PICOR’s Greg Furrier represented an affiliate of 4-D Properties in its $3.9M sale of a 20KSF concrete tilt office building at 1455 W. River Road in Tucson. Max Fisher of BRD Realty represented the buyer, Escalante Concrete.

8. FRC Holdings of Tucson, LLC purchased 44KSF of industrial space at 1825 W. Price St. in Tucson from WAA 1825 W. Price, LLC for $3.6M. Robert C. Glaser of Cushman & Wakefield | PICOR represented the buyer.

9. North Belvedere Avenue Investments LLC purchased Belvedere Gardens Apartments, a 20-unit apartment complex at 914-938 N. Belvedere Ave. in Tucson. The 13.8KSF complex was purchased from David G. Bourne and Mary J. Bourne, 914 Belvedere LLC, and 926 Belvedere LLC for $2.4M. Allan Mendelsberg and Joey Martinez with Cushman & Wakefield | PICOR represented both parties.

10. Tucson Physician Group Holdings, LLC dba Tenet Healthcare purchased 11.1KSF of office space at 551 W. Magee Road in Tucson from NWI MOB, LP for $2.1M. Thomas J. Niemen and Bryce Horner with Cushman & Wakefield | PICOR represented the seller.

Lease Transactions

11. ViaWest Group announced Winsupply signed a lease for 99.5KSF at Cove Logistics Center at the SWC of Van Buren Street and 37th Avenue in Phoenix. Winsupply leased the facility in its entirety. Trilogy CRE’s Matthew Bustamante represented the tenant. CBRE’s Cooper Fratt and Tanner Ferrandi handle Cove Logistics Center’s leasing.