By Roland Murphy for AZBEX

Gov. Doug Ducey’s July 6 veto of a bill that would have sent an extension of the Proposition 400 half-cent sales tax – a major funding source for Maricopa County transportation projects since 1985 – caught nearly everyone but the Governor, himself, by surprise.

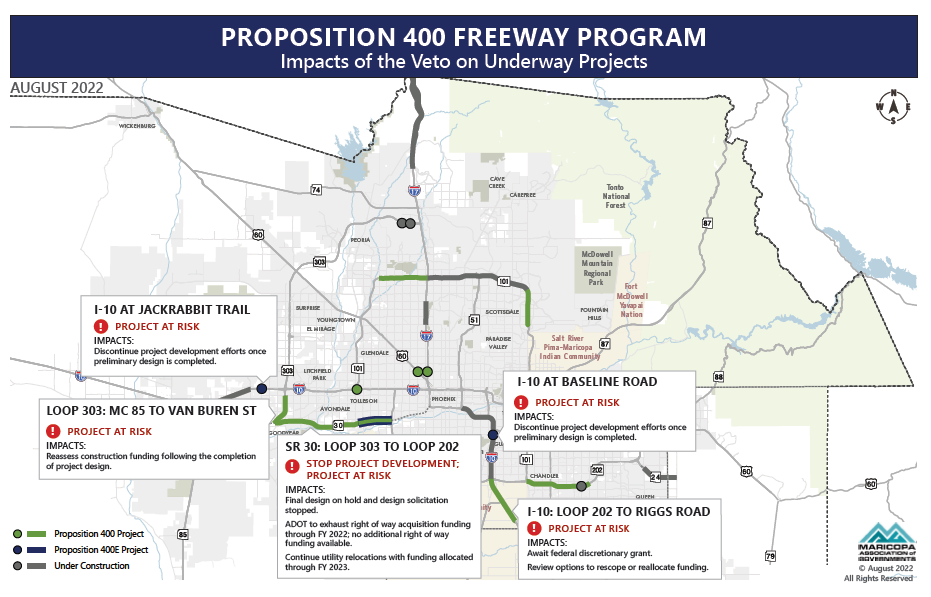

As we noted in our recent article on the ripple effects of impacts already being felt on the State Route 30 – Tres Rios freeway Project in the West Valley, HB 2685 was passed at the end of the Arizona State Legislature’s regular session and would have sent the tax extension to Maricopa County voters in a March 2023 special election. (AZBEX; Oct. 11)

The bill was the product of years of planning and negotiations between the Maricopa Association of Governments; various governmental, business and community stakeholders, and Arizona legislators to assemble a measure that was expected to receive broad-based support among the electorate. Polls showed high levels of approval for the new Regional Transportation Plan – “MOMENTUM” – among residents.

Ducey explained his veto in a letter to the Secretary of State’s Office. His specific objections were:

- The 25-year funding timeline, which the Governor called “a tax increase,” since the previous renewal was for 20 years;

- A reduced focus on freeway projects, and

- The recent expansion of other funding sources, such as the Infrastructure Investment and Jobs Act.

He also said the current, inflationary economic climate made it inappropriate to ask for a tax and criticized the timing of the March 2023 special election. It should be noted the original plan was to have the measure on the Nov. 2022 ballot, but multiple delays in the Legislature made the March timeline necessary.

Lastly, failing to take into account project timelines and funding requirements, the Governor said the measure could have waited until the November 2024 election, since the Prop 400 is not set to expire until the end of 2025.

We discussed the flaws in the Governor’s rationales in our Tuesday column and won’t rehash them here. Suffice it to say, stakeholders at MAG and across the transportation public interest stream are now scrambling to find a path to the ballot in time to secure voter approval before the current program runs out at the end of 2025.

Shock, Recovery and a New Way Forward

Having been caught by surprise to at least the same degree as other observers and stakeholders, MAG has quickly regrouped and begun work on finding a new path to the ballot.

“Our focus now is trying to find a path forward in partnership with the Governor’s Office and our legislators, many of whom are very committed to finding a solution and were instrumental in getting us success this past year,” said MAG Transportation Planning Program Manager Audra Koester Thomas in a video conference with AZBEX last month.

She continued, “Right now, it’s a lot of conversations with elected officials to see if there’s an opportunity. For us, it’s the sooner the better because… of how important it is to have a long-term, sustainable revenue source in place to ensure project development activities for projects that sometimes take a generation to deliver can continue.”

AZBEX NOTE: Audra Koester Thomas is a featured speaker at next week’s BEX 2022 Public Works Conference

At the moment, there is not a clear path to the ballot. Maricopa County is the only county in the state that has to procure a direct referral from the Legislature to place an item on the ballot. “There’s a lot of complexity as to how we deliver the program,” Koester Thomas said. “The vast majority of the bill itself is based on how we implement the (Regional Strategic Transportation Infrastructure Investment) Plan and partnerships with ADOT or Valley Metro… We’re continuing conversations.”

The 32 leaders of the various member agencies have universally re-expressed their support as a result of the transportation need demonstrated in the RTP. Koester Thomas expressed her gratitude at their commitment and said the Plan had been put together as a more lean proposal than would have been ideal given the constraints of remaining with a half-cent – rather than one-cent – sales tax and the diminishing Highway User Revenue Fund as another funding source. “Our mayors worked very hard and were extremely committed to working together and delivering a plan they could unanimously endorse.”

The Consequences of Failure

In the same meeting, MAG Transportation Economic and Finance Program Manager John Bullen stressed the importance of finding a way to bring the measure before voters and warned of consequences if Prop 400 funding is allowed to expire.

“We were completely blindsided by the veto,” he said. “It’s not like we had done a lot of prep work to figure out ‘if this, then that.’ We’ve somewhat scrambled, but as you’re looking at these large-scale transportation investments, they are years and years and years in the making.”

He added that the structure of the programs must, by design, assume a continuation of funding and investment. “Now we’ve sort of pivoted away from, ‘Okay, we have this reasonable degree of certainty that we’re going to have this extension,’ to more of a, ‘We don’t quite know what’s going to happen, and one of the potential outcomes – a real potential outcome – is that the tax goes away in 2025.”

Contrary to some perceptions in the public, media and among officials is that the extension represents a major shift from freeways to transit like light rail and rapid bus transit. “The largest shift between the Prop 400 program and the Extension program was actually into what we call Arterials and Regional programs. It reflects the maturation of our region,” Bullen said. That planning acknowledges the reality that planners cannot keep adding new lanes to arterial roadways and must now focus as well on maximizing arterial roadways’ efficiency, such as with improved traffic light synchronization as just one example.

With the ongoing decreases in HURF and the potential loss of Prop 400 funding, agencies and residents will have to face some hard choices, Bullen said. “Do you want to widen the roadway? Do you want to repave the roadway, or do you want to build this new roadway to serve economic development. You can’t have it all.”

He then brought up the impacts on freeway investment if no way forward is found. “We’re the fastest growing county in the country,” Bullen said. “You look at the map of freeway investments that we have in the extension and there’s new freeway construction like State Route 30, completion of State Route 24 -which is just in interim condition right now – finishing the 303 out by TSMC… there’s all these new freeways and widened freeways to keep up with development. Well, that’s all at risk. You’re not going to get any of it. Without the dedicated half-cent sales tax there will be no new freeways. There will be very little widening of existing freeways, probably none quite honestly. There will be no new interchanges, and there will be very few interchange improvements.

“It’s this really scary reality that, basically, our high capacity transportation network will stop on a dime on Jan. 1, 2026.”

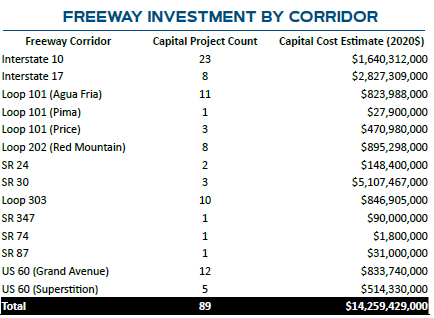

As we mentioned in the column on economic impacts of losing Prop 400 funding, there are more than $14.2B in 89 capital projects across 14 freeway corridors that are part of the Regional Strategic Transportation Infrastructure Investment Plan. The chart breaks down the freeways, project counts and estimated costs.

In an Oct. 12 email, Koester Thomas explained the investment plan impacts by saying, “Because we have a very sophisticated program where we mix a variety of funding sources, it’s hard to say today which capital projects – if any – could still be delivered with only the remaining federal formula funding and HURF available to the region. In other words: the loss of the tax is so substantive, it would completely reshape what we can do and what our priorities are beyond meeting baseline federal performance targets.”

A separate list shows 14 specific freeway projects listed as at risk given the current climate. Many of these are already listed in the DATABEX project database. Some projects, noted (Multiple), have several components. Those marked (N/A) have not yet made it to the various agencies’ published Capital Improvement Programs.

- SR 30 (Project #3318)

- Buildout/completion of SR 24 (Project #4382)

- I-10 West widening and interchange improvements (Multiple)

- I-10 inner loop improvements, including upgrades to the I-10/Loop 202/SR 51 “Ministack” interchange (Project #4154)

- I-17 reconstruction (Multiple)

- Loop 303/I-17 system interchange (to support TSMC) and improvements to Loop 303 (Project #4081)

- Loop 101 (Price) – Loop 202 to US 60 bottleneck improvements (N/A)

- Loop 101 (Price)/Loop 202 (Red Mountain) dedicated HOV ramp (N/A)

- Loop 101 (Agua Fria) general purpose lanes (N/A)

- Loop 101 (Agua Fria)/I-17 dedicated HOV ramp (N/A)

- Loop 202 (Red Mountain) – Priest to Loop 101 System Improvements (N/A)

- US 60 (Grand Avenue) grade separations and improvements (Multiple)

- SR 347 widening/improvements – I-10 to Riggs Road (Project #2550)

- Completion of the HOV network (186 lane miles) (Multiple)

Thoughts from the End of a Long Review

After more than 40 hours spent researching the Prop 400 Extension and examining the various benefits the program has brought to Maricopa County and Arizona since its initial approval in 1985, I am well-impressed by the extent of the direct and indirect economic and cultural benefits the program has delivered.

After nearly 24 hours spent writing the columns and examinations we delivered in this edition of AZBEX, I wish time and space would have allowed for even more. As much as we have said here, believe me when I tell you we left much more out.

At the end of a marathon session like this, it’s expected there will be some kind of conclusion. That’s difficult when dealing with an issue that has yet to be resolved. With that said, here are some final thoughts:

Project funding under the various iterations of Maricopa County’s half-cent transportation tax is one of – and arguably the – primary contributors to the economic development and quality of life the area’s residents enjoy today.

The A/E/C industry has benefitted to the tune of billions of dollars from the projects Prop 400 has funded, creating thousands of jobs and fueling what has traditionally been a cornerstone industry in Arizona.

No one – not even the MAG officials who are working every day to find a path forward to continue this funding – can accurately or wholly envision what life in the Valley will be like in 10 years if this funding is allowed to expire.

We can’t and won’t speculate as the underlying reasons for Gov. Ducey’s veto of HB 2685, but we can find no valid or even reasonable justification for the action.

The one thing we can and will say – loudly, repeatedly, with certainty and without fear of being called out for radicalism – is there are more than 4.5 million people in Maricopa County, and the Valley transportation network affects each of their lives in multiple ways.

We will not – at least not at this point in time – advocate for or against voter approval of whatever measure ultimately appears on a ballot, but we will most assertively advocate that those residents deserve the opportunity to vote on their future rather than having the opportunity denied by legislative or executive fiat.