By Roland Murphy for AZBEX

The current half-cent Maricopa County transportation tax has its roots in the mid-1980s. Mayors around the Phoenix metro regions came together and decided to tax themselves rather than waiting on the state to change its transportation funding mechanisms or to expect the same kind of funding East Coast cities enjoyed under federal spending programs.

The first iteration was focused toward the freeway loop system currently in place.

In a video conference with AZBEX last month, Maricopa Association of Governments’ Transportation Planning Program Manager Audra Koester Thomas said that funding system is unique. “We don’t have a peer anywhere else in the country where the local community came together to literally supplant the role of the Department of Transportation.”

AZBEX NOTE: Audra Koester Thomas is a featured speaker at next week’s BEX 2022 Public Works Conference

At that time, construction of the Loop 101 freeway was expected to take 60 years, according to MAG Transportation Economic and Finance Program Manager John Bullen in the same meeting.

“Had we not changed anything, we still would not have delivered the 101 at this point in the year 2022,” Koester Thomas said. “That was unacceptable to our mayors, obviously, so they got together and established a funding philosophy first conceived as property tax but then moved to a sales tax with feedback from the business community. The sales tax was overwhelmingly passed in 1985 by voters in Maricopa County.” That ballot measure was known as Proposition 300.

According to a 2009 report from The Build America Transportation Investment Center Institute, “The ½-cent sales tax (Proposition 300) in effect from 1986 through 2005 helped fund a significant portion of Maricopa County’s roadway system to accommodate the growth of the 1980s and 1990s. That tax funded 138 centerline miles of regional freeways and highways on which about $5.7B (YOE) was spent. It was not, however, without financial difficulties. Several years into the program, during the late 1980s and early 1990s, it became clear that some of the projects promised under the tax’s plan would not be delivered without additional funding.”

An extension of the tax through 2016 and the addition of another half-cent was sent to the ballot in 1994 but was rejected by voters. As a result, funding forecasts were revised, federal funds were reallocated and two freeway projects were removed.

According to materials from MAG, Prop 300 collected slightly more than $3.4B, not adjusted for inflation, and averaged $171M/year over its 20-year term.

The Birth of Prop 400

As the 2005 expiration for Prop 300 began drawing near, it became clear the measure would have to be renewed for transportation expansion to meet the demands of the area’s increasing population. Between 2000 and 2003, plans were developed showing the area’s transportation needs beyond 2005. A Transportation and Policy Committee composed of municipal officials, Maricopa County representatives, an Arizona Department of Transportation board member, and six private sector business community representatives was established in 2002 to create the next Regional Transportation Plan.

While that was taking place, the Arizona chapter of Associated General Contractors launched the Maricopa 2020 campaign to educate the public and drum up support for a renewal of the tax.

MAG released the RTP in 2003. Again quoting BATICI, “A number of needs studies conducted by MAG for the 2003 RTP development identified a wide range of transportation projects to support projected population and employment growth. Among them included a transit study justifying investments in LRT and BRT corridors, proposed improvements to east/west mobility through the region, improvements within southwest Maricopa County near the border with growing Pinal County, and improvements necessary to serve the rapidly growing West Valley.”

The Arizona State Legislature discussed the renewal effort over the course of several months in 2003 and into 2004. After extensive and sometimes acrimonious debate, the measure that would ultimately expand the area transportation network under Proposition 400 was passed as HB 2456 and signed by the Governor to go on the Nov. 2004 ballot, where it passed with a 58% majority vote, extending the tax through 2025.

In explaining the differences between Prop 300 and Prop 400, Koester Thomas said, “The composition of that program changed to be multi-modal, recognizing the changing needs of a continually growing region (and) now urbanizing area. That included contributions for transit, helping to establish light rail… and supporting bus transit across jurisdictional lines – that regional aspect to ensure people could get to where they needed to go – and countless arterial investments. (It’s) that grid network, which is really unique to this region. That contiguous grid network services about half of our commuting public every single day and is also the backbone of our bus network, as well as our active transportation network.”

MAG’s information – again, not adjusted for inflation – reports slightly more than $7B in funds collected under Prop 400 between 2005 and 2022, an average of $393.2M/year. Another $2.5B is expected before the measure expires.

Planning for Prop 400E

In a Feb. 2022 article, The Arizona Republic reported that with Prop 400 set to expire in 2025, MAG and other stakeholders began planning for its renewal in 2018. Given perceived public support, MAG considered raising the tax to a full one-cent request, but legislative resistance instead led to a recommendation to extend the tax for 25 years, rather than the previous measure’s 20.

The MAG Regional Council approved a new RTP in Dec. 2021 that would serve as the guiding document for how funding would be used, and the campaign began to secure legislative approval to submit the measure to voters.

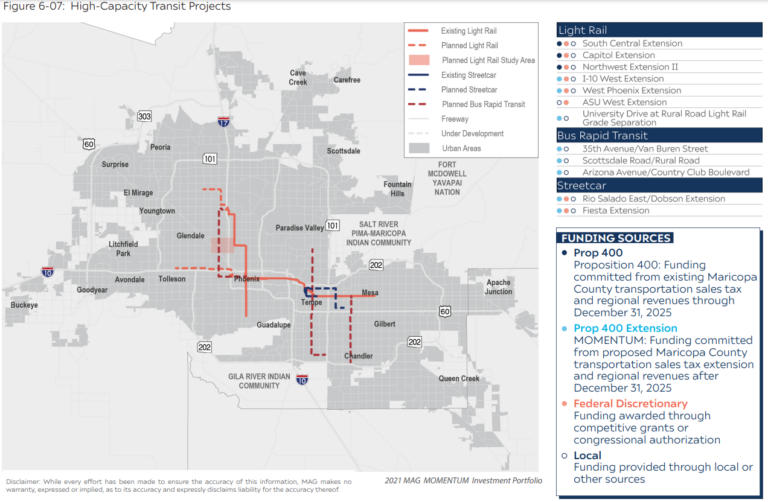

Program investments under the new RTP, known as “MOMENTUM,” were expected to hit $36B over its 25-year life. Plan elements were broken down as follows:

- 367 new freeway/highway lane miles,

- 186 new HOV lane miles,

- 1,300 new or improved arterial lane miles,

- 45 new or improved traffic interchanges,

- 12 new DHOV or system interchange DHOV ramps,

- Four new or improved system interchanges,

- 11.9 miles of new light rail,

- 36.8 miles of Bus Rapid Transit, and

- 6.9 miles of new streetcar.

The proposal in the legislature was assembled under HB 2685 and could have been passed early enough in the session to go to voters on the Nov. 2022 ballot. Various delays – often poorly explained, if they were explained at all – led to the bill’s not being passed until the end of the last legislative session, which then pushed the timeline out to a special election to be held in March 2023.

Still, given Maricopa County’s continuing growth, the impact of the area transportation network on economic development and quality of life, its unanimous support by all 32 county municipal and tribal leaders, and broadly expressed support by the general public, it was assumed by most political watchers and transportation officials that Gov. Doug Ducey’s signing of the bill was a foregone conclusion, a view many held until the moment he vetoed it.