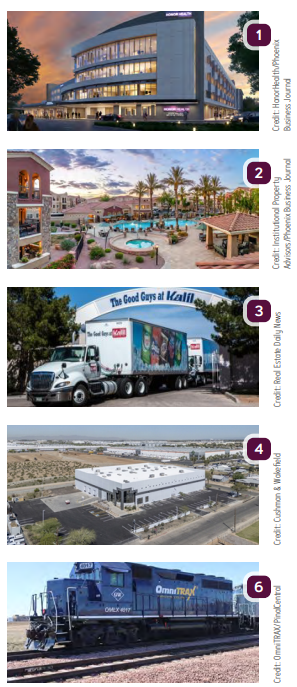

Sales Transactions

1. HonorHealth has agreed to a $250M deal with Steward Health Care System to assume operational control of several of Steward’s Arizona-based hospitals as Steward goes through bankruptcy. Medical Properties Trust Inc. owned multiple Steward hospitals and was an important part of the deal, having ensured that it remained in control of the real estate while severing its ties with Steward. Weil Gotshal & Manges LLP is representing the debtors in the bankruptcy proceedings. HonorHealth took interim control of operations as of Sept. 11 and could be in full control early October.

2. Clarion Partners sold the 497-unit Desert Club Apartments in Phoenix for $187.5M. Institutional Property Advisors’ Steve Gebing and Cliff Davidprocured the buyer, Weidner Apartment Homes, and represented Clarion. Desert Club Apartments is at the SWC of Mayo Boulevard and Scottsdale Road and was 97% occupied at the time of purchase. This is the largest single-asset multifamily sale in the state so far this year.

3. American Bottling Company (dba Keurig Dr Pepper) has closed on a previously announced $8.55M deal to acquire the 7.71-acre, 161.9KSF, seven-building Kalil Bottling Company properties at 931 S. Highland Ave. and 1201-1262 E. 19th St. in Tucson. The deal is part of an agreement in which KDP is acquiring all of Kalil’s production, sales and distribution assets.

4. Cushman & Wakefield announced the firm has advised the sale of a freestanding 39.6KSF industrial building in Phoenix at 20 S. 69th Avenue. The property, acquired by Comunale Properties, is fully leased to Action Gypsum Supply. Local news sources report that the deal was valued at $8.2M. C&W’s Phil Haenel, Will Strong, Foster Bundy and Katie Repine represented the buyer and seller in the transaction; Mike Haenel and Andy Markham provided leasing advisory.

5. A 12KSF, 100% occupied retail building in Green Valley was sold for $4M. The property is located at 140 Duval Mine Road at Valley Verde Center on the NWC of Interstate 19 and Duval Mine Road. The seller was represented by Gary Heinfeld of Advisors in Real Estate, Inc. and Matt McNeill of SRS Capital Market while the investor was represented by Century 21 Ludecke, Inc.

6. OmniTRAX has purchased 679 acres of rail infrastructure at Central Arizona Commerce Park on the west side of Casa Grande. OmniTRAX will now service the industrial properties on the site. The infrastructure connects to the Union Pacific Railroad. Saint Holdings’Jackob Andersen brokered the deal. The price of the deal was not disclosed.

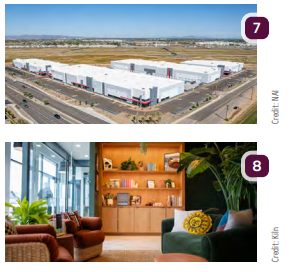

Lease Transactions

7. The NAI Global Veterans Council facilitated a lease for industrial space at the Chandler Airport Business Park. The tenant, True Up Companies, was represented by NAI’s Tony Machabee, Jeffrey Garza Walker and John Fili. The landlord, CRP III Chandler Airport AZ LLC, was represented by Stein Koss with Lee & Associates. The lease totals $4.2M and the property is located at 1900 E. Queen Creek Road. True Up will occupy 60.4KSF of a 318.7KSF building at the business park.

8. Coworking and flex office firm Kiln has announced the opening of its new location, Kiln Biltmore, in partnership with Federal Realty Investment Trust and RED Development. The 20KSF space provides a workplace able to cater to teams of all sizes. The property is located at 1801 E. Camelback Road, Suite 201 in Phoenix. JLL represented both parties, with Ryan Timpani and Ryan Bartos representing RED and Kyle Seeger, Brett Thompson and Jami Savage Gray representing Kiln.