By Rebekah Morris for AZBEX

Late last month, UMB Bank provided notice that Legacy Cares has officially defaulted on a series of tax-exempt bonds that were meant to fund the Bell Bank Park construction project. While that has been widely reported (examples here and here), the fact that more than a dozen local contractors have not yet been paid on a project that completed construction back in Jan. 2022 has been mostly just a sidenote.

While most stories quote the project cost at $280M, the primary construction contracts were substantially less than that. Roughly $130M between contracts were issued to Haydon Building Corp. for exterior fields and sitework and Okland Construction for the vertical building portion of the project. By all accounts, progress payments were being made until Jan. 2022 – when the park opened for business – leaving retention and the last progress payments outstanding. Then the checks stopped coming.

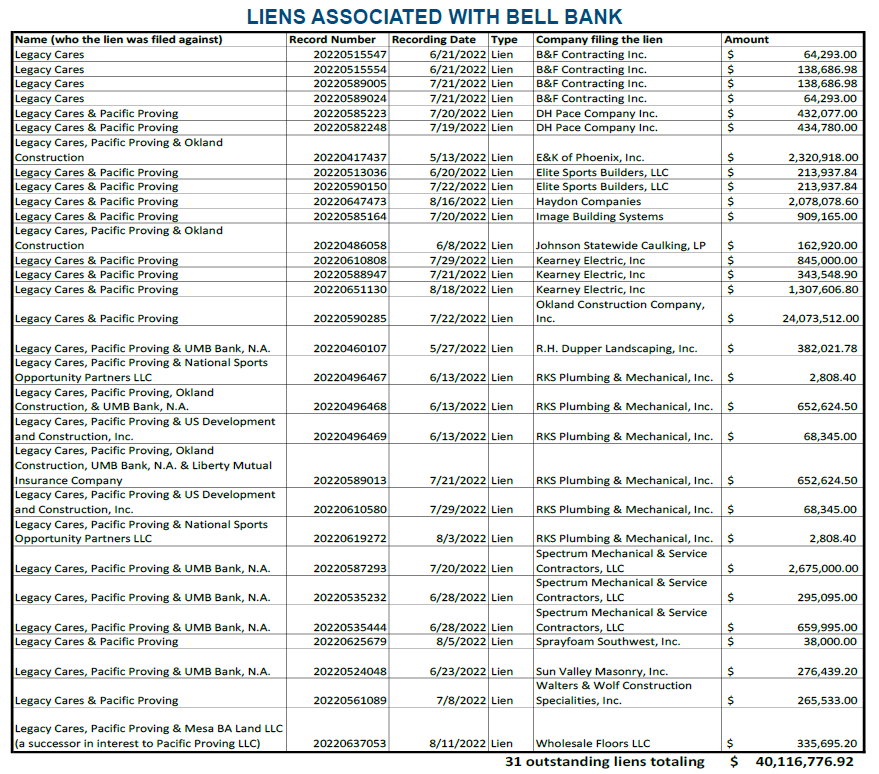

Active liens listed on the Maricopa County Recorder’s website show a total of 16 contractors have more than $40M in outstanding liens on the property, all filed between May and August of 2022. There is likely some duplication in the lien records, e.g. a subcontractor’s amount is shown in both a standalone lien as well as the General Contractors lien amount. In the bondholders’ call, the Trustee, UMB Bank, stated the outstanding liens are approximately $30M.

Without worrying too much about how precise to get with our estimations, here lies the major question: If the owner had $280M in bond funds and only paid out $100M to contractors ($130M between Haydon and Okland minus the $30M in liens UMB says are outstanding), what happened to the other $180M? Surely there are allowable expenses outside the base construction contract amounts – everything from design fees, development consulting fees, and a full FFE package would qualify – but any reasonable person would conclude that something weird would have to happen to not be able to make the final payments to the contractors.

Asked directly when we were reporting on the story back in Sept. 2022, Chad Miller, CEO of Legacy Sports stated that ‘circumstances outside of their control’ resulted in the project not having the funds available. (AZBEX, Sept. 02) That does not provide a good or clear answer as to how $280M in bond funds couldn’t cover the $130M in construction contracts and other allowable uses like design fees that went into the project.

Bond Funded Project Should Have Been a Low Risk to Contractors

The Bell Bank project was able to secure tax-exempt bond financing using the Arizona Industrial Development Authority. That quasi-government entity acts as a conduit between banks and those wishing to obtain bond financing. Bonds were sold to the market and funds deposited into an escrow account. According to Miller, several layers of controls are installed on the project to prevent abuses of bond funds.

Contractors did their due diligence and concluded the project had solid financial capabilities to be a reasonable endeavor. With solid contracts and bond funding in place, the project should have been a low risk. Further, progress payments were being made for the duration of the project, right up until the doors opened to the public and a Certificate of Occupancy was obtained.

Liens are Moving to Foreclosure

Miller also stated on the record in September that all contractors would be paid in full by the end of October and the liens would be resolved. That did not happen; the liens are still outstanding and the firm has now defaulted on the loans.

While contractors involved in the project have been somewhat open with my questions in the past, that has now changed and my requests for comment are all being directed to lawyers or politely declined due to non-disclosure agreements that have recently been signed. While not expressly stated, it is believed that at least some of the outstanding liens are moving to foreclosure.

Jordan Schell, project executive with Okland, stated back in early September that they have never filed a lien on a project in Arizona. He indicated that was a last resort for the company. Subcontractors we talked to also noted that they did not want to file a lien, but felt they had no choice. Lien rights have specific timelines to protect contractors. The only remedy afforded contractors is to foreclose on the property and to do it quickly.

Foreclosing on the property will introduce a whole new level of complexity. The land is not owned by Legacy Cares, but is being leased from Pacific Proving, LLC. Repeated requests to the attorney for Pacific Proving, LLC were not returned.

The Arizona Republic’s Oct. 25 article on the default and investors’ call reported Michael Slade of UMB Bank said he was trying to work with contractors and other businesses that had filed liens to get them to hold off on moving to foreclosure. In the same article, Troy Whisenhunt, CFO for lienholder Wholesale Floors, said his company had not yet been contacted and that it intended to pursue foreclosure over the $335K it was owed. We do not know how, or if, UMB’s negotiations or Wholesale Floors’ foreclosure plans have proceeded.

Bond Funds Require Disclosure and Public Records

One of the default notices filed in late October was related to disclosures – Legacy Cares has failed to provide required financial records, including audit records and financials. Trustee UMB has hired a consultant to perform a forensic audit of the bonds. When that is completed and the documents are made public, it should provide a very good view into the $180M question: Where did all the money go?