By Roland Murphy and Rebekah Morris for AZBEX

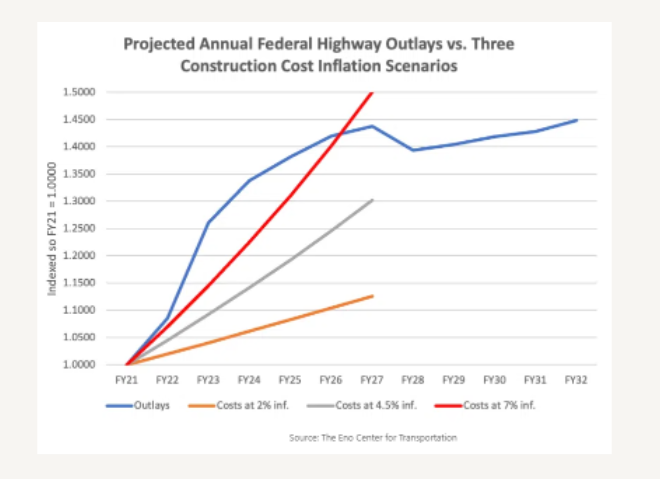

Spiraling inflation costs spurred, in part, by federal stimulus spending intended to boost a U.S. economy stalled by the pandemic and its after-effects is having the unintended consequence of diminishing – and for some projects, negating – the stimulus, itself.

Of particular concern is the inflationary pressure those trillions of dollars have triggered – and the impacts of that inflation on long-planned and much-desired infrastructure projects.

While some of the various COVID-related spending was focused on accelerating infrastructure project deployments, the hallmark of the Biden Administration’s efforts was the Infrastructure Investment and Jobs Act – also known for promotional purposes as the Bipartisan Infrastructure Law – which dedicated $1.2T to fund and accelerate timelines for infrastructure projects around the country. Of that total, roughly $660B is dedicated via grants and direct funding over five years for freight, transit and other projects overseen by the U.S. Department of Transportation.

A Quick Look at the Numbers

It was understood from the outset the massive infusion of cash into the economy would likely trigger inflation. Given that economic leaders had infused capital into investment markets through quantitative easing and other mechanisms for more than a decade while the economy struggled to reach the standard target of 2% annual inflation, it was hoped that the inflation triggered would be moderate and somewhat easily controlled. In reality, between year-end 2020 and year-end 2021, the annual rate of inflation noted in the Consumer Price Index jumped from 1.4% to 7.0%.

When the stimulus collided with a collapsing global supply chain and a hot-to-overheated construction sector, however, the predicted ripple effect became a chain reaction that fueled accelerating Federal Reserve interest rate increases to try to cool things down, increasing borrowing costs and adding significantly to input prices that were already increasing well beyond the standard rate of inflation. The Federal Funds Rate at year-end 2020 was 0.25%. It currently stands at 1.5%-1.75%, with more increases expected.

According to CNBC, the Producer Price Index rose 1.1% in June, exceeding predictions. Year-over-year, the PPI is up 11.3%, down slightly from its record of 11.6% in March.

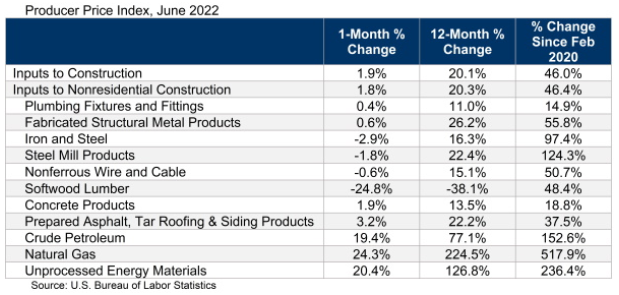

In its most recent announcement, Associated Builders and Contractors reports a 12-month construction inputs cost increase of 20.1% and a percent change of 46.0% since February 2020, the last full pre-pandemic month. During the monitoring period, prices have risen for every non-residential construction input ABC tracks. On the low end, prices for plumbing fixtures are up 14.9%. On the high end, natural gas has increased 517.9%.

Of particular concern to infrastructure projects, ABC reports prices for asphalt and related products are up 37.5% since February 2020, iron and steel are up 97.4%, steel mill products increased 124.3% and concrete products are up 18.8%.

Local Project Impacts

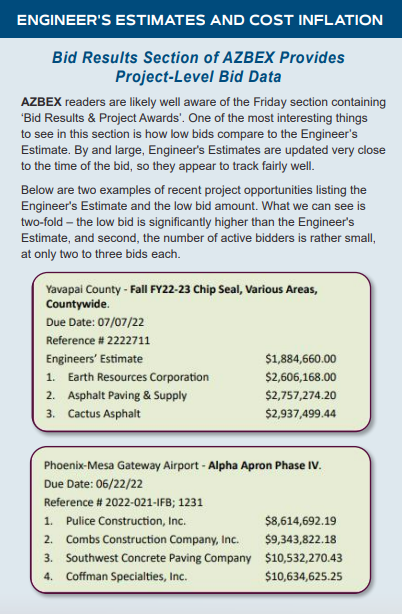

Across the country, cities and states that had eagerly anticipated expanding or accelerating their Capital Improvement Project suites are running into the reality of major project cost inflation caused not only by the generally inflationary state of the economy, but also the increased demand for materials in a still truncated supply chain and an increasingly desperate and expanding shortage of skilled labor to perform jobs when they are scheduled.

A recent Associated Press report quoted American Association of State Highway and Transportation Officials Executive Director Jim Tymon summarizing project management concerns by saying, “Those dollars are essentially evaporating. The cost of those projects is going up by 20%, by 30%, and just wiping out that increase from the federal government that they were so excited about earlier in the year.”

The article mentions a four-phase water main project in Tucson that has seen ductile iron pipe prices rise from $75/foot from when it was first bid in 2020 to $90/foot when the latest phase was bid this spring. Gate valves for the same project in the same period have risen from $3,000 up to $4,100.

Scott Schladweiler, Tucson’s chief water engineer, is quoted as saying, “To sum it up, we’re doing less work for the same amount of money.”

Other Arizona cities are seeing similar problems. A June 16th Independent Newsmedia article covered problems the City of Peoria is encountering with its Beardsley Water Reclamation Facility Expansion. Phase 2A of the four-phase project, currently under construction, is running 17%-20% over budget due to rising costs and materials availability. City Council recently amended the project contract by an additional $21.95M, and the timeline has been moved out from the end of 2023 to sometime in 2024.

A July 11th follow-up story by Independent Newsmedia looked at the “unprecedented” impact rising costs and supply chain problems are having on the City’s CIP projects across the board.

In addition to the Beardsley Water expansion project, City officials have voted to put a planned park project – Phase II of the Paloma Community Park – on hold until the current state of affairs better resolves itself. The project design is 90% complete. Phase II is a more than 45-acre expansion that will add trails, multi-purpose fields, a skate/rollerblade court and other amenities to an existing park on the north side of the city.

The original budget and timeline for Phase II were $22M, with delivery planned for fall 2023. Sources close to the project tell AZBEX the earliest estimate to begin construction has been moved to early 2024, but that that is by no means definitive.

Peoria officials told Independent Newsmedia the top priority projects at the moment are those with a critical safety component and those with specific completion obligations already in place.

On the other side of the Valley, a recent article in the Gilbert Sun News reports that city (Can we please stop pretending it’s still a ‘town’?) – like all others – is trying to deal with its own CIP impacts from inflation and supply chain problems.

As just one example, Gilbert has a project on the books to rehabilitate 140 deteriorating manholes. Because of a 17% increase in expected costs since the project was budgeted just two years ago, the number has to be cut to 120 unless additional funding is located.

A more significant project facing impacts is a set of water quality improvements for the North Water Treatment Plant. The cost of the project has increased by $4.6M since it was originally planned in 2018, and some key commodities have gone up in price by as much as 400%, according to Gilbert officials.

Project planners focused on street and transportation projects say materials costs and availability are having major impacts on their ability to plan and schedule. Concrete availability is a key factor, with officials pointing out large volume deliveries and project pours are not possible in the current environment.

The article quotes Ryan Blair, Gilbert’s CIP supervisor, as saying costs for concrete have increased 50%, while asphalt is up 35%, and PVC waterlines have gone up 200%.

Both the article and the suite of panelists at the most recent BEX Companies Leading Market Series that focused on Construction Costs say a key component in dealing with rising costs and extended delivery times and project schedules is including all members of the ownership, design, vendor and contractor teams in the process as early as possible and sharing information and status changes on a frequent and collaborative basis. (AZBEX, June 10th)

Still, regardless of how seamless and cross-connected the stakeholders are, the brutal reality of a PPI that is seeing monthly year-over-year increases of more than 10%, materials backlogs reaching out more than a year for many basics, and the ever-increasing likelihood of some period of actual recession, can seem like Band-Aid treatments to a major wound.

Unless and until one or all of those factors begin to retreat, though, project planners will have to take comfort in the fact that at least there are Band-Aids available and harken back to the mantra of the early days of the pandemic: We are all in this together.