By Roland Murphy for AZBEX

In its first “Retail Market in Focus” report, CBRE Research has taken a look at the state of retail in Phoenix. Among the report’s highlights, Phoenix has been a Top Five market for new retail development over the last two years and is expected to be a Top Three market in the next two years.

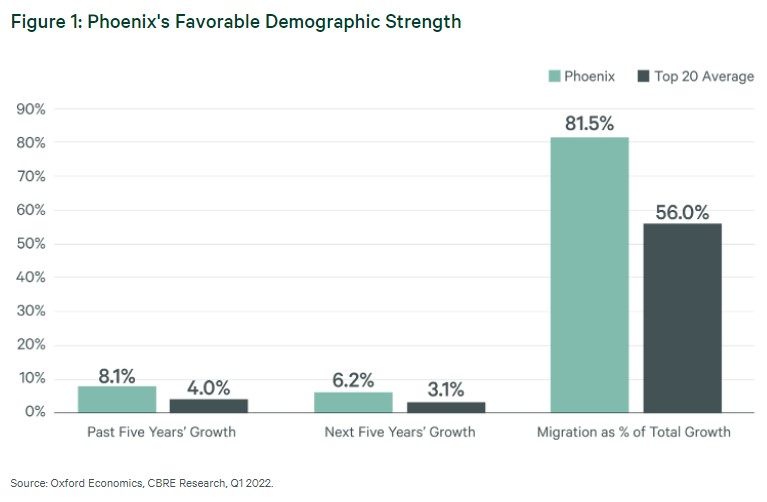

A key factor in Phoenix’s retail market health is its demographic strength. With a population of nearly 4.9M and a growth rate of 8.1% over the last five years, Phoenix comes in second only to the greater Dallas-Fort Worth area for net migration, and the market leads in in-migration.

Phoenix’s retail absorption rate is a robust 1.6% over the last two years, compared to a national average of only 0.6%. Retail availability has tightened by 2.1%, the most among major markets. The national rate is a mere 0.58%.

Because of these strong fundamentals, retail rent rates are projected to increase 3.7% in Phoenix, while the national expectation is 2.2%.

Phoenix saw a year-over-year increase in retail real estate investment volume of 29% in 2021, hitting a local record of $2.1B. Cap rates fell to between 6.5% and 7.5%.

The report also highlights the Phoenix area’s Scottsdale submarket, pointing out retail asking rents in Scottsdale are 65% higher than those in Phoenix proper. Scottsdale’s status as a home for luxury retail is a contributing factor, and retail availability fell to just 4.3%, according to the report.

That status may be precarious, however. Earlier market reports show Scottsdale is dramatically over-served by retail, with a per capita inventory of 90.1SF. For reference, Tempe has the next highest per capita retail inventory at 69.6SF, and the national average is only 56SF.