By Roland Murphy for AZBEX

Over the past several months we have extensively covered the issue of bureaucratic resistance/development fatigue/NIMBY-ism impacting project approvals – particularly in multifamily – across the state.

That’s only one of a three-pronged set of challenges facing the construction industry’s ability to deliver projects in the face of overwhelming demand across several sectors, however. In addition to the complicated and lengthy approvals process, builders are dealing with a labor pool that is insufficient to meet the volume of work and a combination of supply chain difficulties that make it difficult to procure building materials in sufficient quantities or at manageable prices.

A February 8th article in Scottsdale Progress showed one ripple effect the latter two issues are having on municipal finances – namely that construction sales tax revenues are flat. According to the story dealing with a recent update to City Council from City Treasurer Sonia Andrews, general sales tax revenues for Scottsdale are up $14.3M beyond the originally projected $69.4M original projections.

Vice Mayor Tammy Caputi questioned Andrews about the fact that construction sales taxes, however, merely matched, rather than exceeded, the projected volume of $7.3M. Given the volume of work and demand in the sector, and that the City’s bond-funded capital projects are $24M over budget, Caputi expected construction sales tax revenues to exceed their projections. The article quoted her as correctly summarizing the paradox by saying the construction business “couldn’t be any busier.”

Progress reported several explanations – including the possibility that contractors were delaying payments until their large projects are completed – were discussed by Andrews and Council members. While that could well be a contributing factor, it overlooks a market reality that is simultaneously simpler to summarize and more difficult to address.

The supposition that construction tax revenues should be up is a reasonable one on its face, but it fails to take into account the very real issue that the construction market is saturated in terms of its ability to deliver projects. There is no capacity for expansion given the state of the labor force and ongoing problems with supply chain capacity and inflation.

One can extend the approved and planned project pipeline from here to the horizon, but if materials cannot be obtained – particularly at cost-effective prices – and workers cannot be put on site to build the projects, the materials are not going to be purchased at the same volumes, and tax revenues will remain flat.

The Problems of Labor, Inflation and Scarcity

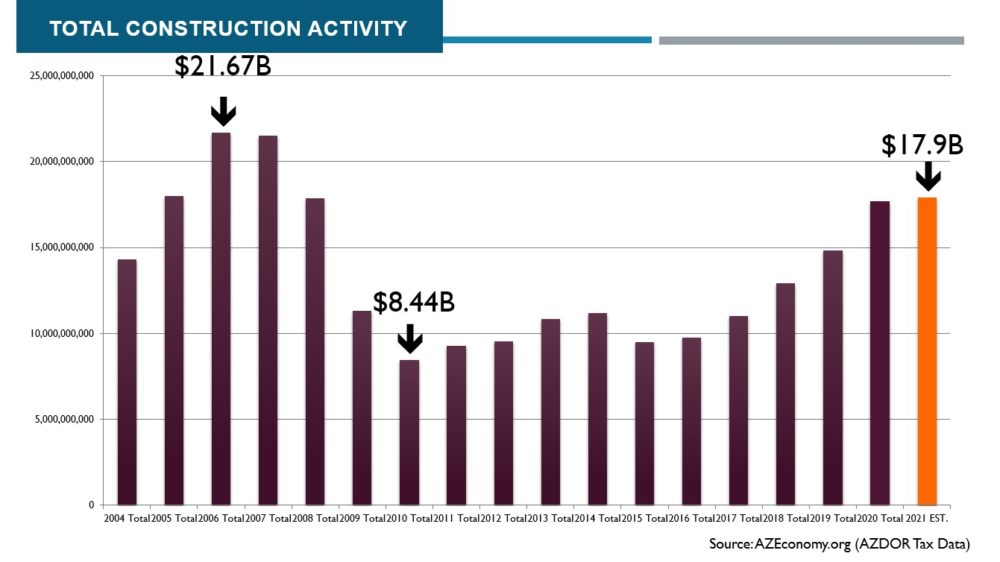

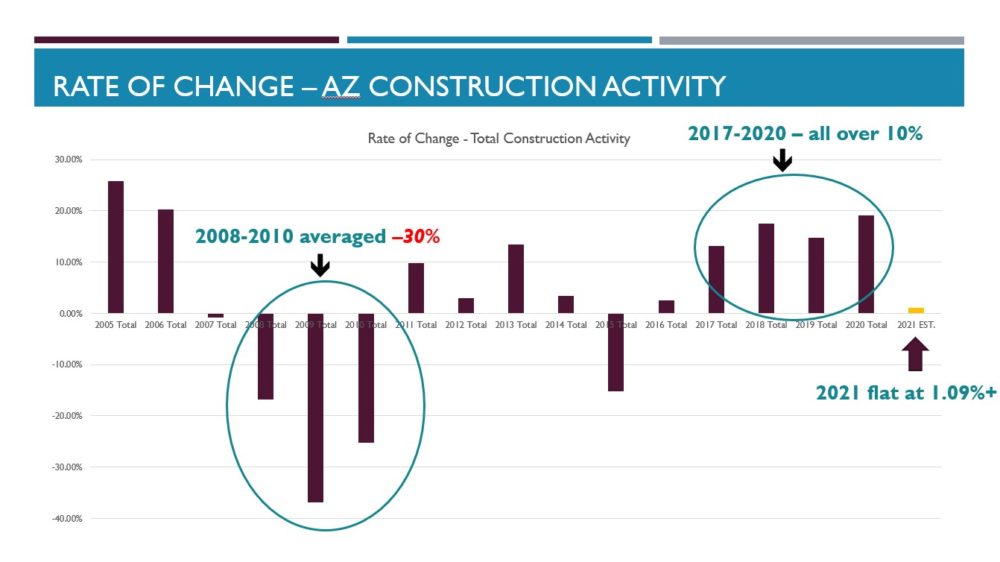

The fact that market constraints are tying up billions of dollars in projects around the state was the key takeaway from this year’s BEX Companies 2022 Forecast Event in January (AZBEX, January 18th.). Examining the DATABEX project database against tax data from the Arizona Department of Revenue, we found statewide construction activity for 2021 versus 2022 to be largely flat, with a Year-over-Year increase of only 1.09%, even in a market experiencing the hottest demand uptick in recent history.

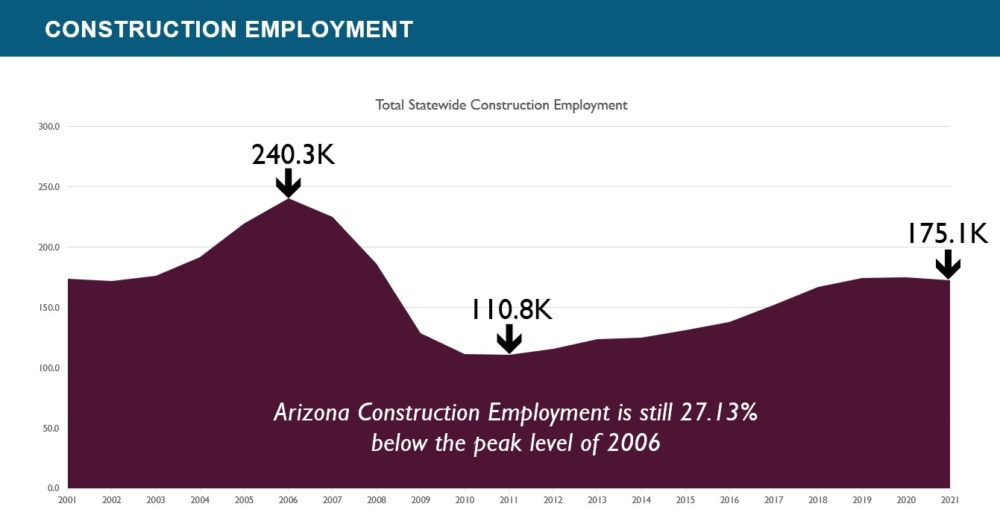

Now consider the labor shortage. The 2021 construction labor force in Arizona was 175,100 – 27.13% lower than its 2006 peak of 240,300. This, of course, means projects get delayed, timelines get extended, and per-project materials purchases decrease.

The other factor impacting construction taxes is materials cost inflation and availability. From energy costs to steel to lumber to plumbing fixtures, every input experienced Year-over-Year price increases, according to information from Associated Builders and Contractors.

Consider this overly simplified example for what happens when all those streams converge. Eighteen months ago a material component cost $100. You regularly bought that component in 100-unit lots. You were taxed on that $10K purchase.

Now, however, the price is up to $120. You cannot predict when you will be able to get workers on-site to build your project. Your suppliers cannot guarantee precisely when the material will be delivered. There is also a chance the price may go down between now and when you actually need the material.

As a result, you decrease your order by 15%, down to 85 units while you wait for circumstances to adjust or resolve. The purchase you are now taxed on is $10,200, only $200 more than your historical order. That negligible difference is what officials are seeing as they look at their revenue streams.

Now, expand that across jurisdictions, project sectors and a pipeline that delivered a little less than $18B in activity for which it had $22B in demand, and you can understand why local officials are noting construction sales tax revenues remaining flat even in an inflated economy.

Caputi, Andrews and other officials around the state are not the only ones the stagnation of delivery capacity caught by surprise. BEX’s own experts had predicted market activity growth to increase 16.1% to $20.5B statewide from 2020-2021 based on project volumes. The reality came in at $17.9B.

As BEX Founder and President Rebekah Morris told the Forecast Event audience, “We projected a massive increase… We have project level data to support saying, ‘Hey! The market wants to build these projects.’ We have that. We talk to developers and owners all the time. We know the demand is out there. The market did not deliver.”

She went on to explain, “We have demand. We can demonstrate demand… The volume stayed flat, and prices were increasing rapidly. We couldn’t do it. The output could not keep up with what the market wanted. There’s plenty of demand there. We could have done twenty-two billion dollars… The market can’t handle all the volume for all the projects that really want to happen.”

As much as we have focused on Scottsdale as a Ground Zero point for institutional resistance to project approvals, it is not an outlier in terms of market impacts. Every jurisdiction that made responsible projections as to construction tax revenue can realistically expect to see them met, but not exceeded.

The unfortunate reality is bureaucratic impediment to project development would actually be the easiest one to remedy. As just one example, if the hyper-aggressive legislation proposed in House Bill 2674 (AZBEX, February 8th) were approved and enacted tomorrow, most logjams in that particular stream would disappear overnight.

The drought of labor and the damming of affordable materials, however, are much more difficult, cumbersome and draining ones to address, much less resolve.