By CBRE

With e-commerce penetration expected to grow to 26 percent of all retail sales by 2025, the U.S. will need an additional 330MSF of distribution space just to handle the increase in online ordering in that timeframe, according to a new report from CBRE.

That anticipated, e-commerce-generated demand for another 330MSF of distribution space represents 27 percent of the projected overall demand for industrial real estate in the U.S. through 2025, according to CBRE Econometric Advisors. The broader category of industrial real estate includes warehouses for traditional retail distribution, manufacturing, R&D space, and data centers.

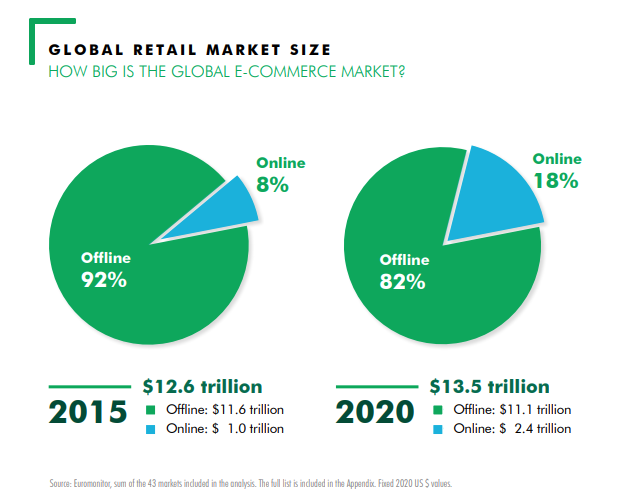

CBRE forecasted the incremental demand based on its estimate that every additional $1B of e-commerce sales requires 1MSF of new distribution space. According to CBRE’s forecast, which is based on Euromonitor data for 2020, U.S. e-commerce sales are expected to increase $330B from 2020 to 2025. Globally, e-commerce sales are forecast to rise by $1.5T in this same time period, requiring an additional 1.5BSF of warehouse/distribution space to accommodate this growth. The U.S. and Mainland China are the biggest e-commerce markets in the world, accounting for 57 percent of global internet sales.

According to the CBRE report, South Korea is forecast to have the world’s highest e-commerce penetration in 2025 at 43 percent. The U.S. will be one of the top 10 markets globally for e-commerce penetration in 2025. To forecast growth, CBRE looked at such drivers as each country’s percentage of urban population, debit and credit card use, the population’s digital skills and digital technology infrastructure. (Source)