By Rebekah Morris for AZBEX

Rapid Increases in Lumber, Steel and Raw Materials Lead to Significant Project Cost Spikes.

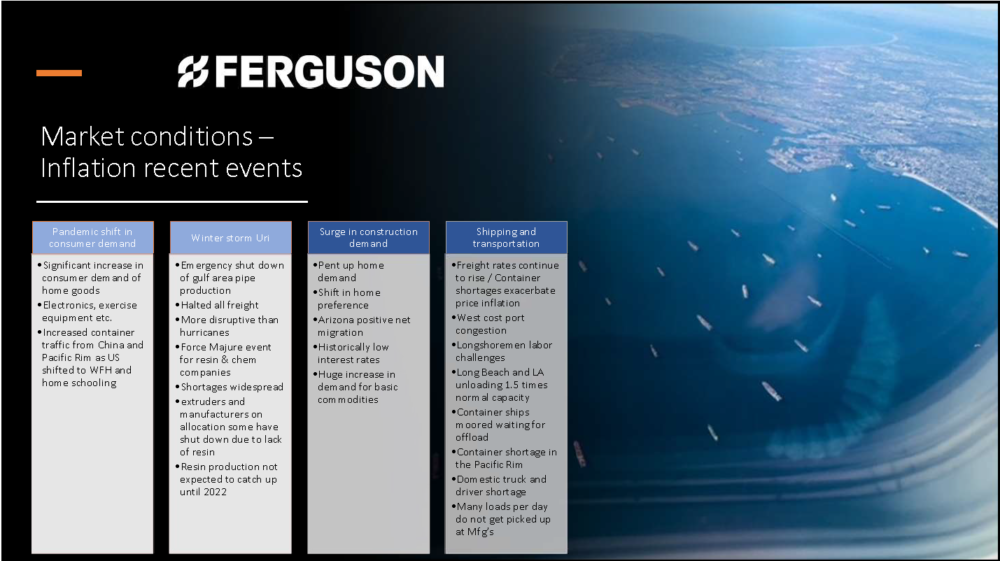

The biggest story in the Arizona construction market has been the rapid cost escalation of construction materials prices since Q4 of 2020. The sources of materials price increases are wide and varied from increased demand for new industrial space and new housing (both single–family and multifamily), to constrained supply chain logistics including the big storm in Texas shutting down manufacturing plants. Total construction volume in Arizona topped $17.7B in 2020 and is projected to top $19.7B in 2021.

Construction activity in Arizona has been on a tear since 2017, growing no less than 10 percent YOY since that time. The most recent month that statewide construction volume experienced a decrease in YOY activity was November 2018. In 2020, construction activity realized nearly 20 percent YOY growth, but in the first quarter of 2021, growth is clocking in at 6.36 percent YOY. This tells us the rate of growth is slowing sharply.

Comparing the employment to volume numbers, we can see that construction employment has held steady while total volume is increasing, meaning that materials prices are the underlying force currently pushing volume up. (AZBEX_May 21, 2021)

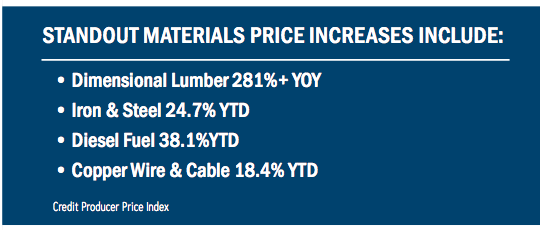

More on Materials Price Increases

From formwork and reinforcing in foundations, to roofing and all the parts and pieces between, construction materials prices are rising fast. At the BEX Private Development Summit earlier this month, manufacturers including Ferguson and Integrated Structural Concepts described fast and steep rises in prices from their suppliers. Prices for individual components are increasing, which pushes assemblies such as HVAC units and electrical gear higher. Wrapping that into the numerous trades’ bid prices (labor prices have not gone down by the way), and then into the overall project price, the market is seeing total project prices increase anywhere from five percent to 30 percent in the last year alone.

According to the Producer Price Index, materials are up 6.7 percent YTD.

Complexities and Fragility in Supply Chains Exposed

Not only are prices through the roof, so to speak, the availability and timing of materials are causing major headaches for the local industry. In the Industrial Panel at the BEX Development Summit, Kevin Evernham with Ware Malcomb described roof trusses for some of their industrial projects being 40-46 weeks out, causing them to release that item before the project has even been fully designed.

In ‘normal times’, materials prices fluctuated a bit, but in general, the price received was likely to be held for 90 days, giving the subcontractor and general contractor enough time to complete buyout, negotiate contracts and process purchase orders for materials. Those normal times are more of a nice daydream in today’s conditions. Materials prices are being held for 30 days or less, and in more extreme cases, not being honored unless materials are being shipped by a cutoff date established by the manufacturer. Oh, by the way, the manufacturer is highly unlikely to meet that cutoff date for the quote they already gave you. Specialty trade partners are very much at the mercy of the suppliers, with limited options on finding a new supplier.

The reality is there are very few suppliers of raw construction materials, which has benefitted the market in the past with economies of scale and lower prices. Now that the tables have turned and with less manufacturers, less options are available to procure materials which has created fragility in the supply chain. Add disruption to manufacturing, whether it be from COVID-19 or extreme weather events, and combine with shipping challenges at ports and trucking, the whole supply chain for construction materials is feeling the pinch.

Forecast: Continued Increases

Construction activity in Arizona is projected to hit $19.7B in 2021; a slight downward revision from January. While demand for Industrial and Housing will continue, demand for hospitality, office and retail will remain low. As long as underlying macroeconomic forces of population growth and employment continue to trend positively, the Arizona construction market will continue to prosper.

Rising construction prices have not tipped projects into the realm of not penciling on any grand scale. So far, the market has absorbed the cost, mostly due to increased rental rates and the lower cost of capital. We can start to worry about a broad-based pullback in activity when the cost of lending increases or the rents no longer keep up with the increased cost of construction.