Sales Transactions

1. CapRock Partners purchased Northern 101 Commerce Center, a 388.6KSF, state-of-the-art industrial development at Glen Harbor Airpark, Glendale, for $44M, from Creation Equity. The development was designed and built by LGE Design Build. Will Strong and Greer Oliver with Cushman and Wakefield managed the sale.

1. CapRock Partners purchased Northern 101 Commerce Center, a 388.6KSF, state-of-the-art industrial development at Glen Harbor Airpark, Glendale, for $44M, from Creation Equity. The development was designed and built by LGE Design Build. Will Strong and Greer Oliver with Cushman and Wakefield managed the sale.

2. ZH Multifamily purchased Sunnybrook, a 103-unit, garden-style multifamily property at 138 W. 1st Street, Mesa. Sterling Real Estate Partners purchased Pennytree, a 146-unit, garden-style multifamily property at 232 S. MacDonald, also in Mesa. Senior Director Dan Cheyne and Senior Managing Directors Ric Holway and Mark Forrester of Berkadia Phoenix completed the $31.3M in combined sales on behalf of the respective sellers.

3. An Arizona-based buyer purchased Santana Ridge Luxury Rentals, a 109-unit multifamily condominium property in Chandler, for $27M. ABI Multifamily‘s Phoenix-based Institutional Apartment Group – Alon Shnitzer, Rue Bax, Eddie Chang and Doug Lazovick represented the Canada-based seller.

4. Silver View RV Resort SPE LLC purchased Silver View RV Resort, a 428-site Class A RV Park, and Bullhead RV Park, a 157-site park, both in Bullhead City, for $21M total. Jack A. Cardinal, with Cooper Cardinal & Company, represented both the seller, 1802 North Carson Street LLC, and the buyer.

5. 51st Fenix, LLC purchased the Allred Tech Center, a 132.7KSF, single-tenant industrial building at 10027 S. 51st Street, Phoenix, for $19.5M. CBRE’s Mark Krison, Bob Young, Glenn Smigiel, Rick Abraham and Luke Krison represented the seller, Douglas Allred Company.

6. An affiliate of Portal Investment Management, purchased the Rolling Hills Shopping Center, a 114.1KSF, a Fry’s Food and Drug-anchored center at 7050 E. Golf Links Road, Tucson, for $14.825M. Michael Hackett and Ryan Schubert of Cushman & Wakefield represented the undisclosed seller.

7. A limited liability company purchased The Vibe on Thomas, a 100-unit apartment property at 2735 E. Thomas Road, Phoenix, for $14.2M. Paul Bay and Darrell Moffitt with Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, a private investor.

8. McCormick Project LLC, Yury Gampel purchased The Grove at McCormick Ranch, a 28KSF mixed-use project at 7300 & 7400 N Via Paseo Del Sur, Scottsdale, for $14M. Eric Wichterman and Mike Coover with Cushman & Wakefield in Phoenix represented the seller, McCormick Retail Partners, LLC.

9. OrbVest purchased Talavi Spectrum, a 75.6KSF office property at 5701 W. Talavi Boulevard, Phoenix, for $13M. Tivon Moffitt and Peter Bauman, Senior Directors at Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, Dunbar.

10. Pulte Homes closed on 227 lots in the Rancho Vistoso Master Planned Community in Oro Valley for $12.5M, from JEN Arizona 34, LLC. Will White and John Carroll of Land Advisors Organization handled the transaction.

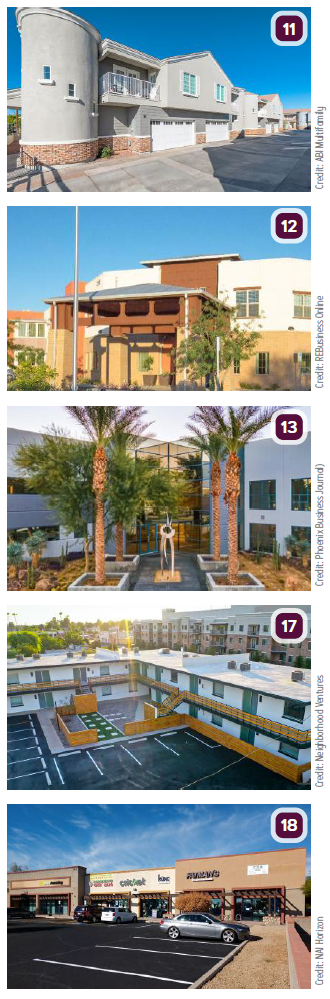

11. A California-based buyer purchased Gifford Groves Townhomes, an 18-townhome unit complete project in Phoenix, for $10M. ABI Multifamily‘s Phoenix-based Institutional Apartment Group – Alon Shnitzer, Rue Bax, Eddie Chang and Doug Lazovick represented the buyer and the Arizona-based seller.

11. A California-based buyer purchased Gifford Groves Townhomes, an 18-townhome unit complete project in Phoenix, for $10M. ABI Multifamily‘s Phoenix-based Institutional Apartment Group – Alon Shnitzer, Rue Bax, Eddie Chang and Doug Lazovick represented the buyer and the Arizona-based seller.

12. Chicago Pacific Founders (CPF) and its subsidiaries, CPF Living Communities and Grace Management Inc., have acquired The Ranch Estates of Tucson, a 107-unit senior living community in Tucson, for an undisclosed amount. The seller was also not disclosed.

13. Mechanical Keyboards purchased a 78KSF building at 7300 W. Boston Street, Chandler, for $9.2M, and plans to use it for warehousing, distribution and a showroom. Stein Koss and Tom Louer of Lee & Associates represented the seller, Jay Donkersloot.

14. Lennar Arizona, Inc. purchased an additional 78 lots at La Estancia in Tucson for $5.2M, from Sunbelt Holdings. The transaction was handled by Will White and John Carroll of Land Advisors Organization.

15. An individual/personal trust purchased Super Star Car Wash, a 5KSF net-leased property at 3930 E. Baseline Road, Phoenix, for $4.855M. Zack House, Chris Lind and Mark Ruble, investment specialists in Marcus & Millichap’s Phoenix office, had the exclusive listing to market the property on behalf of the seller, a limited liability company. The buyer was procured by Hamid Panahi and James Crawley, investment specialists also in the firm’s Phoenix office.

16. A private investor purchased Glenrosa Gardens, a 22-unit apartment property at 4250 N. 25th Street, Phoenix, for $4.61M. Paul Bay and Darrell Moffitt with Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, a private investor.

17. Neighborhood Ventures announced the $3.562M sale of Venture on Marlette, a 14-unit apartment complex in Uptown Phoenix. The deal closed on April 20th. The buyer and seller were not disclosed.

18. Olivia Pearl, LLC purchased Apache Trail Marketplace, a 12.4KSF, multi-tenant retail property at 2430 W. Apache Trail, Apache Junction, for $2.34M. NAI Horizon Executive Vice President Lane Neville and Senior Associate Logan Crum represented the seller, JAM Apache Trail, LLC. The buyer was represented by Steve Ghirardo of Ghirardo Real Estate Group.

19. An individual/personal trust purchased Midtown on 2nd, a 42-unit apartment property at 3601 E. 2nd Street, Tucson, for $2.8M. Hamid Panahi and James Crawley, investment specialists in Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, a private investor.

20. Neighborhood Ventures announced the $2.1M sale of Venture on Wilson, a 12-unit apartment building in downtown Tempe. The deal closed on April 13th. The buyer and seller were not disclosed.

21. The Land Agency announced the successful closing of a land sale within Anderson Farms in Maricopa, for an undisclosed amount. Anderson Farms will be a themed residential  masterplan community developed by Lennar Homes. Howard Weinstein and Patty Lafferty of The Land Agency brokered the sale. The buyer and seller were not disclosed.

masterplan community developed by Lennar Homes. Howard Weinstein and Patty Lafferty of The Land Agency brokered the sale. The buyer and seller were not disclosed.

Lease Transactions

22. Photocentric, Inc. will move its US-based headquarters to Avondale. They recently leased 50KSF facility in the Avondale 107th Industrial Park, located at 855 N. 107th Avenue, and plan to open in fall 2021, with plans to double their space.