Sales Transactions

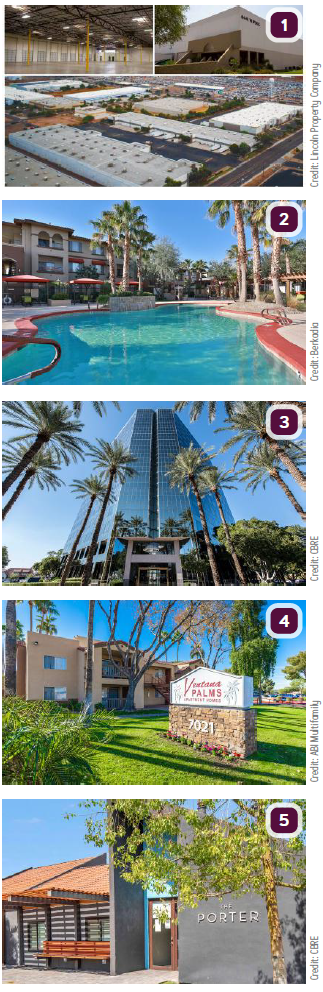

1. KKR purchased a five-building industrial portfolio, representing 540,039 square feet of multi-tenant, fully leased infill space at 4441 W. Polk Street, 120 E. Watkins Street, 4720 W. Van Buren Street and 5240 and 5302 W. Buckeye Road, Phoenix, for $68M, from Lincoln Property Company. CBRE’s National Partners Team, led by Darla Longo, represented LPC in the portfolio sale.

1. KKR purchased a five-building industrial portfolio, representing 540,039 square feet of multi-tenant, fully leased infill space at 4441 W. Polk Street, 120 E. Watkins Street, 4720 W. Van Buren Street and 5240 and 5302 W. Buckeye Road, Phoenix, for $68M, from Lincoln Property Company. CBRE’s National Partners Team, led by Darla Longo, represented LPC in the portfolio sale.

2. 29th Street Capital purchased Lunaire, a 240-unit garden-style multifamily property at 949 S. Goodyear Boulevard, Goodyear, for $59.7M. Senior Managing Directors Mark Forrester and Ric Holway, Senior Director Dan Cheyne and Director Andrew Curtis of Berkadia’s Phoenix office represented the seller, RK Properties.

3. CAMCO Investment Group purchased The Mesa Tower, a 16-story, 311.9KSF, Class A high-rise office building at 1201 S. Alma School Road, Mesa, for $39.5M. CBRE’s Barry Gabel, Chris Marchildon and Will Mast represented the seller, Barker Pacific Group and Iron Point Partners.

4. A California-based buyer purchased Ventana Palms Apartment Homes, a 160-unit multifamily apartment property at 7021 W. McDowell Road, Phoenix, for $32.25M. ABI Multifamily‘s Alon Shnitzer, Doug Lazovick, Rue Bax, Eddie Chang, and John Kobierowski represented the buyer and seller, Geringer Capital.

5. A private investor purchased The Porter, a 165-unit multifamily community at 1532 S. Price Road, Tempe, for $32M. Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke of CBRE represented the seller, a private investor. Rocco Mandala and Anthony Valenzuela of CBRE arranged financing on behalf of the buyer. The CBRE team also represented the buyer.

6. An undisclosed buyer purchased Tierra Del Sol, a 276-unit apartment property in Mesa for an undisclosed amount. Steve Gebing and Cliff David with Institutional Property Advisors, a division of Marcus & Millichap, represented the seller, Bridge Investment Group, and procured the buyer.

7. Commercial Properties, Inc./CORFAC International (CPI) announced the sale of a +/-729KSF Opportunity Zoned land assemblage in Tempe slated for mixed-use redevelopment, called Banyan North Tempe, for $20M. Robert (Bob) Soules, Vice-President – Investment Sales for Commercial Properties, Inc., represented the undisclosed seller.

8. A private, Southern California-based 1031 exchange investor purchased a newly built 146.5KSF distribution and manufacturing facility at 4615 W. McDowell Road, Phoenix, for $16.8M. Newmark Knight Frank’s Executive Managing Director Rick Sheckter and Managing Director Robert Stephens represented the buyer. The seller, Caprock Partners, was represented by Payson MacWilliam and Don MacWilliam of Colliers International.

9. Harvard Investments bought 25.69 acres of land at the SEC of Estrella Parkway and Lower Buckeye Road, Goodyear for $10.5M, from El Dorado Holdings. The brokers on the deal were Patrick Burch and John Klocek of ABI Multifamily.

10. A California 1031 exchange buyer purchased New Horizons Women’s Care, a 14.1KSF office property at 1900 W. Frye Road, Chandler, for $5.425M. Alan Laulainen, Chris Lind and Mark Ruble, investment specialists in Marcus & Millichap’s Phoenix office, had the exclusive listing to market the property on behalf of the seller.

11. Mattamy Homes purchased 189-lots in Phase II of Rincon Knolls in Vail for $5.2M, from TTLC Rincon Knolls, LLC. The transaction was handled by Will White and John Carroll of Land Advisors Organization-Tucson.

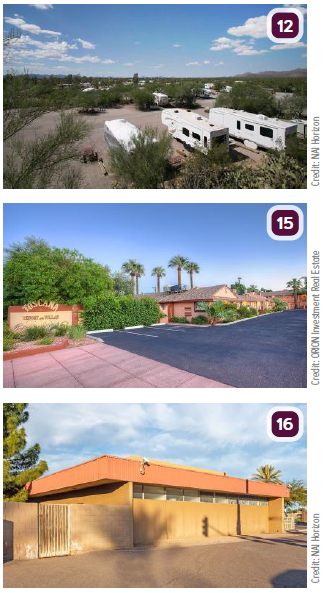

12. Desert Trails RV Park LLC purchased the Desert Trails RV Park located at 3551 San Joaquin Road, Tucson, for $4.5M. The park includes 200 full hookups, a 35-foot observation deck, library and more. NAI Horizon Manufactured Housing Specialist and First Vice President Andrew Warner represented the seller, Desert Trails Land Holdings LLC, and the buyer.

12. Desert Trails RV Park LLC purchased the Desert Trails RV Park located at 3551 San Joaquin Road, Tucson, for $4.5M. The park includes 200 full hookups, a 35-foot observation deck, library and more. NAI Horizon Manufactured Housing Specialist and First Vice President Andrew Warner represented the seller, Desert Trails Land Holdings LLC, and the buyer.

13. Pulte Homes bought 20.6 acres of land at the SEC of 91st Avenue and West Cardinals Way, Glendale, for $4.4M, from John F. Long Properties. The brokers on the deal were Bret Rinehart, Ryan Semro, Ben Heglie, and Greg Vogel of Land Advisors Organization.

14. Becton, Dickinson and Company purchased 32.65 acres of industrial land located in Century Park Marketplace. Block 1, situated at the NEC of Valencia Road and Kolb Road in Tucson, was purchased from Valencia Kolb Properties, LLC for $4,124,731. Stephen D. Cohen, Principal, and Industrial Specialist with Cushman & Wakefield | PICOR, represented the seller. William Honsaker with Jones Lang LaSalle Americas, Inc., and Jodie Matthews, with Jones Lang LaSalle Brokerage, Inc., represented the buyer.

15. Risi Companies purchased Toscana Resort and Villas, a 24-unit multifamily community at 929 E. Bethany Home Road, Phoenix, for $4M. Jackson Everhart and Zack Mishkin of ORION Investment Real Estate represented the buyer and seller, DF Sauer Properties LLC.

16. EMPACT – Suicide Prevention Center purchased an 11.7KSF office building at 7800 N. 59th Avenue, Glendale, for $2M. Christopher Lewis with NAI Horizon represented the seller, Rick & Sharon Wilson, and Kevin Lange with Reveal Concepts Company represented the buyer.