Source: Colliers International

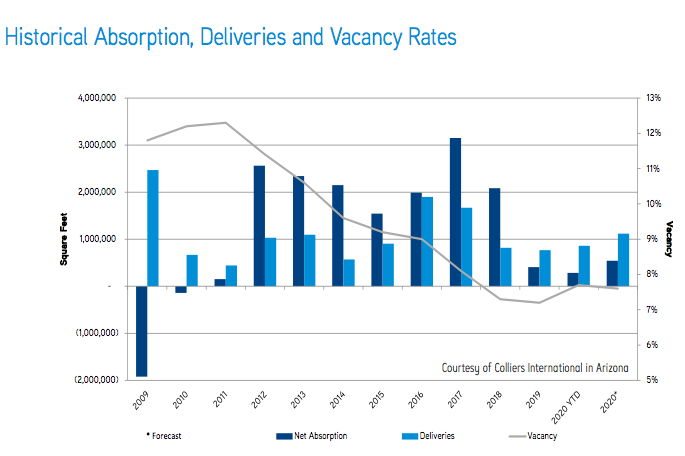

The Greater Phoenix retail market posted positive net absorption in third quarter, despite the continued impact of the COVID-19 pandemic. Vacancy rose slightly during the quarter to 7.7 percent as the city was recognized for comparatively low unemployment and small business closures.

During third quarter, Greater Phoenix posted a 1.7 percent increase in unemployment, finishing September at 5.9 percent. This marks a steep decline from an April unemployment rate of 12.5 percent. August employment in the Retail Super Sector dropped just 0.26 percent below the level of August 2019 Retail Super Sector employment. Many retail establishments are small businesses.

An Opportunity Insights report shows the number of small businesses operating in September 2020, compared to January 2020 dropped just 19 percent in Greater Phoenix. This places Phoenix as #8 in the nation for retention of small businesses during the pandemic.

Net absorption of retail space totaled 101KSF during third quarter. This figure includes completion of several large, big box construction projects. West Valley, East Valley and Scottsdale submarkets led the net absorption for third quarter. North Phoenix had the most negative quarter, caused mainly by Costco closing its 155KSF store at Christown Spectrum. That center will experience another significant hit when J.C. Penny’s vacates its 98KSF in the next quarter. Leasing activity increased 122 percent over second quarter, but was down 20 percent from this time a year ago.

Vacancy increased 10 basis points over-the-quarter to 7.7 percent, up 40 basis points year-over-year. Five new projects were completed during third quarter, totaling 353KSF. These projects posted 3.16 percent vacancy upon completion because of large tenant commitments. The shutdown of gyms and health clubs forced two You Fit Gyms to permanently close in North Scottsdale. The pandemic impact also forced the closure of SteinMart’s eight locations in Greater Phoenix. Scottsdale and West Valley submarkets posted the strongest improvements in vacancy year-over-year, while Downtown Phoenix posted the largest increase in vacancy year-over-year.

Currently, there are 672KSF of retail space under construction, with only six percent available for lease. Most of these are focused in the Southeast and Northwest Valley submarkets. The build-to-suit structure of most of these projects created strong occupancy before completion.

Retail rental rates are struggling to maintain pre-pandemic levels. While average rental rates are 0.55 percent higher year-over-year, they dropped 0.20 percent over-the-quarter to $14.62/SF. Rental rates are beginning to soften in older properties, but newer properties with strong anchor tenants continue attracting high rents.

The investment market for retail projects attracted more interest in third quarter. Investment sales volume increased 130 percent over second quarter, totaling $182M of sales. This marks a 38 percent decrease from third quarter 2019. Investors are bullish on Greater Phoenix. The median price of retail assets larger than 10KSF rose 32.5 percent during third quarter to $170.82/SF. This is a decrease of 1.6 percent over-the-year.

New dynamics are forming in the brick and mortar retail industry. Multiple variations are being explored. These include ordering consumer goods online and picking them up at a physical retail site. Also considered is using retail space strictly as showroom with products being shipped from outside warehouses to homes.

Large big box retailers and grocery stores will continue leading the physical retail space market. Several quick-service restaurant chains are looking to enter the Greater Phoenix market. However, curbside takeout will continue dominating the market until the public is more confident dining in restaurant establishments.

NEWS TICKER

- [November 21, 2025] - Gilbert Council Issues 2nd Continuance for Harvest Grove Requests

- [November 21, 2025] - Scottsdale Council Approves Axon Agreement

- [November 21, 2025] - Mesa DRB Discusses Child Safety Office Building

- [November 21, 2025] - Major Donation Funds New Western Art Museum in Wickenburg

- [November 21, 2025] - Arizona Projects 11-21-25

- [November 19, 2025] - Controversy Continues Around Tolleson High School Stadium

- [November 18, 2025] - Scottsdale Council Considering Compromise Agreement with Axon

- [November 18, 2025] - Phoenix Approves Extension of Apprenticeship Program