ABI Multifamily recently issued its “Q1 2022 Phoenix MSA Construction Pipeline” report. For the moment, at least, the sector is continuing its booming pace.

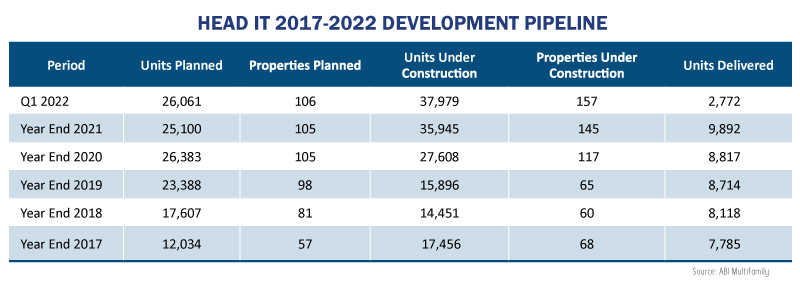

At the end of Q1, ABI reports 26,061 units planned in 106 properties, 37,979 units under construction at 157 properties and 2,772 units completed at 12 properties for the year-to-date.

By way of comparison, the 2021 Year End Construction Pipeline report listed 25,100 units planned at 105 properties, 35,945 units under construction at 145 properties, and 9,892 units completed for the year.

The Last Five Years

Full disclosure: In between my stints here at AZBEX, I spent a year as ABI’s research director. That time made me aware of two things that make ABI reports particularly useful. First, being exclusively focused on the Multifamily sector, they provide a greater depth of detail than many other brokerages. Second, their format, data sources and criteria reviewed have remained largely consistent over time, allowing for both an easier and more comprehensive apples-to-apples look at past sector performance.

One caveat to consider before getting started is ABI’s data for projects in various stages of development only take into account projects of 50 or more units. While that is certainly the majority of the development sphere, it’s an exception worth noting. ABI also sorts sales data by properties of 10-99 units and properties of 100 units or more.

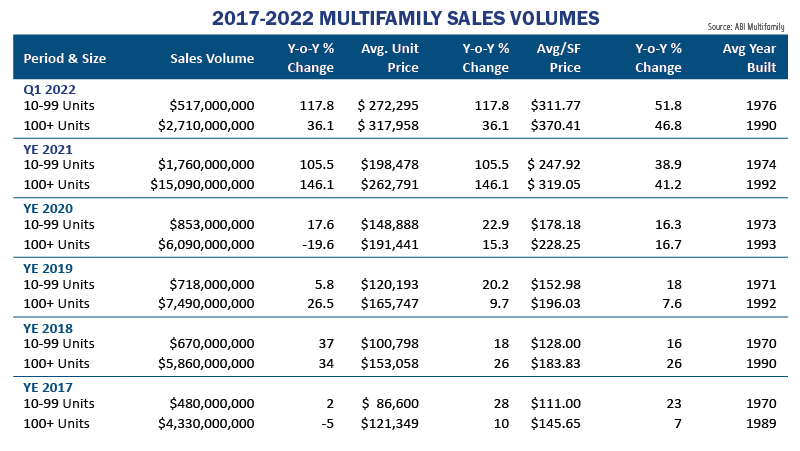

Having such a historical depth lets a reviewer take note of several interesting items in Phoenix Multifamily’s recent history. In particular, it gives a clear scope as to the massive growth in sales value and volume. From the end of 2017 through the end of 2021, total sales volume for properties of more than 100 units went from $4.33B to $15.09B. For properties of 10-99 units, the volume went from $480M up to $1.76B.

Per unit prices more than doubled for both size categories, going from $121,349 up to $262,791 for 100-unit+ properties, and from $86,600 up to $198,478 for 10-99.

Prices/SF were also impressive. In 2017 sales prices for a 100-unit+ property averaged $145.65. Properties of 10-99 units averaged $111. At the end of 2021, those prices were up to $319.05 and $247.92, respectively.

As of the end of Q1 2022, sales volumes were $2.71B for 100-unit+ properties and $517M for properties of 10-99 units.

What is really interesting, or concerning, is the increase in prices per unit and per square foot. As of the end of Q1 the average unit and /SF prices at 100-unit+ properties were up to $317,958 and $370.41. The prices at properties with unit counts of 10-99 were $272,295 and $311.77.

While no sane analyst would stake their reputation on a three-month data window, the scale and pace of those increases should at least start raising concerns about an overheating market.

Yes, demand is still high, with occupancy sitting at more than 96%. Yes, many buyers are snapping up every property they can because interest rates are going up, financing is becoming (and will continue to become) more complicated and difficult, and the Biden Administration appears adamant in its desire to eliminate 1031 exchanges and other investment incentives.

These and other purchase-driving considerations are reasons to temper and moderate the degree of concern, but price increases such as we are experiencing simply cannot be explained away by pointing to the fundamentals.

Materials, Labor and Deliveries

Another set of concerns has been with us for years longer than many observers are bothering to remember: Construction materials costs and availability, the labor shortage and Phoenix’s anemic pace of unit delivery.

Many elected officials have attempted to place the blame for the high price and low availability of materials squarely on the shoulders of the pandemic. While COVID-19 and its variants certainly didn’t help the situation, those of us who have been watching and involved in the industry for any length of time are aware that materials availability is a problem that pre-dates the pandemic by years, as is labor availability in the skilled trades.

Turning back to ABI’s construction pipeline reports since Year-End 2017, we see what appears to be an ongoing disconnect between units under construction and units delivered.

At the beginning of 2018, ABI reported 17,456 units under construction. By the end of the year, 8,118 had been delivered, a ratio of 0.465 units delivered/units under construction.

2019 started the year with 14,451 under construction and 8,714 delivered, a ratio of 0.603.

In 2020, the year kicked off with 15,896 under construction and finished with 8,817 delivered, a ratio of 0.555.

2021 was where things start to get interesting. The year started with 27,608 under construction and finished with 9,892 delivered, for a ratio of 0.358.

2022 started with a major spike in units under construction, with 35,945. At the end of Q1, 2,772 had been delivered. There is no valid way to predict the pace of delivery for the year based on one quarter’s results, but if the Q1 pace remains consistent, Phoenix will deliver slightly more than 11,088 units and maintain a delivery ratio of 0.308.

The last item of concern is, of course, rising construction costs. The most recent cost information I was able to obtain breaks down as follows. Three-story garden apartments had 2020/SF construction costs ranging from a low of $149 to a high of $161. For 2021, the cost range increased to $179-$193, and the 2022 estimate as of the end of Q1 is at $206-$222.

For developments of five stories or more during the same period, costs were $304-$339, $365-407, and $420-468.

With these kinds of cost increases, more projects not yet under construction will fail to pencil out, and it is likely to have an impact on projects not yet officially put into the pipeline.

Since the 145 projects under construction at the end of 2021 are less likely to be put on hold than the 106 in various stages of planning at the beginning of 2022, we may be somewhat safe in assuming a reasonably consistent number of deliveries this year.

There are three cautionary notes to keep in mind, however:

- Even at 11,000 units delivered, Phoenix is still more than 4,000 units short of its minimum needed to start offsetting demand,

- Neither the supply chain, labor market, capital availability or inflationary pressures will improve significantly over the course of 2022, and

- Many economists are predicting a full-on recession late in 2022 or early in 2023.

There are headwinds aplenty coming on the horizon. The Phoenix market’s desperate level of need for residential units may be its saving grace in weathering the storm, or it may mean the metro and the state take a greater buffeting than others that have seen less stellar highs as satisfying demand becomes even more challenging.