Sales Transactions

1. Institutional Property Advisors, a division of Marcus & Millichap, announced the $65.4M sale of Aventura, a 408-unit multifamily property in Avondale. Steve Gebing and Cliff David, IPA senior managing directors, represented the seller, Boston Capital, and procured the buyer, an institutional investment manager.

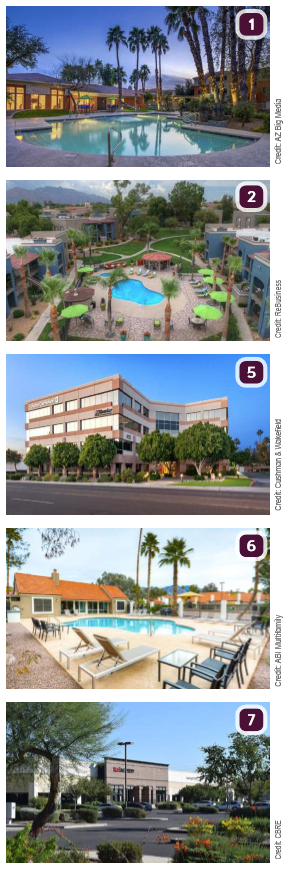

1. Institutional Property Advisors, a division of Marcus & Millichap, announced the $65.4M sale of Aventura, a 408-unit multifamily property in Avondale. Steve Gebing and Cliff David, IPA senior managing directors, represented the seller, Boston Capital, and procured the buyer, an institutional investment manager.

2. Investors Capital Group has purchased Domain 3201, a multifamily property located within the Casas Adobes area of Tucson. Aspen Square Management sold the property for $37.7M. Hamid Panahi, Steve Gebing and Cliff David of Institutional Property Advisors represented the seller and procured the buyer.

3. Rosewood Property Co. purchased the 283-unit Jefferson Chandler, 3950 W. Chandler Blvd, Chandler, from JPI for $26.25M.

4. Mikhail Holdings Limited purchased Black Canyon Tower, a 147.7KSF office building at 10851 N. Black Canyon Hwy, Phoenix, for $20.1M. Newmark Knight Frank Capital Markets represented the seller, Fenway Capital Advisors.

5. Clayton A. Varga, trustee of the Varga Revocable Trust, purchased Arcadia Gateway Center, a four-story, 90.2KSF Class A multi-tenant office building at 4222 E. Thomas Rd, Phoenix, for $17.25M. Eric Wichterman, Mike Coover and Tim Whittemore of Cushman & Wakefield Phoenix represented the seller, MIG Real Estate LLC, and McAlister Cleary of Marcus & Millichap represented the buyer.

6. A private investment partnership composed of BlueSky Equity and Vista Laguna Asset Management purchased Orange Tree Village Apartment Homes, a 110-unit apartment community at 645 W Orange Grove Rd, Tucson, for $15.9M. ABI Multifamily’s Alon Shnitzer, John Kobierowski, Rue Bax, Doug Lazovick and Eddie Chang, along with Ryan Kippes of ABI’s Tucson office, represented both the buyer and seller, Next Wave Investors, LLC.

7. Fullerton Properties purchased the Chandler Business Center, a 129.8KSF creative office, flex-tech and retail space at 6150 and 6170 W. Chandler Blvd, Chandler, for $13.26M. CBRE’s Glenn Smigiel, Bob Young, Steve Brabant, Rick Abraham, Mark Krison and Jackie Orcutt represented the seller, Montana Avenue Capital.

8. Newmark Knight Frank announced the sale of The Ross Walgreens Shopping Center, measuring 94.6KSF for $13.12M. NKF Managing Directors David Guido and Tim Westfall as well as Associate Director Ryan Moroney represented the seller, an out of state investor.

9. Marcus & Millichap announced the sale of Franmar Manor Apartments, a 78-unit multifamily community at 3825 W McDowell Rd, Phoenix, for $8.5M. Rich Butler, Senior Vice President of Investments in Marcus & Millichap’s Phoenix office as well as Sean Connolly, a multifamily specialist in the Phoenix office negotiated the sale on behalf of both the seller and buyer.

10. LJ Mainstreet Holdings, LLC of Mesa has purchased the Main Street Lofts at Verrado for $5.25M from Waitt Verrado LLC. The property is located at 21068 W. Main St. in Buckeye. Matt Kolano and Charlie Steele of Jones Lang LaSalle of Phoenix represented the seller. Chris Roach and Matt Roach of Colliers International in Arizona represented the buyer.

11. Meritage Homes of Arizona purchased A 31.4-acre parcel of unincorporated land at the SWC of El Mirage & Northern for $4.317M. Lee & Associates Principals Mike Sutton & Brent Moser negotiated on behalf of Marbella Ranch Limited Partnership. The Land Agency represented the buyer. The site is three miles from the Glendale Loop 101 Entertainment District, near University of Phoenix Stadium, home to the Arizona Cardinals, and Gila River Area, home to the Arizona Coyotes.

12. Williams Investments of Arizona, LLC, sold two adjacent industrial buildings, approximately 50KSF, located at 5706 W. Missouri Ave. in Glendale, for $3.25M. The buyer, Maximum Management Corporation, was represented by Todd Hamilton of Citywide Commercial. Menlo Group Commercial Real Estate negotiated the sale.

12. Williams Investments of Arizona, LLC, sold two adjacent industrial buildings, approximately 50KSF, located at 5706 W. Missouri Ave. in Glendale, for $3.25M. The buyer, Maximum Management Corporation, was represented by Todd Hamilton of Citywide Commercial. Menlo Group Commercial Real Estate negotiated the sale.

13. Newmark Knight Frank has announced the sale of Cheryl Plaza, at the SWC of 19th Ave and Northern Ave for $2.4M. NKF Managing Directors David Guido and Tim Westfall as well as Associate Director Ryan Moroney represented the seller, an out of state investor.

14. Nuveen Real Estate purchased a single-tenant, 319.9KSF industrial property at 2060 S. 51st Ave, Phoenix, for an undisclosed price. John Repstad and Mark Repstad of Realty Advisory Group represented the buyer in the deal. The seller was not disclosed.

15. Redwood Capital Group, LLC, a multifamily investment advisor, has acquired Carter Apartments, a 365-unit Class A apartment property in downtown Scottsdale.

16. SLM Land Holdings has bought its second land parcel in the West Valley, 121 acres near Interstate 10 and 411th Ave in Tonopah. The purchase price was about $8.7K per acre for the parcel. Real estate broker Joe Dodani represented the buyer.

Lease Transactions

17. Integrated CBD has announced it will open its first U.S. manufacturing location and hire approximately 100 employees at HUB 317. JLL Managing Director Andrew Medley and Executive Vice President Steve Larsen represented Integrated CBD. Ken McQueen, Chris McClurg and Brian Payne represented the owner and developer, a joint venture between DPC Companies and Confluent Development.

17. Integrated CBD has announced it will open its first U.S. manufacturing location and hire approximately 100 employees at HUB 317. JLL Managing Director Andrew Medley and Executive Vice President Steve Larsen represented Integrated CBD. Ken McQueen, Chris McClurg and Brian Payne represented the owner and developer, a joint venture between DPC Companies and Confluent Development.

18. Bear Communications, LLC leased a 27.4KSF industrial yard, located in the Tucson Industrial Center, 4203 E. Tennessee St. in Tucson, from Gallaher Grit, LP. Max Fisher, Industrial Specialist with Cushman & Wakefield | PICOR, represented the landlord. Matthew Pennington with Pendev, LLC, represented the tenant.

19. Diggins & Sons Power Sweeping, Inc. leased 3.55 acres of industrial land at 3131 and 3161 E. Atlas Pl. in Tucson, from Mosey 1, LLC and Deb-Bar Investments, LLC. Robert C. Glaser, SIOR, CCIM, Principal and Industrial Specialist with Cushman & Wakefield | PICOR, represented the landlord. David Blanchette with NAI Horizon, Tucson, represented the tenant.

20. Aguirre Enterprises, Inc. renewed their lease with CJ Southwest Property Partners, LLC for 20.4KSF of industrial space located at 3850 E. 44th St. in Tucson. Stephen D. Cohen and Russell W. Hall, SIOR, GSCS, Principals and Industrial Specialists with Cushman & Wakefield | PICOR, represented the landlord.

21. Arizona Steel & Ornamental Supply, Inc. leased 15.4KSF of industrial space, located at 1501 E. 21st St. in Tucson, from Kash Property Management, Inc. Paul Hooker and Robert C. Glaser, SIOR, CCIM, Principals and Industrial Specialists with Cushman & Wakefield | PICOR, handled the transaction.

22. Jupiter Research signed a six-year lease for 12.4KSF of space at the recently opened Camelback Collective located at 2801 E. Camelback Road, #180, Phoenix. Jupiter Research moved into their new facility in early June. Earlier this year, Jupiter Research was acquired by TILT Holdings, a vertically integrated infrastructure and technology platform serving the cannabis industry.