Sales Transactions

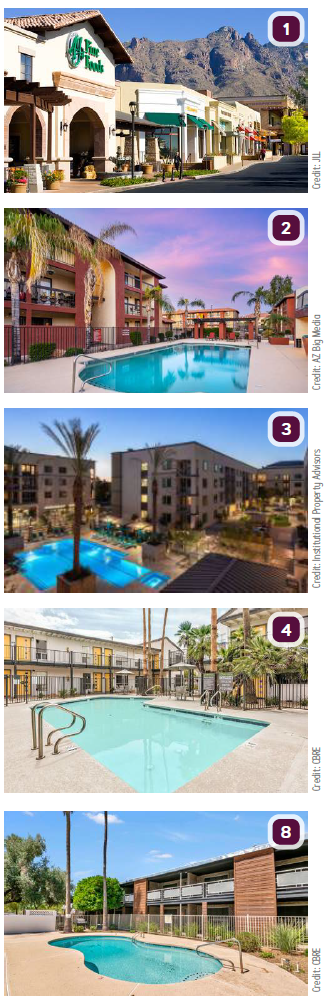

1. JLL Capital Markets has closed the $165.25M sale and secured $102M in acquisition financing for La Encantada, a 246KSF shopping center in Tucson. JLL represented the seller, Macerich Company. A group of local investors purchased the property. JLL arranged the fixed-rate, full-term, interest-only acquisition loan with an investment bank and financial services company.

1. JLL Capital Markets has closed the $165.25M sale and secured $102M in acquisition financing for La Encantada, a 246KSF shopping center in Tucson. JLL represented the seller, Macerich Company. A group of local investors purchased the property. JLL arranged the fixed-rate, full-term, interest-only acquisition loan with an investment bank and financial services company.

2. Institutional Property Advisors, a division of Marcus & Millichap, announced the sale of Accolade, a 548-unit multifamily property in Phoenix. It sold for $155M ($282,847/unit). Steve Gebing and Cliff David of IPA represented the seller, Weidner Apartment Homes, and procured the buyer, Knightvest Capital.

3. Institutional Property Advisors, a division of Marcus & Millichap, announced the sale of Peak 16, a 233-unit multifamily asset in Phoenix, for $81.35M ($349,142/unit). IPA’s Steve Gebing and Cliff David represented the seller, Virtú Investments, and procured the buyer.

4. CBRE’s Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke represented both the buyer and seller in the $60M off-market sale of The Amara, a 302-unit multifamily complex in Phoenix. The property was purchased by a private buyer based in Washington state.

5. The Koll Company announced the sale of Broadway Industrial Park in Tempe. The firm partnered with Cushman & Wakefield, Will Strong and Phil Haenel. Acquired in 2019 for $7.47M, the property was sold for more than $13M. Broadway Industrial Park comprises two tenants in two buildings totaling more than 58KSF.

6. Online car reseller Carvana Co. will purchase roughly 150 acres at Cactus and Litchfield roads in Surprise in the Cactus Commerce Center from Surprise/Dysart Properties LLC. The transaction price is unknown, but the rail-capable property had been listed at $25M.

7. ReNew 3030, a Class B, 126-unit garden-style complex in Mesa, has been purchased by SB Real Estate Partners for $24.3M. The property was rebranded as Portola East Mesa and will receive value-add upgrades.

8. CBRE announced the sale of six multifamily properties in Phoenix, Tempe and Scottsdale for a total of $22.5M. Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke of CBRE facilitated all six transactions. The properties are: Mount Crescent: 26 units; The Rise @ Old Town: 24 units; The Michelle: 24 units; Parkview on 5th: 17 units; Baker’s Apartments: 14 units, and The Chelsea: 12 units. All six have been renovated. The Parkview, Baker’s and Chelsea properties were acquired by private out-of-state investors, while the Mount Crescent, Michelle and The Rise @ Old Town were purchased by Arizona-based limited liability companies.

9. Electrical contractor Helix Electric announced its first Arizona manufacturing facility will be in Goodyear. The company will occupy a 112KSF building in the VB|143 development, developed by Baker Development Corp. with Foundation Capital Partners and marketed by JLL. Helix Property VI LLC purchased the building in July for $14.8M from Airport Gateway West LLC.

10. An 82.5KSF warehouse at 2434 S. 10th St. in Phoenix sold for $11.1M to Stos Partners. The seller was Finnerty Investments Limited Partnership. Both buyer and seller were represented by David Wilson at DAUM Commercial Real Estate Services.

11. Grand Village Center, a nearly 26KSF retail center in Surprise sold for $5M. Newmark’s Steve Julius, Jesse Goldsmith and Chase Dorsett represented the seller Boros Investments. The buyer was LJ Mainstreet Holdings.

11. Grand Village Center, a nearly 26KSF retail center in Surprise sold for $5M. Newmark’s Steve Julius, Jesse Goldsmith and Chase Dorsett represented the seller Boros Investments. The buyer was LJ Mainstreet Holdings.

12. ORION Investment Real Estate recently represented the seller in the sale of 4600 N. Central Avenue near Coolidge Street. The buyer intends to redevelop the location as a mixed-use property. The sale price was $2.43M.

Lease Transactions

13. NAI Horizon represented the tenant in the turn-key deal of a long-term lease for a 132KSF brand new, freestanding warehouse in Chandler. The total value of the lease is approximately $8.5M. NAI Horizon’s Jeff Adams represented AES Direct Express, LLC (dba SKU Distribution) in its lease of Parc Germann located at 2225 E. Germann Road, Building B.