Sales Transactions

1. LPC Desert West announced the 1.25MSF Park 303 Phase I in Glendale has sold for $186M to BentallGreenOak, making it the largest single-building industrial transaction in state history. The speculative project completed construction approximately a month ago and has been fully leased to a major retailer. The tenant was represented by Ed Lampitt, Mike Haenel, Andy Markham and Phil Haenel of Cushman and Wakefield. Will Strong of Cushman and Wakefield represented LPC. LPC will continue to provide property management services.

1. LPC Desert West announced the 1.25MSF Park 303 Phase I in Glendale has sold for $186M to BentallGreenOak, making it the largest single-building industrial transaction in state history. The speculative project completed construction approximately a month ago and has been fully leased to a major retailer. The tenant was represented by Ed Lampitt, Mike Haenel, Andy Markham and Phil Haenel of Cushman and Wakefield. Will Strong of Cushman and Wakefield represented LPC. LPC will continue to provide property management services.

2. The Empire Group/Aspirant Development has sold the 312-unit The Stewart Apartments in downtown Phoenix to New York Life Real Estate Investors for $125.5M in a cash deal.

3.Brad Cooke, Matt Roach, Cindy Cooke and Chris Roach of the Cooke Multifamily Team with Colliers in Arizona have completed the sale of the Terraces and Winfield at the Ranch apartment complexes in Prescott. The two developments total 326 units, and the combined price was $111.6M. Terraces was sold by Virtu Investments to JRK Investors, Inc. for $76.6M. The Tanbic Co. sold Winfield at the Ranch to FSO REAL ESTATE SERVICES for $35M.

4. SAM Residential Group (Shelter Asset Management) has purchased the 164-unit Riverside apartments in Tempe for $46M ($280.5K/unit). The seller was Knightvest Management, represented by Steve Gebing and Cliff David of Institutional Property Advisors, a division of Marcus & Millichap.

5. Trevor Koskovich, Bill Hahn, Jesse Hudson and Ryan Boyle of NorthMarq brokered the $32.8M ($99K/unit) sale of the 332-unit Apple Apartments in Tucson to Hannapat Management, LLC. The seller was Catalina Investments, LLC.

6. CBRE announced the sale of the 89KSF North Loop 101 Building D office building in Phoenix to Stafford Holdings for $22.1M. Seller Regent Properties was represented by Barry Gabel, Chris Marchildon and Will Mast of CBRE. The buyer was represented by Blake Hupfer of Premiere Property Group, LLC.

7. The 35-unit townhome rental community 8th and Row in the Roosevelt Row Arts District has sold for nearly $18M ($515K/unit). Newmark Knight Frank’s Ryan Ash, Director Mike Woodrick, Chris Canter, Brett Polachek and Brad Goff represented the seller 8th and Row NSMM, LLC. The buyer was Watt New Leaf-Roosevelt, LLC.

8. NAI Horizon’s Investment Services Group represented Structured REA- 3080, LLC in the $8.2M disposition sale of 3080 North Civic Center Plaza. The 23KSF multi-tenant, Class-A office property is located in Old Town area of Scottsdale.

9. Marcus & Millichap has announced the sale of the 13.1KSF WSS Shoes & Habit Burger in Phoenix for $8.125M. Mark Ruble and Chris Lind of Marcus & Millichap represented the seller. Peter James and Rob Narchi, also with Marcus & Millichap, procured the buyer.

10. Paul Bay of Marcus & Millichap’s Phoenix office represented the seller and procured the buyer for a 23-unit Phoenix apartment complex Heatherbrae. The sale price was $3.68M. Both the buyer and seller are private investors.

11. DAUM Commercial Real Estate Services recently completed the sale of a portfolio comprising two industrial properties fully leased to CenturyLink. Skip Corley, Jr. of DAUM represented the seller, EPL Federal, LLC. The first property, located in Phoenix, is 8.1KSF. The second, in Casa Grande, is 3.77KSF. Bob Beardsley and Todd Hamilton represented the buyer.

12. Eastgate Apartments, a 32-unit complex in Tucson, recently sold for $2.525M. The investor was Winding Creek Apartments LLC. Both buyer and seller were represented by Allan Mendelsberg and Conrad Martinez of Cushman & Wakefield | PICOR.

13. Colliers in Arizona sold Sonoran Desert Surgery Center in Chandler to a private investor. The fully occupied property is the only off-campus outpatient surgery center for general surgery near Chandler Regional Medical Center. The sale price and parties were not disclosed.

Lease Transactions

Lease Transactions

14. Battery recycler Li-Cycle will occupy the 139KSF Building 2 at Gilbert Gateway Commerce Park in January. The “Spoke 3” facility joins two others in Li-Cycle’s U.S. operations group and will process up to 10,000 metric tons of used batteries and battery scrap when operational.

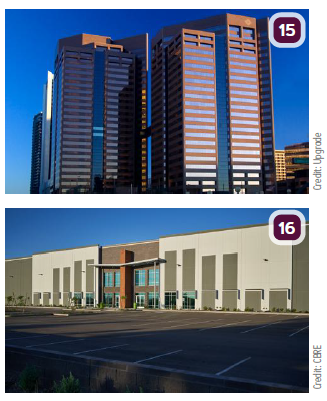

15. Financial technology company Upgrade, Inc. will expand its Arizona operations at Ren Square in Downtown Phoenix. The company will add 39KSF over two floors for a total of 108KSF at Ren Square.

16. CBRE announced Cranial Technologies, Inc. signed a 21KSF lease at Lotus Project in Chandler. The company will use the space to manufacture and distribute a cranial helmet to treat infants with plagiocephaly. CBRE’s Jackie Orcutt and Rusty Kennedy represented the landlord, LaSalle Investment Management. Lindsey Carlson at Colliers represented the tenant.