Sales Transactions

1. CBRE announced the sale of the multifamily communities Ascend at Kierland and Elite North Scottsdale to The Ezralow Company for $312.5M. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter and Matt Pesch of Phoenix Multifamily Institutional Properties represented the seller, a joint venture of Bascom Arizona Ventures and Pacific Life Insurance Company.

1. CBRE announced the sale of the multifamily communities Ascend at Kierland and Elite North Scottsdale to The Ezralow Company for $312.5M. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter and Matt Pesch of Phoenix Multifamily Institutional Properties represented the seller, a joint venture of Bascom Arizona Ventures and Pacific Life Insurance Company.

2. Berkadia managed the sale and secured financing for a four-property multifamily portfolio of 892-units in metro Phoenix. Properties consisted of Banyan Tree, Belcourt, Coronado and Ridgeway Village Apartments. Senior Managing Director Ric Holway, Senior Director Dan Cheyne and Senior Managing Director Mark Forrester of Berkadia Phoenix completed the $155.75M sale on behalf of seller The Barry Company, LLC.

3. Institutional Property Advisors, a division of Marcus & Millichap, announced the sales of The District at Fiesta Park, a 321-unit multifamily asset in Mesa and Arcadia on 49th, a 192-unit multifamily asset in Phoenix. The District at Fiesta Park’s $69.85M sales price equates to $217,601/unit, while Arcadia on 49th’s $37.45M price equals $195,052/unit. Steve Gebing, IPA executive managing director and Cliff David, IPA executive managing director, represented the seller, JB Partners, for both properties, while also procuring the buyer, Bridge Investment Group.

4. JLL Capital Markets announced it has closed the sale of Sedona Ridge, a 250-unit, garden-style multi-housing community in Phoenix. The JLL Capital Markets Investment Sales Advisory team representing seller Sares Regis Multifamily Funds was led by Director Mike Higgins and Managing Directors John Cunningham and Charles Steele. The buyer was undisclosed.

5. Tower 16 Capital Partners has acquired two properties across two separate transactions totaling 508 units in metro Phoenix, for a total of $78.5M. Banyantree Apartments, a 232-unit multifamily property in Phoenix, was acquired for $36.5M, and Solano Pointe Apartments, a 276-unit multifamily property in Glendale, was acquired for $42M. Solano Pointe was secured on off-market. The Banyantree seller was represented by Ric Holway, Dan Cheyne and Mark Forrester of Berkadia’s Phoenix office. Berkadia also helped secure debt financing for the buyer. Alon Shnitzer, Rue Bax, Eddie Chang, and Doug Lazovick of ABI Multifamily’s Institutional Apartment Group represented the buyer and seller in the Solano Pointe transaction.

6. IHP Capital Partners and Värde Partners, acting together as Vistancia Development LLC, recently purchased 3,721 acres of land in Vistancia for $68M. The purchase includes the 3,300 entitled residential dwelling units in the Northpointe neighborhood and 370 acres of commercial.

7. CBRE arranged the sale of the 205-unit multifamily community The Ledges at West Campus in Tucson to Tara Investment Group LLC for $33.75M. CBRE’s Jeff Casper, Asher Gunter, Matt Pesch, Tyler Anderson and Sean Cunningham represented the seller, Berger Investment Group.

8. Newmark announced the sale of Copper Point, a multi-tenant 92KSF medical office building in Gilbert for $33M in an off-market transaction. Newmark Managing Directors Kathleen Morgan and Trisha Talbot represented the seller, West Coast Capital Partners. The buyer, CA Ventures, was self-represented.

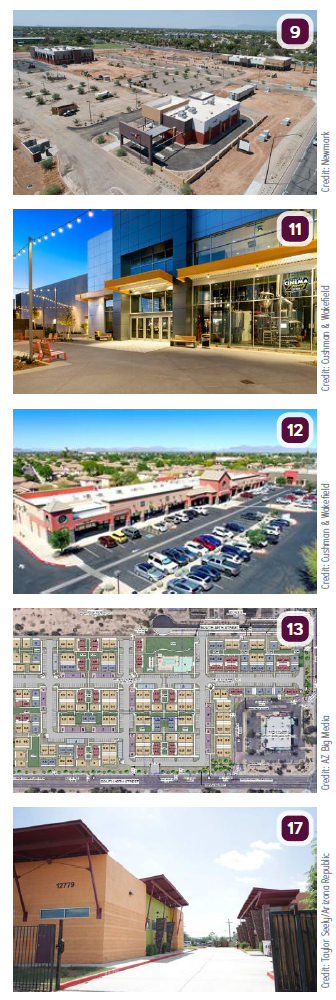

9. Newmark completed the sale of three retail assets at Gilbert Crossroads in Phoenix. The properties traded for a combined total of $13.9M to three separate investors. Senior Managing Directors Steve Julius and Jesse Goldsmith and Associate Director Chase Dorsett brokered the transactions.

9. Newmark completed the sale of three retail assets at Gilbert Crossroads in Phoenix. The properties traded for a combined total of $13.9M to three separate investors. Senior Managing Directors Steve Julius and Jesse Goldsmith and Associate Director Chase Dorsett brokered the transactions.

10. SST VI 11658 W Bell Rd LLC, which is affiliated with Strategic Storage Trust IV, has purchased 665-unit, 72.8KSF self-storage facility Coyote Lakes Cool Storage in Surprise for $13.5M. It has been renamed SmartStop Self Storage.

11. Cushman & Wakefield announced it brokered the sale and lease of a 35KSF theater and brewhouse property in Chandler’s Overstreet mixed-used development. AZ Management & Investments LLC acquired the property for approximately $7.1M. The seller was DT Chandler, LLC. The buyer executed a lease with LOOK Dine-In Cinemas Monrovia for the property. Eric Wichterman, Brent Mallonee, Mike Coover and Chris Hollenbeck represented the seller. Mallonee also procured the tenant.

12. Cushman & Wakefield announced the $6.1M sale of a 24KSF multi-tenant retail shop building Western Skies in Gilbert. The buyer was an individual investor, Metallinos. The seller was Jumping Cholla I, LLC, which was represented by Chris Hollenbeck and Shane Carter with Cushman & Wakefield in Phoenix.

13. Berkadia announced the sale of 15.78 net acres of land near 40th Street and Southern Avenue in Phoenix. Senior Managing Director Mark Forrester and Director Andrew Curtis of Berkadia Phoenix completed the $5.5M sale on behalf of buyer The Brown Group, which will develop a 166-unit build-to-rent community.

14. Marcus & Millichap announced the sale of Super Star Car Wash, a 3.5KSF net-leased property located in Gilbert. Sale price was $5.2M.

15. Marcus & Millichap announced the sale of Santa Rita Heights Mobile Home Park, a 15.71-acre manufactured homes community in Sahuarita for $2.1M.

Lease Transactions

16. Washington Prime Group Inc. announced Landmark Theatres will open an eight-screen location at Scottsdale Quarter in fall 2021. Negotiations were led by Michael Fant, SVR of Real Estate and Development for Landmark Theatres.

17. Surprise will open the 56KSF Surprise Housing Support Center to address housing insecurity and homelessness in 2022. Nonprofit group A New Leaf will manage the facility, which is located near US 60 and Greenway Road.