Sales Transactions

1. A Delaware-based entity managed by Greenberg Traurig paid $125M for the former Chrysler Proving Grounds in Wittmann. The seller of the land was iStar. The most interesting aspect of the blockbuster deal for the 5,458 acres is that some reports say Apple is behind the entity, which means the site is likely to become the primary testing grounds for the Apple Car.

1. A Delaware-based entity managed by Greenberg Traurig paid $125M for the former Chrysler Proving Grounds in Wittmann. The seller of the land was iStar. The most interesting aspect of the blockbuster deal for the 5,458 acres is that some reports say Apple is behind the entity, which means the site is likely to become the primary testing grounds for the Apple Car.

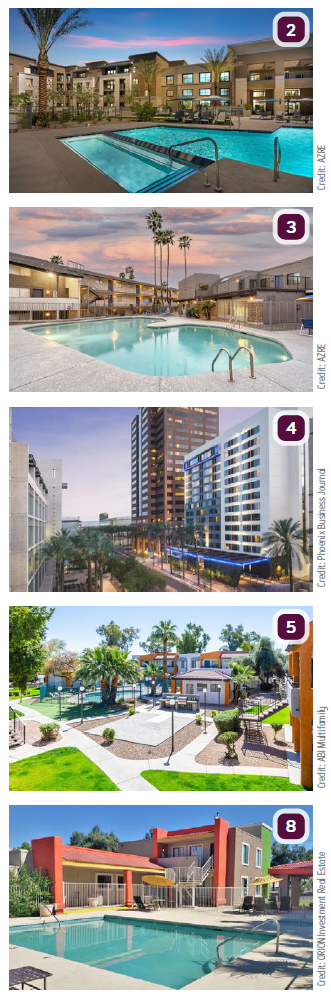

2. Decron Properties purchased Broadstone Grand, a 300-unit multifamily community at 1003 W. Washington Street, Phoenix, for $106.5M. The seller was undisclosed.

3. Bridge Investment Group purchased The District at Fiesta Park, a 321-unit multifamily asset in Mesa for $69.85M. Steve Gebing and Cliff David with Institutional Property Advisors, a division of Marcus & Millichap, represented the seller, JB Partners, and procured the buyer.

4. Arbor Lodging Partners purchased the AC Hotel Phoenix Downtown at the Arizona Center, a 199-room hotel near Fifth and Van Buren Streets, for $65M. The hotel opened in February and was developed as a joint venture between LaPour Partners, NewCrest Image and Peachtree Hotel Group. The sale was brokered by NewGen Advisory.

5. Tower 16 Capital Partners purchased Solano Pointe Apartments, a 276-unit multifamily apartment property at 6565 W. Bethany Home Road, Glendale, for $42M. ABI Multifamily‘s Phoenix-based Institutional Apartment Group – Alon Shnitzer, Rue Bax, Eddie Chang, and Doug Lazovick represented the buyer and undisclosed, Arizona-based seller.

6. Bridge Investment Group purchased Arcadia on 49th, a 192-unit multifamily asset in Phoenix for $37.45M. Steve Gebing and Cliff David with Institutional Property Advisors, a division of Marcus & Millichap, represented the seller, JB Partners, and procured the buyer.

7. Tower 16 Capital Partners purchased Banyantree Apartments, a 232-unit property at 12435 N. 28th Drive, Phoenix, for $36.5M. The undisclosed seller was represented by Ric Holway, Dan Cheyne and Mark Forrester of Berkadia’s Phoenix office.

8. An undisclosed buyer purchased Urban 55, a 209-unit apartment complex at 55th Avenue and Camelback Road, Glendale, for $33.975M. Lacey Eyman and Jon Coffen of ORION Investment Real Estate represented the buyer and undisclosed seller in the off-market transaction.

9. Hannapat Management LLC purchased the 332-unit Apple Apartments in Tucson for an undisclosed amount. NorthMarq’s investment sales team of Trevor Koskovich, Bill Hahn, Jesse Hudson and Ryan Boyle brokered the sale. The seller was also undisclosed.

10. A private investor purchased Casa Nueva, a 90-unit apartment property at 2502 E. Greenway Road, Phoenix, for $17.4M. Paul Bay and Darrell Moffitt of Marcus & Millichap’s Phoenix office procured the buyer and had the exclusive listing to market the property on behalf of the seller, another private investor.

11. Ken Garff Automotive Group purchased a 32.5KSF auto dealership on 5.84 acres at 12925 N. Autoshow Avenue, Surprise, for $12.5M, from Earnhardt Auto Centers.

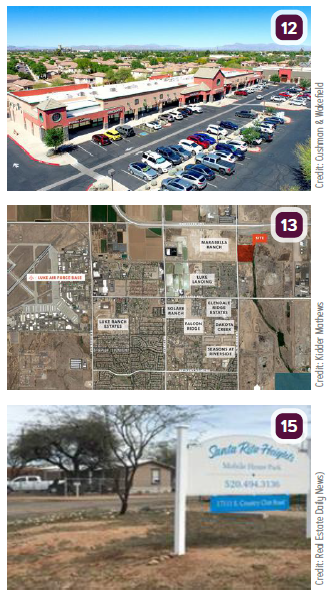

12. Metallinos purchased Western Skies, a 24,128-square-foot Class A, multi-tenant retail shop building at 1534 E. Ray Road, Gilbert, for $6.1M. The seller was Jumping Cholla I, LLC, which was represented by Chris Hollenbeck and Shane Carter with Cushman & Wakefield in Phoenix.

12. Metallinos purchased Western Skies, a 24,128-square-foot Class A, multi-tenant retail shop building at 1534 E. Ray Road, Gilbert, for $6.1M. The seller was Jumping Cholla I, LLC, which was represented by Chris Hollenbeck and Shane Carter with Cushman & Wakefield in Phoenix.

13. Marbella Ranch East, LLC purchased a 35-acre development site located at El Mirage Road and Northern Avenue, for $4.85M. Kidder Mathews land broker Brian Rosella represented the buyer. Southwest Rock Products was the seller and was represented in the sale by Rob Martensen with Colliers. Marbella Ranch East, LLC is planning to develop up to 312 rental units on the site.

14. South Coast Commercial, LLC purchased Fry’s Shops at 35th & Peoria, an 11.8KSF multi-tenant property at 10410 N. 35th Avenue, for $3.76M, from 35th Ave & Peoria Investors, LLC. Newmark Knight Frank Senior Managing Directors Steve Julius and Jesse Goldsmith and Associate Director Chase Dorsett brokered the transaction.

15. A limited liability company purchased the Santa Rita Heights Mobile Home Park, a 15.71-acre, 48-unit manufactured homes community at 17111 S. Country Club Road, Sahuarita, for $2.1M. Michael Escobedo, an investment specialist in Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, another limited liability company.

Lease Transactions

16. NAI Horizon’s Jeff Adams represented the tenant, Liquidity Services Operations, LLC in a 65-month industrial lease for 84.7KSF at 6800 W. Van Buren Street, Phoenix. The landlord, Van Buren Owner, LLC was represented by Mike Gilbert and Gary Anderson with Cushman & Wakefield.

17. Thomas J. Nieman and Richard M. Kleiner, MBA, Principals, and Office Specialists with Cushman & Wakefield | PICOR, co-represented lease of 13.9KSF for a medical practice on the second floor of 7470 N. Oracle Road, LLC. The subject property is Units 27, 28, 31, 32 & 42 in the Oracle Medical Plaza Condominiums Phase II, located at 7470 N. Oracle Road, Tucson.