Sales Transactions

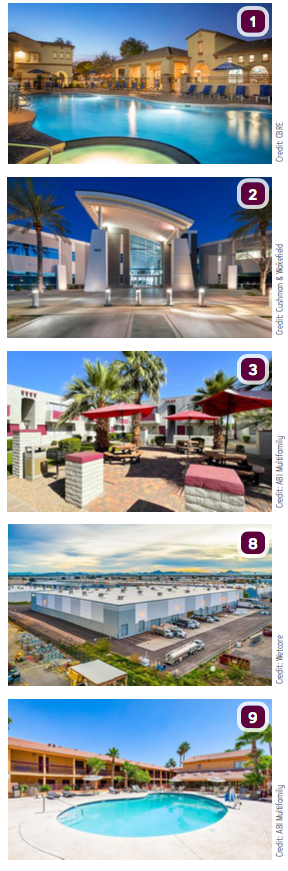

1. Funds managed by Oaktree Capital Management L.P purchased Ravenwood Heights, a 240-unit multifamily community at 647 W. Baseline Road, Tempe, for $94.5M. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter and Matt Pesch of Phoenix Multifamily Institutional Properties represented the seller, Hudye Group.

1. Funds managed by Oaktree Capital Management L.P purchased Ravenwood Heights, a 240-unit multifamily community at 647 W. Baseline Road, Tempe, for $94.5M. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter and Matt Pesch of Phoenix Multifamily Institutional Properties represented the seller, Hudye Group.

2. The joint venture of Cypress Office Properties and Harbert Management Corporation purchased The Arc (fka. Stapley Corporate Center), a 180.1KSF, Class A office project at 1840 and 1910 S. Stapley Drive, Mesa, for $37M, from Buchanan Street Partners. Cushman & Wakefield’s capital markets team of Chris Toci and Chad Littell handled the transaction on behalf of both parties.

3. Intrust Property Group purchased Veranda & Sunflower Apartments, a 208-unit multifamily community in Glendale for $32.85M. ABI Multifamily‘s Phoenix-based Institutional Apartment Group, Alon Shnitzer, Rue Bax, Eddie Chang, and Doug Lazovick, represented the buyer. ABI Multifamily’s Private Apartment Team, Carson Griesemer, Dallin Hammond, and Mitchell Drake represented the seller, Margreen Properties.

4. Falcon North Capital LP purchased Longbow Marketplace, a 58KSF Sprouts Farmers Market-anchored store at 5918 E. Longbow Parkway, Mesa, for $26M, from Kitchell. Chad Tiedeman, Steven Underwood and Danny Gardiner at Phoenix Commercial Advisors represented Kitchell. Garrett Stasand of CBRE arranged the $17M loan on behalf of the buyer.

5. National Indoor RV Centers purchased 170.6KSF facility it was leasing, and an additional 5.6 acres of land in Surprise for approximately $16.5M total. The seller of the facility was Rioglass Solar Inc. The seller of the land was Camelott Properties LLC.

6. A Utah-based fund manager purchased Canyon 35, a 98-unit apartment property at 4336 N. 35th Avenue, Phoenix, for $15.5M, from WhiteHaven Capital. Paul Bay and Darrell Moffitt with Marcus & Millichap’s Phoenix office procured the buyer.

7. Capstone Advisors purchased Galveston Technology Center, a 75,525-square-foot Class A multi-tenant industrial flex building at 6825 W. Galveston Street, Chandler, for $14.05M. The seller was Wexford Developments, which was represented by Cushman & Wakefield’s Steve Lindley.

8. Westcore acquired a 114.9KSF warehouse building at 200 S. 49th Street, Phoenix, from an owner-user party for $13.5M. The seller will lease back the building for a period of time. Subsequently, Westcore plans to make cosmetic upgrades and market the property for lease in late 2022. Mike and Phil Haenel of Cushman & Wakefield represented Westcore, while Ben Geelan and Andrew Medley of JLL represented the seller.

9. An Arizona-based buyer purchased 1410 S. Country Club Drive, a 120-unit hotel-conversion property in Mesa, for $13.2M. ABI Multifamily‘s Mitchell Drake, Dallin Hammond, and Carson Griesemer represented the buyer and undisclosed seller.

10. Rancho California Center, LP purchased a 94.8KSF, sale/leaseback investment property at 6885 E. Southpoint Road, Tucson, from Teritom Holdings, LLC, for $11.25M. Stephen D. Cohen, Principal, and Industrial Specialist with Cushman & Wakefield | PICOR, represented the seller. Ronald King and Joseph McDermott, with Kidder Mathews of California, represented the buyer.

11. OP 3030 7th Property purchased Ace Asphalt, a two-building property at 3030 S. 7th Street, Phoenix, for $8.5M, from Aceland LLC. Dan Colton of Colton Commercial represented the seller, while Pat Harlan of JLL’s Phoenix office represented the buyer.

12. Winding Creek Apartments, LLC, acquired three, mid-town Tucson apartment complexes from Eastgate Apartments, LLC, Jerrie Street Apartments, LLC, and Executive Apartments, LLC. Eastgate Apartments, 1175 N. Jefferson Avenue, Jerrie Apartments, 1031 N. Jerrie Avenue, and Executive Apartments, 5530 E. Bellevue Street, were purchased for $5.025M. Allan Mendelsberg, Principal, and Conrad Martinez, Multifamily Specialists with Cushman & Wakefield | PICOR, represented both parties.

13. Mapleton Investments purchased a 29.7KSF freestanding industrial building at 3279 E. Harbour Drive within the Southbank Industrial Business Park in Phoenix, for $4.45M. The investment sales team of Chris Toci and Chad Littell of Cushman and Wakefield’s Phoenix office represented the buyer and Mike Parker of CBRE represented the Stephen M. Javinett Trust as seller.

13. Mapleton Investments purchased a 29.7KSF freestanding industrial building at 3279 E. Harbour Drive within the Southbank Industrial Business Park in Phoenix, for $4.45M. The investment sales team of Chris Toci and Chad Littell of Cushman and Wakefield’s Phoenix office represented the buyer and Mike Parker of CBRE represented the Stephen M. Javinett Trust as seller.

14. An undisclosed buyer purchased Encanto Park, a 29-unit, value-add multifamily community at 730-820 E. Turney Avenue, Phoenix, for $4.443M, from an undisclosed seller. ORION Investment Real Estate represented the buyer.

15. Hanson Capital Group purchased two industrial buildings totaling 27.8KSF at 3440-3502 E. Broadway Road, Phoenix, for $3.338M. Max Schumacher and Patrick Sheehan of Rein & Grossoehme represented both the buyer and seller.

16. A limited liability company purchased AAA, a 5,375-square foot net-leased property at 17312 N. 99th Avenue, Sun City, for $3.1M. Mark Ruble and Chris Lind, investment specialists in Marcus & Millichap’s Phoenix office, procured the buyer and had the exclusive listing to market the property on behalf of the seller, a limited liability company.

17. Landsea Homes Corporation closed on 80 new homesites for a new community called Marlowe, in Glendale, for an undisclosed amount. Construction is slated to begin in 2023.

18. Miedema Produce, Inc. purchased +/- 37 acres at the NEC of Bethany Home Road and Citrus Road, Litchfield Park, for an undisclosed amount. The property has an approved preliminary plat for 82 single-family homesites. Brad Kuiper, Howard Weinstein, and Patty Lafferty of The Land Agency represented the buyer. The seller was undisclosed.