Sales Transactions

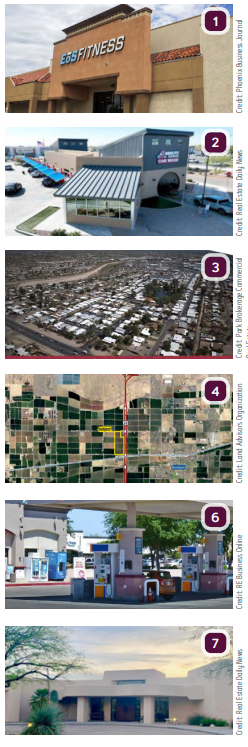

1. Realty Income Corp. acquired five EoS Fitness properties from Barclay Group in a transaction set up by SRS Real Estate Partners. The total purchase cost was $94M. The properties were:

- 40.35KSF in Queen Creek for $14.3M;

- 57.8KSF in Mesa on Baseline Road for $5.4M;

- 51.7KSF in Mesa on University Road for $5.1M;

- 63.84KSF in Tempe for $4.4M, and

- 46KSF in Scottsdale for $5.8M.

2. Marcus & Millichap announced the portfolio sale of six Ultra Clean Express Car Wash properties totaling $41.4M. The properties are located in Phoenix and Las Vegas, and no specific details were provided. M&M’s Chris Lind, Zack House and Mark Ruble listed the property on behalf of the undisclosed seller. Ryan Sarbinoff and Frank Cameron Glinton assisted in closing the transaction.

3. John Sheedy with Park Brokerage & Commercial LLC represented the seller and procured the buyer for Swan Lake and Friendly Village Estates in Tucson for $37M. The two manufactured housing communities total 373 sites. The parties were not disclosed.

4. Two land sales in Buckeye, totaling 225 acres for $37M, will be developed into the six-building, 3.6MSF Buckeye 225 industrial park. The Land Advisors Organization team of Greg Vogel, Bobby Wuertz, Ben Heglie and Max Xander represented the sellers in the two transactions. A joint venture between Van Tuyl Companies and the Eisenberg Company acquired both parcels with plans to develop and/or sell the property into an industrial park.

5. VanTrust Real Estate, LLC has acquired 66 acres at the SWC of Northern Avenue and Reems Road in Glendale for $11.5M. The site is zoned industrial and entitled for more than 1MSF of development.

6. Lanwin 120 Windsor LLC has paid $5.8M for a retail site at 777 W. Ray Road in Gilbert. The property is occupied by a 2KSF gas station with a 20-year NNN lease. The seller was undisclosed. The buyer was represented by Barton Thompson with Pinnacle Real Estate Advisors.

7. The Third Church of Christ Scientist, a 10KSF property at 7355 N. Paseo Norte in Tucson, sold for $2.25M to Lifepoint Church. Mara Judy Burghard with Keller Williams of Southern Arizona represented the seller, and the buyer was self-represented.

8. JLL Capital Markets announced it arranged the sale of an infill Phoenix industrial portfolio, which includes six industrial buildings totaling 586.9KSF in metro Phoenix. JLL represented the seller and procured the buyers, ViaWest Group and Walton Street Capital. The JLL Capital Markets Investment Sales team was led by Mark Detmer, Greer Oliver, Ryan Sitov and Connor Nebeker-Hay. Additionally, JLL assisted with the procurement of the financing led by Kevin MacKenzie, Jason Carlos and Jarrod Howard. JLL is also managing leasing and financing of the properties, which consist of:

- 6718 S. Harl Ave., Tempe, 149.7KSF;

- 9160 S. McKemy St., Tempe, 106.2KSF;

- 9185 S. Farmer Ave., Tempe, 47.2KSF;

- 9245 S. Farmer Ave., Tempe, 47.2KSF;

- 7400 E. Tierra Buena Lane, Scottsdale, 66KSF, and

- 125 N. 67th Ave., Phoenix, 170.6KSF.

Lease Transactions

9. nVent has leased 84.7KSF at Sight Logistics Park in Tempe, which it will use as a regional office and manufacturing site for its nVent ERICO operations. The tenant was represented by Keri Scott with Colliers in Arizona. The Colliers in Arizona team of Rob Martensen, Sam Jones and Phil Breidenbach represented landlord ViaWest Group.