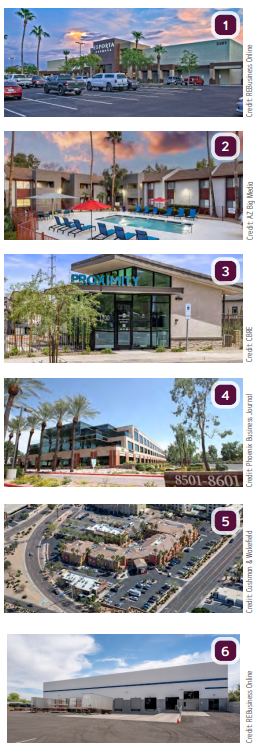

Sales Transactions

1. Steven Underwood and Chad Tiedeman with Phoenix Commercial Advisors represented the seller in the $31.3M sale of Plaza32, a 15.9-acre shopping center at Bell Road and 32nd Street in Phoenix. The parties were not disclosed.

2. Dalan Management has paid $28M for the 139-unit Country Gables apartment community in Glendale. Seller Western Wealth Capital was represented by Cliff David and Steve Gebing of Institutional Property Advisors, a division of Marcus & Millichap, who also procured the buyer. Acquisition financing was arranged by IPA Capital Markets’ Brian Eisendrath, Cameron Chalfant, Jake Vitta and Tyler Johnson.

3. CBRE has negotiated the sale of Proximity Baseline, an 80-unit Build-to-Rent property in Phoenix, for $27.2M. Griffen Tymins, Sean Cunningham, Asher Gunter, Matt Pesch and Austin Groen of CBRE’s institutional multifamily practice in Phoenix represented seller Avenue North in the off-market deal. The buyer, CVG Properties, will rebrand the community as The Linq @ South Mountain.

4. LPGS Gainey II LLC, a joint venture between Lincoln Property Company and Goldman Sachs, has sold the 151.5KSF Gainey Center II office property at 8501 N. Scottsdale Road for $26.5M, $8.75M less than they paid to acquire the property in March 2016. The new buyer is Reliance Management.

5. Cushman & Wakefield announced the firm has brokered the sale of the 169-room Holiday Inn Express & Suites Scottsdale – Old Town in Scottsdale and the 121-room Hampton Inn by Hilton Phoenix-Biltmore in Phoenix to MCR. The announcement did not disclose the sales prices, but secondary media reports put the prices at $25.52 for the Hampton Inn and $23.32M for the Holiday Inn Express. Bill Murney with Cushman & Wakefield’s Hospitality team in Phoenix represented seller MIG Real Estate.

6. Stonelake Capital Partners has paid $8.3M for a 37.59KSF industrial property at 8590 W. Jefferson St. in Tolleson. Cushman & Wakefield’s Phil Haenel, Foster Bundy and Will Strong represented the seller, Westcore, and the firm’s Mike Haenel and Andy Markham provided leasing advisory.

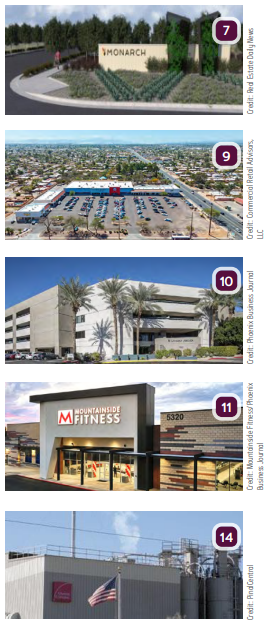

7. HSL Properties, Inc. paid $4.45M for approximately 21 acres in Marana’s Monarch master-planned community. The seller of Block 5 was Monarch developer Sunbelt Holdings. The transaction was brokered by Land Advisors Organization’s Will White and John Carroll, who are also in charge of marketing for Monarch.

8. An undisclosed California investor has paid $3.82M for the 20-unit Park Avenue Apartments and 24-unit Studio One Apartments in Tucson. Acting as Trustee, Eliza Landon Dray of Tierra Antigua Realty represented seller Bogutz & Gordon PC. The buyer was represented by Scott Michael Hotchkiss with Coldwell Banker Residential Brokerage.

9. The Grant & Alvernon Shopping Center at Grant Road and Alvernon Way in Tucson has been sold to Bob Camino Principal, LLC. Craig Finfrock of Commercial Retail Advisors, LLC represented the seller, Grant & Alvernon Realty Trust. Bob Zhang represented the buyer.

Lease Transactions

10. Engineering firm Kimley-Horn has leased 78.7KSF in the Camelback Arboleda office building at 1661 E. Camelback Road in Phoenix. Chris Latvaaho and Chris Beall of JLL are leasing brokers for the building.

11. Mountainside Fitness has leased 50.3KSF in Scottsdale Towne Center at Pima Freeway and Frank Lloyd Right Blvd. JLL’s Regan Amato and Ryan Tanner represented the tenant. Landlord Vestar was represented by Ryan Desmond and Neil Board of Western Retail Advisors.

12. Nyal Sewell with Menlo Group Commercial Real Estate represented The Pickle Guild in its lease of 20KSF in Thunderbird Village at 7586 W. Thunderbird Road, Peoria. Landlord Deerwood Retail Opportunities, LLC was represented by James DeCremer and Matt Milinovich of Avison Young.

13. Trevor’s Liquor has leased 11.2KSF in Gaslight Square at 3601 E. Indian School Road in Phoenix. The tenant was represented by Trent Goulette of Southwest Retail Group. Landlord Gaslight Square Retail LLC was represented by Jared Lively of Rein & Grossoehme CRE.

Closing

14. Slightly more than a year after reopening the facility, Owens Corning will again close its fiberglass manufacturing plant in Eloy. The firm cited housing conditions as the reasons for the shutdown. The plant was first opened in 1995 and operated until 2010. The company announced plans to restart the plant in 2021. Owens Corning is now moving all West Coast production to the new plant in Utah.