Sales Transactions

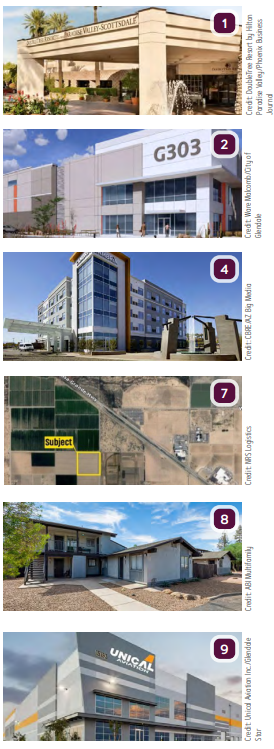

1. Global Hospitality Investment Group has paid $115.5M for the DoubleTree Resort by Hilton Paradise Valley in Scottsdale and is planning an additional capital investment to improve the property. The seller was Southwest Value Partners.

2. EQT Exeter has paid $105M for 570KSF of the total 1.25MSF G303 Industrial development at 6605 N. Sarival Ave. in Glendale. The sellers were Hines and Oaktree Capital Management.

3. Arizona Land Consulting has bought 265 acres near Baseline Road and Highway 85 for $24M. The site is expected to be the eventual home of a new industrial development, but no developer is currently attached.

4. Kingsbury Hospitality REIT I, Inc. has paid $21.5M for the 136-room Cambria Hotel Phoenix Chandler Fashion Center in Chandler. The seller was Concord Hospitality Enterprises. Both parties were represented by Jennifer Bergamo, Ron Danko, and Hana Friedman and Hana Friedman with CBRE Hotels. CBRE’s Michael Straw and Dylan Brandt assisted in securing the debt.

5. Commercial Properties, Inc./CORFAC International announced the land sale of ±22.5 acres in Pinal County. The ±979.7KSF parcel is located across from CMC Steel Mill of Arizona and is situated on the east side of Meridian Road, just south of Pecos Road in Queen Creek. Jeff Hays and Sam Rutledge of CPI represented buyer Lakeshore Ventures, LLC. The parcel sold for $11M.

6. The Phoenix Theatre Company has paid $7.6M for an apartment complex on 5th Street south of McDowell Road, which it will use both to house visiting actors and apprentice program members and as a revenue source, keeping more than half the units for standard tenants. Board member and Clear Commercial Advisors partner Donny Peper represented PTC.

7. NRS Logistics America Inc. has closed on a 40-acre industrial site in Casa Grande, for $7.05M. The sale includes four acres of rail right of way. Land Advisors Organization’s Kirk McCarville and Trey Davis facilitated the deal on behalf of seller Auza Ranches.

8. ABI Multifamily announced the $4.8M sale of First Avenue Townhouses, a 20-unit multifamily apartment community in Mesa. ABI‘s Mitchell Drake, Carson Griesemer and Dallin Hammond represented the unidentified buyer and seller. Financing was secured by Carson Krause from ABI Commercial Capital.

Lease Transactions

9. Unical Aviation Inc. has leased nearly 600KSF for its corporate headquarters and a parts warehouse in the Falcon Park 303 industrial development in Glendale.

10. Vanguard Group has signed a lease for approximately 135KSF in the Northsight Corporate Center, 14400 N. 87th St., Scottsdale. The company has not detailed its plans for the new space. CBRE’s Sean Spellman and Lauren Lovell are the leasing brokers for Northsight Corporate Center.

11. Environmental services company SolarCycle has leased 82KSF in The Hub@202 in Mesa. The firm will move in this fall. Chris McClurg and Ken McQueen of Lee & Associates are the development’s leasing brokers.

12. Romac Industries Inc. will lease 60KSF in the 190.2KSF Yuma|143 industrial development in Goodyear for a new manufacturing facility. The remaining 130KSF is leased by Apex Tool Group. JLL’s Tony Lydon, Marc Hertzberg, Riley Gilbert and John Lydon are the leasing brokers.

13. Cushman & Wakefield announced Lucid Private Offices has leased a full floor totaling 26.9KSF at 24th At Camelback II. The property is owned and was developed by the partnership of Hines and Invesco Real Estate. Cushman & Wakefield’s Scott Boardman and Kristina Cutillo, together with Hines, represented the owners. Cresa’s John Pelletier and Austin Studebaker, in collaboration with Locate’s Jim Sadler, represented the tenant.