Sales Transactions

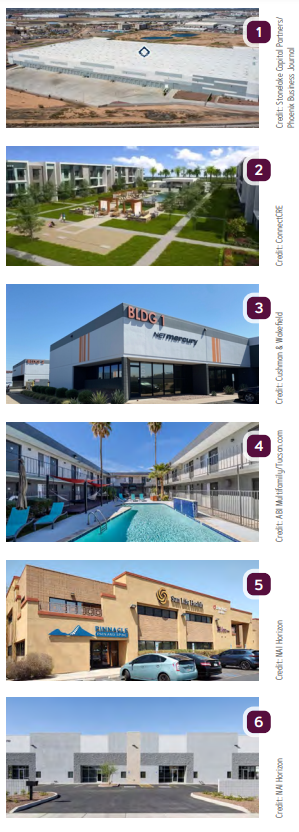

1. Stonelake Capital Partners purchased two industrial buildings totaling more than 726KSF for $108M in Goodyear. CIM Group was the seller. The first building was purchased for $67M and is a 450KSF building located at 2250 S. Litchfield Road. The tenants are Meyer Burger Technology AG and NPSG Global. The second building at 1685 S. Litchfield Road sold for $41M. It is more than 276KSF and is leased by Meyer Burger.

2. The Praedium Group has paid $64M for The Livano Deer Valley, a 242-unit apartment community in Phoenix. Steve Gebing and Cliff David of Institutional Property Advisors, a division of Marcus & Millichap, represented both The Praedium Group and seller LIV Development.

3. Cushman & Wakefield announced the $32.9M sale of Broadwood Business Centre, a 156KSF industrial property in Mesa. A joint venture of Bendetti and Westport Capital Partners were the buyers. Bob Buckley, Tracy Cartledge, Will Strong, Michael Matchett and Molly Hunt of Cushman & Wakefield represented the seller, BKM Capital Partners.

4. Midtown on 1st, a 94-unit student housing complex in Tucson, sold for $13.6M. Hamid Panahi and Clint Wadlund of Marcus & Millichap handled the sale.

5. Lane Neville, Cole Neville, Brandon Hall, Whitney Heritage and Matt Westra of NAI Horizon represented the seller, Chandler Medical Property Company LLC (Tolis Advisors) in the $7.3M sale of Chandler Medical Center, a 22.6KSF medical office building in Chandler. Provider Real Estate Partners Fund I, L.P. was the seller.

6. Jeffrey Garza Walker of NAI Horizon negotiated the $4.7M sale of 2760 S. La Luna in Goodyear. NAI Horizon represented the buyer, American Gem Packaging Solutions, LLC. The seller was A1 Desert Investments, LLC.

7. Stos Partners announced the $4.45M purchase of 2325 W. Cypress St., a 35KSF industrial complex in Phoenix. James Cohn and Stirling Pascal of Stream Realty Partners represented the seller. Rob Martensen and Sam Jones of Colliers will retain leasing oversight.

8. Block “C” Properties, LLC purchased 40KSF of industrial space at 2106 N. Forbes Blvd. in Tucson from North Forbes, LLC for $3.92M. Stephen D. Cohen with Cushman & Wakefield | PICOR represented both parties.

9. Arizona Food Bank Network purchased 35.9KSF of industrial space at 13 Calle Cristina, Rio Rico, from ACKA #3 Limited Partnership for $2.7M. Jose Dabdoub of Cushman & Wakefield | PICOR represented the seller. Brian Uretzky with Keyser represented the buyer.

10. Rick Foss of NAI Horizon represented the seller, McDowell Sonoran Holdings, LLC in the $2.2M sale of 5230 S. 39th St. in Phoenix. Garrett Wilson of Cushman & Wakefield represented the buyer, Bell Holdings 1100, LLC.

11. Kirk McCarville and Trey Davis of Land Advisors Organization facilitated the sale of an 80-acre parcel slated to become a new power switching yard and substation in Casa Grande. LAO represented both the buyer and seller in the transaction. The sellers were Lester Barnes and Patricia Barnes of Casa Grande. The buyer was not disclosed, nor was the sale amount.

Lease Transactions

12. Jeffrey Garza Walker of NAI Horizon represented the tenant, Southwest Key Programs, Inc. in the 60-month lease of 1201 S. 7th Ave., a nearly 150KSF office space in Phoenix. CPLC PM Redevelopment, LLC is the landlord.

13. Drew Eisen and Isy Sonabend of NAI Horizon represented the tenant, Elliot Electric Supply, Inc. in a 120-month lease of 9172 E. Florentine Road, a more than 15KSF industrial space in Prescott Valley. Mat Fish of Prescott Commercial Real Estate represented the landlord, Flex Space, LLC.