Sales Transactions

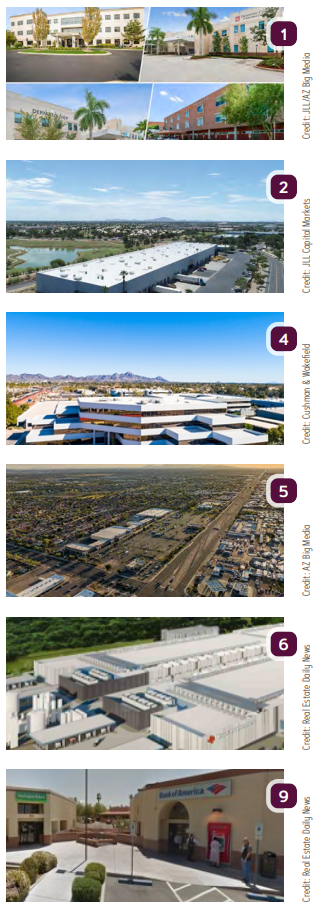

1. JLL Capital Markets announced the $86M sale of a four medical building portfolio totaling more 181KSF in three areas: Phoenix, southern Florida and Chicago. The Phoenix property was the Oasis Surgical Hospital at 750 N. 40th St. Remedy Medical Properties and Kayne Anderson Real Estate were the buyers. Seller Flagler Healthcare Investments was represented by Mindy Berman, Matt DiCesare and Liam Sorensen of JLL’s Medical Properties Group Advisory team.

2. ViaWest Group has completed the $71.8M acquisition of a 428.4KSF industrial portfolio in Gilbert. This portfolio is 98% occupied, spans 26.87 acres and comprises six buildings housing 11 tenants. The JLL Capital Markets team, led by Mark Detmer, Greer Oliver, Ryan Sitov and Connor Nebeker-Hay, facilitated the transaction. JLL also assisted with the procurement of the financing, led by Kevin MacKenzie, Jason Carlos and Jarrod Howard.

3. CBRE negotiated $8M in financing for Mesa South Center LP to acquire the 133.7KSF Mesa South Shopping Center at 1230 S. Gilbert Road in Mesa. Shaun Moothart, Bruce Francis, Bob Ybarra, Doug Birrell, Nick Santangelo and Jim Korinek with the CBRE Capital Markets Debt and Structured Finance team secured the 10-year loan. Cushman & Wakefield’s Michael Hackett and Ryan Schubert represented the confidential seller. Regal Properties’ Maha Odeh-Arnold represented Mesa South Center LP in the $15M sale.

4. Cushman & Wakefield brokered the $11.3M sale of Elevate at Dunlap, a four-story, 93.6KSF office building in Phoenix. Michael Kitlica, Jerry Roberts and Pat Boyle with Cushman & Wakefield represented seller D23, LLC, and Keith Lammersen of Jones Lang LaSalle represented buyer Maricopa County.

5. Newmark announced the $8M sale of The Marketplace at Signal Butte, a 116.35KSF retail center in Mesa. Chase Dorsett, Steve Julius and Jesse Goldsmith of Newmark represented seller Marketplace at Signal Butte SPE, LLC.

6. A former 124KSF Texas Instruments office building in Tucson sold for $5M to BP 5411 Investors, LLC, an affiliate of Bourn Properties. The seller, an affiliate of Orion Office REIT, was represented by Trevor Moffitt, Peter Bauman and Tom Nieman with Cushman & Wakefield. Bourn self-represented.

7. An undisclosed east coast apartment investor seeking to diversify its portfolio has paid $4.15M for the Quarry Pines Golf Club in Marana. The property is 165 acres, 60 of which are maintained. The sellers were United Metro Materials and CEMEX. The sale was announced by Jones Lang Lasalle Brokerage and cooperating broker Steven Ekovich of LIPG. LIPG’s Terence Vanek represented the buyer.

8. Ellen Golden and Claud Smith with Goldsmith Real Estate represented seller Staff of Life, LLC in the $3.5M sale of the 44.7KSF Pinecrest Neighborhood Center at 4805-4897 E. Speedway Blvd. in Tucson. The buyers were undisclosed California investors.

9. Former bank branch buildings previously occupied by Bank of America and Washington Federal Bank sold for $2.2M in Tucson. Bank of America was the seller. Regan Amato and Ryan Tanner with JLL Capital Markets handled the transaction. Buyer HungryPeak 1, LLC has contracted Brian Ghast with Velocity Retail to handle leasing.

10. Bridge33 Capital has acquired 398.6KSF of the 1MSF-plus Yuma Palms Regional Center retail center in Yuma. David Disney and Adam Crockett of Disney Investment Group represented the unidentified seller and located the buyer. Terms of the deal were not disclosed.

Lease Transactions

11. Dollar Tree Stores, Inc. leased 13.65KSF of retail space at 2175 W. Ina Road in Tucson from Casas Adobes Baptist Church. Natalie Furrier, Greg Furrier and Aaron LaPrise with Cushman & Wakefield | PICOR represented the landlord.