Sales Transactions

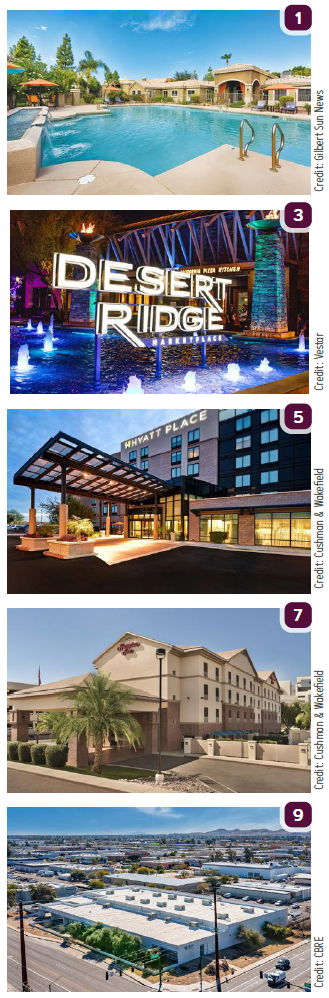

1. Investors Capital Group has paid $86M for Desert Mirage, a 258-unit apartment complex on Guadalupe Road in Gilbert. The seller, New York Life Insurance, bought the property in 2014 for $32.8M.

2. Northmarq’s Phoenix Investment Sales team of Trevor Koskovich, Jesse Hudson, Ryan Boyle and Logan Baca brokered the $53M sale of a 144-unit Build-to-Rent community at 250 N. Ellsworth Road in Mesa. Northmarq represented seller Taylor Morrison. The buyer was Ellsworth Housing Partners, LLC. The new owner plans to rebrand the property as The Logan at Ellsworth.

3. Vestar DRM-OPCO LLC (Vestar) was the sole bidder in an Arizona State Land Department auction of the 115-acre Desert Ridge Marketplace site near Tatum Blvd. and Deer Valley Road. The minimum bid was $29.4M. Vestar had been in a long-term land lease on the property since it initially developed the shopping center in 2001.

4. SRS Real Estate Partners’ John Redfield and Alan Houston represented the seller in the $22M 1031 exchange disposition of the 8.4-acre Silverbell Plaza shopping center in Tucson. The undisclosed buyer was represented by Gary Gallelli Jr. and Adam Rainey of Gallelli Real Estate.

5. Cushman & Wakefield announced the firm has brokered the sale of a 127-room Hyatt Place hotel on South Market Street in Gilbert. The six-story property was sold to HWC Hospitality for nearly $19.5M. Bill Murney and Jesse Heydorff with Cushman & Wakefield’s Hospitality team in Phoenix represented the seller, Sethi Management.

6. Ken Garff Automotive Group, through its entity Hoppy Gilbert LLC, has paid $18.5M for two former Earnhardt Auto Centers. Garff paid $12M for a 4.5-acre site in the SanTan Motorplex in Gilbert with a 28.7KSF building and $6.5M for a 4.42-acre site in Avondale with a 29.5KSF building. The locations will be rebranded as Ken Garff Volkswagen Gilbert and Ken Garff Kia Avondale.

7. Cushman & Wakefield announced the firm has brokered the sale of a 99-room Hampton Inn hotel in Phoenix. Located at 160 W. Catalina Drive, the property sold to Mango Tree LLC for $16.25M. Mango Tree LLC plans to make significant renovations to the Midtown Phoenix property. Bill Murney and Jesse Heydorff with Cushman & Wakefield’s Hospitality team in Phoenix represented the seller.

8. Project Capricorn Fund V, LLC paid $5.15M for the Walgreen’s at 3910 E. 22nd Street and $4.6M for the Walgreen’s at 550 N. Silverbell Road, both in Tucson. Both were sold by the Walgreens Corporation and there were no brokers involved.

9. 3201 E. Broadway Road, a 48.4KSF industrial building south of Sky Harbor, has sold for $8.5M. Seller Atlas Phoenix was represented by CBRE’s Geoffrey Turbow, Gary Cornish, Cooper Fratt and Tanner Ferrandi. The building is fully NNN leased to Barnes Aerospace.

10. Jay Sagar LLC has bought the 52-room boutique lodging property The Tempest Hotel in Tempe for $7.5M. The seller was Clearview Capital Group.

11. ABI Multifamily announced the $6.77M sale of Venture on 19th, a 41-unit multifamily community in Phoenix. The buyer and seller were represented by ABI’s Mitchell Drake, Dallin Hammond and Carson Griesemer.

12. Marcus & Millichap announced the sale of a 4.5KSF, net-leased Super Star Car Wash in Peoria for $6.2M. M&M’s Zack House, Mark Ruble and Chris Lind listed the property for the seller and located the buyer.

13. Arizona Land Consulting has sold a 120-acre industrial-zoned parcel in an Opportunity Zone near I-10 and 339th Avenue in Tonopah for $5.4M. The undisclosed buyer plans to develop an industrial project on the site.

14. Taylor Street Advisors announced the $3.9M sale of The Hepburn, a renovated 16-unit apartment community at 631 N. 4th Avenue, Phoenix. Brian Tranetzki and Anton Laakso had the exclusive listing and negotiated the transaction on behalf of the seller, a local syndicator, and the buyer, an out-of-state 1031 Exchange investor.

15. NAI Horizon’s Chris Gerow, Shelby Tworek and Gabe Ortega negotiated the sale of 12.09 acres for $3.65M, representing the buyer, Real Estate Equities, LLC. The property is located at the SEC of Korsten and Trekell roads in Casa Grande. The seller, Trekell-Korsten 17, LLC, was represented by Bea Lueck with Coldwell Banker ROX Realty.

16. Menlo Group Commercial Real Estate recently negotiated the $2.5M sale of a licensed surgery center in Mesa at 4540 E. Baseline Road, Bldg. 8. Seller Aspen Glade, LLC, was represented by Menlo Group’s Rich Andrus and Steve Berghoff. The buyer, Canyon Pain and Spine, PLLC, was represented by Menlo Group’s Tanner Milne.

17. QuikTrip paid $2.5M for 5.3 acres near Valencia Road and I-10 in Tucson, where it plans to build a new store and travel center. The seller was Valencia Crossing Long Term Investment Company, LLC. QuikTrip was represented by Randy Emerson of GRE Partners. The seller was represented by Derrick Sinclair of Terramar Properties.

18. Jormar Investment Company, LLC has purchased a 3.61 site at the NEC of Cortaro and I-10 in Marana for $2.1M. The seller was Cortaro Commercial JV, LLC (Thompson Thrift Development), represented by Jeramy Price and Brenna Lacey of Volk Company and Chuck Wells of Kidder Mathews. The property is intended for development as a Mark Mazda Dealership.

Lease Transactions

19. Logistics Plus, Inc. announced the opening of a new 1.1MSF warehouse in Glendale at the NEC of Bethany Home Road and Loop 303. The site is adjacent to another 543KSF warehouse LP opened earlier in 2022.

20. The Raley’s Companies, the parent company of Basha’s, has taken a 59KSF office and support center space at 2650 W. Geronimo Place in the Chandler Freeway Crossing business park with the goal of consolidating local operations.

21. Granite Construction Company leased 16.1 KSF of industrial space at North Tucson Business Center, 3755 N. Business Center Drive in Tucson from S&G Leasing, LLC. Paul Hooker with Cushman & Wakefield | PICOR, represented the landlord.