Sales Transactions

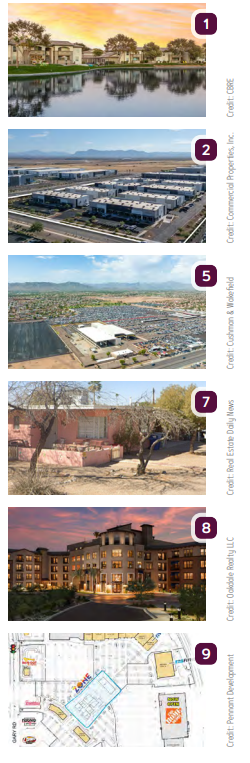

1. TGM has acquired the 296-unit Ocotillo Bay apartments in Chandler for $90.5M. The community, now renamed TGM Ocotillo Bay, will be managed by TGM Communities LLC. CBRE represented the seller, a national fund manager.

2. McCarthy Cook & Company has acquired the 172.2KSF Tailwinds at Gateway industrial complex in Mesa for $51.5M. The fully leased Class A property includes four multi-tenant and six single-tenant free-standing buildings, with tenants such as ABB Inc., Hermle USA and Crane Worldwide Logistics. The Leroy Breinholt Team at Commercial Properties Inc. represented the seller, Jeff Arnold.

3. Arte Moreno (as San Tan Crossing LLC) has purchased two vacant parcels totaling nearly 21 acres in Gilbert for $24.5M. The land is located at 2025 E. Williams Field Road (20 acres) and 2590 S. Market St. (one acre). Macreich Company was the seller.

4. Management and Training Corporation has paid the State of Arizona $15M for a closed prison facility at 12700 W. Silverbell Road in Marana. MTC built and operated the 500-bed prison, which closed in 2023, in the mid-1990s. The company says the site will be reopened for detention purposes, but it has not given specific plans or timelines.

5. Capitol Engineering has acquired a 20.4KSF A-1 industrial facility on 11 acres at 1945 W. Broadway Road in Phoenix for $13M. The space contains a 14.4KSF flex building, 6KSF of office space and four open production/manufacturing bays. The buyer will relocate from a nearby site. Cushman & Wakefield represented both parties. The property was formerly owned by Camblin Steel Service and operated as a steel fabrication facility.

6. Health Wealth Fund One Series 1, LLC has paid $5.01M for the 13.9KSF Tucson Medical Dental Complex at 4625 N. Oracle Road in Tucson. The transaction was executed between the buyer and JetSet Surgeon Founders LLC under a 15-year absolute triple-net lease. The property is occupied by three tenants. The transaction was brokered by Matt Hardke, Brenton Baskin, and Julius Swolsky with Graystone Capital Advisors.

7. Tucson from RW Adelaide for $3.4M. The properties, which totaled 13 duplexes and two single-family residences—with 28 units in all, include 1415 E. Adelaide Dr., 1503 E. Adelaide Dr. and 1511 E. Blacklidge Dr.

8. MC Companies has acquired The Core Scottsdale, a 282-unit Class A community in north Scottsdale. The 2018-built midrise property includes studio, one- and two-bedroom apartments. Acquisition financing was arranged through CBRE Capital Markets. No additional transaction details were provided.

Lease Transactions

9. EoS Fitness has leased 40KSF at 33239 N. Gary Road in San Tan Valley’s Skyline Ranch Marketplace. Echelon Realty Advisors brokered the deal. The gym is expected to open in 2026.