Sales Transactions

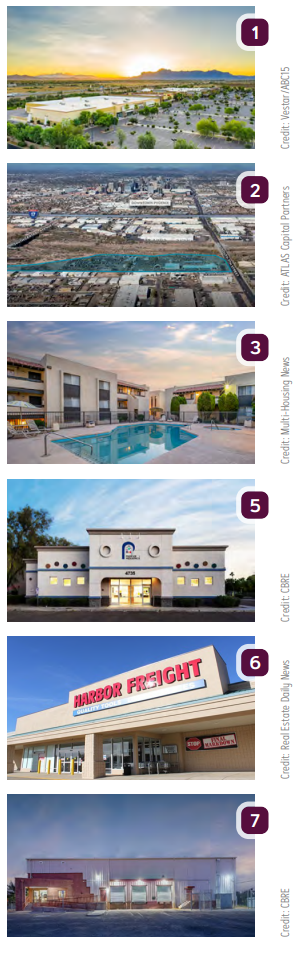

1. A Los Angeles-based investor acquired the Superstition Gateway shopping center in east Mesa for $121M. The 66-acre retail shopping center contains 495KSF of leasable space, which is more than 90% occupied. The buyer assumed the existing $77M CMBS loan and its 3.6% interest rate. Lee & Associates brokered the transaction, and Thomas Title & Escrow closed the deal.

2. ATLAS Capital Partners has sold a parcel to the City of Phoenix for $29.5M to be part of Phoenix’s Rio Reimagined revitalization project. The 29.4-acre site is located at 3030 S. 7th St. and contains a 42.5KSF industrial building with tenancy through 2028. The property is in an Opportunity Zone. OakPoint Real Estate partnered with ATLAS on the transaction, and Cushman & Wakefield‘s Capital Markets Group represented ATLAS in the sale.

3. Bridge Investment Group purchased Monte Vista, a 208-unit, 18-building multifamily property in Glendale, for $25.5M from a private individual. Truist Bank provided acquisition financing. Institutional Property Advisors and Marcus & Millichap brokered the deal. Units in the property range from one to two bedrooms and in size from 687SF to 887SF.

4. Kelly Ranch, a 109.7-acre property in southern Arizona, was purchased by Pima County for $6M. The acquisition was made in a move for wildlife and archaeological preservation, as it borders Catalina State Park. Pima County plans to eventually transfer the property to the park. The property contains a historic home and guesthouse designed by Josiah Joesler. Funding for the purchase included $2.1M from the County’s general fund, $600K from the Regional Flood Control District, and anticipated grants and private donations, including a $1.5M grant application submitted by Pima County to the Regional Flood Control District.

5. CBRE Newport Beach brokered the $3.2M sale of 4735 E. Union Hills, an 8.6KSF single-tenant office building in Phoenix currently leased to Phoenix Pediatrics. CBRE Tucson represented the seller.

6. Como Se Va LLC recently sold its retail property at 8730 E. Broadway Blvd. at Broadway East Plaza in Tucson to Agree Central, LLC for slightly more than $3M. The 21.4KSF building is being redeveloped into a Harbor Freight Tools store. Its reopening is planned for June of this year.

7. 102-120 W. 29th St., a single-tenant industrial property in Tucson, sold for $2.4M. TT DVI LLC, an affiliate of Diamond Ventures, sold the property. CBRE represented Diamond Ventures in the transaction. The property is currently leased to Tucson Foods Inc. The buyer was involved in a 1031 exchange.