By Roland Murphy for AZBEX – BEXCLUSIVE

A recently released report from LGE Design Build shows metro Phoenix continues to maintain its status as a national construction and development leader, even though the market is as affected by national trends and economic conditions as any other.

In its Q4 2023/Q1 2024 Construction Delivery Outlook, LGE reports Phoenix has officially become a rising tech hub. VP of Preconstruction Blake Wells writes in the introduction, “The growth of the semiconductor industry in Phoenix reflects a pivotal role for technology without direct reference to national initiatives.”

Discussing core market demand, the report credits Phoenix’s ability to attract major new tech and advanced manufacturing development to its climate of comparatively low utility costs, a traditionally business-friendly environment and business-palatable regulatory measures, along relatively stable weather and a low likelihood for natural disasters.

Looking at the various market segments LGE focuses on, the report’s examination of the Phoenix Industrial market says, “Phoenix secured the top spot with a 3% gain in occupied space, attributed to its expanding consumer base and accessibility to trade points. Despite the national trends of an overall slowdown in demand, Phoenix’s strategic location and demographics contributed to the delivery of 16.5MSF of buildings during the third quarter of 2023.”

Looking at Office, Phoenix shares the current downturn and uncertainty experienced by the rest of the country arising from ongoing economic doldrums, persistent inflation and high interest rates. Still, the report says, an appetite remains for Class-A and so-called “trophy” office space as part of the “drive to quality” many companies are incorporating into their efforts to bring workers back on-site and away from remote work.

Even though the state has a significant backlog and discrepancy between projects planned and those underway, and Construction as an employment sector still lags far behind its pre-Great Recession peak, the report praises the Arizona Construction labor market. “There were over 900 Construction Jobs added in the Phoenix Metro area in November for a total of 161,400 according to Arizona Office of Economic Opportunity. The state has fostered partnerships, training programs, and initiatives like the Voluntary Protection Programs to enhance workplace safety, apprenticeship opportunities, and overall workforce development, contributing to Arizona’s robust construction talent pipeline.”

The market difficulties faced Arizona in general and Phoenix in particular are the same ones faced by the rest of the country. While supply chain disruptions have eased significantly, there are shortages of skilled professionals across the entire supply chain that will require “a combined effort of people and technology to rebuild and strengthen…”

Particular pain points include HVAC units and electrical components.

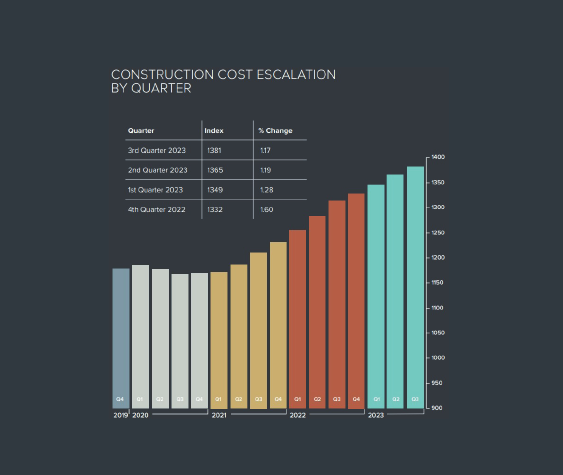

Materials costs remain another challenge. While cost escalation has largely slowed across materials types, costs remain elevated over their pre-pandemic rates. While most material prices have fallen from their peaks, concrete has continued to experience increases, and gypsum has remained consistently high since its initial peak in early Q3 2022.

On the design side, challenges both locally and nationally include increased strain on municipalities to complete entitlements and permit reviews in a timely manner, leading to drawn out timelines.

Adding to that pressure is an increase in expected design standards, particularly for Industrial projects. The report notes design review boards are now insisting Industrial developments more closely resemble high-end Office aesthetics, including mandating multiple materials and textures, taller parapets, enhanced landscaping and increased glazing.

The complete LGE report is available here.