Sales Transactions

1. HARRI5 Manufactured Housing and Commercial Brokerage has closed on a $25M mobile home portfolio that includes two Glendale properties. The seller was MAR Companies. The buyer was Comfort Communities. The assets were Flamingo Mobile Home & RV Park with 107 spaces and Royal Glen Mobile Home & RV Park with 95. HARRI5 expects to close on seven more Arizona properties with an estimated total value of $150M by the end of the year.

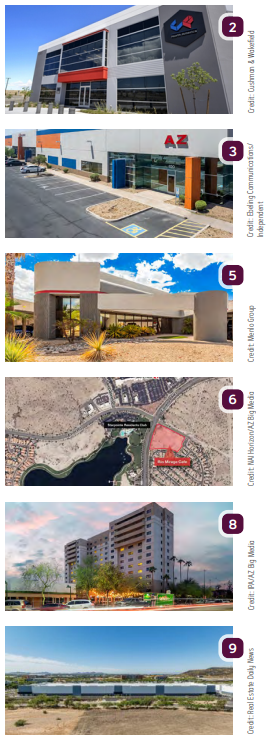

2. Cushman & Wakefield advised on the $10.5 sale and leaseback of High-Tech Corporate HQ Building, a 50KSF-plus industrial/office building in Prescott. Eric Wichterman and Mike Coover with Cushman & Wakefield represented seller CP North America, LLC. Sewell Trust was the buyer.

3. Stos Partners acquired 620 N. 43rd St., a 49.5KSF industrial complex in Phoenix, from Auto Body Parts LLC for $9M.

4. A 2.4KSF Chipotle restaurant and drive-thru at 1838 W. Baseline Road recently sold for $3M. The undisclosed seller was represented by Mark Ruble and Chris Lind of Marcus & Millichap.

5. Menlo Group announced the sale of 4840 S. 35th St., a 10.7KSF industrial space in Tempe, for $2.75M. Tom Ellixson of Menlo Group represented the seller, Daniel Dubei and Sue E. Muth of Décor Properties represented buyer Dogwood Dr LLC.

6. NAI Horizon represented the seller, Kitchell Development, in the $2.3M sale of 4.72 acres of retail land in Goodyear. The buyer, Estrella Mountain Lago, LLC, plans to build their third restaurant, Rio Mirage Café, on the site.

7. Hark Investors, LLC and Rancho Rillito LLC purchased the 15-unit apartment community Rancho Rillito at 3801 N. Swan Road in Tucson from Damian Community LLC for $2M. Rob Tomlinson with Cushman & Wakefield | PICOR represented the seller. Gary Roberts of the Roberts & Norris Team with Long Realty Company represented the buyers.

8. Institutional Property Advisors, a division of Marcus & Millichap, announced the sale of Courtyard Towers, a 13-story residential tower in Mesa. Cliff David and Steve Gebing of IPA represented seller Okland Capital and procured the buyer, Soltrust Robson. Blueprint Capital Income REIT financed the sale.

Lease Transactions

9. DAUM Commercial Real Estate Services represented Fox Factory Inc. in a long term lease of a 112KSF industrial building in Phoenix totaling $12M. CBRE negotiated on behalf of Meritex, the new building’s owner.

10. NEFAB Packaging West, LLC leased 81KSF of industrial space at 2020 W. Prince Road, Suite C in Tucson from Prince Rd Distribution, LLC. Greg Furrier and Paul Hooker with Cushman & Wakefield | PICOR represented the landlord. Hagen Hyatt with Jones Lang LaSalle Americas, Inc. represented the tenant.