Sales Transactions

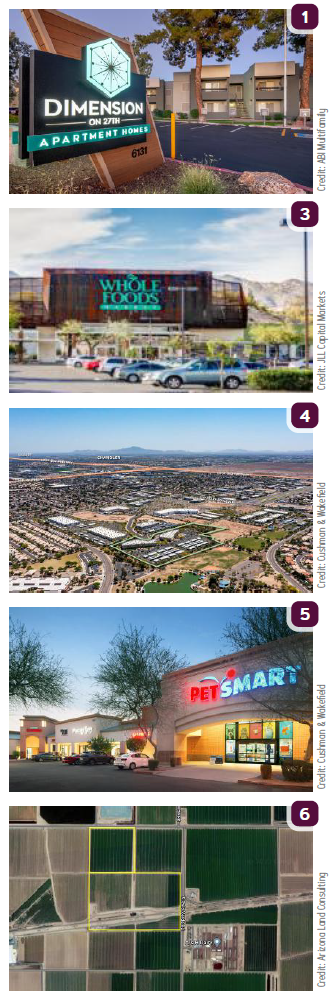

1. ABI Multifamily announced the $49.75M sale of Dimension on 27th Apartment Homes, a 260-unit multifamily community in Phoenix. ABI’s Alon Shnitzer, Rue Bax, Eddie Chang and Doug Lazovick represented the undisclosed buyer and seller.

2. Concord Wilshire Capital and TLG Investment Partners, in partnership with CDS International Holdings Inc., announced the acquisition of the Metrocenter Mall, including the Dillard’s Building and U-Haul Building (formerly Macy’s Building) has closed. The transaction was completed with no mortgage financing. The reported transaction price was $48M. The sellers were Carlyle ER Metro LLC (Carlyle Development Group Inc.), Dillard’s Properties Inc., and AMERCO Real Estate Co.)

3. JLL Capital Markets announced it has closed the $31.1M sale of River Center, a 107.5KSF, Whole Foods-anchored neighborhood retail center in Tucson. Seller First Washington Realty was represented by JLL’s Patrick Dempsey, Geoff Tranchina and Patrick Anthon. The buyer was a private investor.

4. Cushman & Wakefield announced it has advised the sale of a 136.7KSF, 28-square-foot, multi-tenant Class A office portfolio in Chandler consisting of two buildings in the Chandler Corporate Center. The buyer was Zeitlin Capital. Seller Mass Equities was represented by C&W’s Chris Toci, Jerry Roberts and Pat Boyle.

5. Cushman & Wakefield announced the firm has brokered the $16.4M sale of Red Mountain Plaza, a 69.3KSF Home Depot shadow-anchored retail shopping center at the NWC of Power Road and McKellips Road in Mesa. The asset was sold to Red Mountain Plaza, a Washington LLC. Seller HJ Red Mountain, LLC, an entity formed by Jakosky Properties, was represented by Ryan Schubert and Michael Hackett with Cushman & Wakefield in Phoenix.

6. Arizona Land Consulting announced the closing of a 94-acre 1031 exchange property for $13.5M in Buckeye. ALC closed on 18 acres off Yuma Road and Miller Road in Dec. 2020 for $2.75M. One year later, 12 of the original 18 acres were sold for $3.7M in a 1031 exchange, and ALC purchased a 94-acre property located on Palo Verde and Baseline for $6M. The 94 acres were then sold to a recycling company for $13.5M.

7. 8500 S Rita Road, LLC (Chrome Hearts, LLC) has purchased a 116.9KSF building on 13.8 acres on South Rita Road in Tucson for $13M. Seller Mithril Real Property Inc. was represented by Rob Glaser and Jesse Blum of Cushman & Wakefield | PICOR. The buyer was represented by Gary Emerson of GRE Partners with Robert Cohen of Newmark Knight Frank. Chrome Hearts bought an adjoining 39 acres last November for $2.5M.

8. The 22.6KSF River Village Retail Center at the NEC of Oracle and River Road, Tucson, sold for $5.8M. The buyer is JVZ Greystones Trust of Highland Park, IL. Seller The River Equities, LLC was represented by John Redfield with SRS Real Estate Partners.

9. CP Tucson Endo, LLC (MedCore Partners) purchased the 12KSF second floor at Oracle-Ina Professional Plaza, 7490 N. Oracle Road for $3.05M. MedCore will occupy the space. Richard M. Kleiner and Thomas J. Nieman with Cushman & Wakefield | PICOR represented the seller. Larry Serota and CeCe Conway with Transwestern represented the buyer.

Lease Transactions

10. Cushman & Wakefield announced the firm has represented property owner Stos Partners in fully leasing a 94.2KSF industrial/warehouse facility Stos recently purchased at 1002 S. 54th Avenue in Phoenix. The new tenant is Copper State Bolt & Nut. C&W’s Phil Haenel, Andy Markham and Mike Haenel represented the landlord. CBRE’s Bill Bayless represented the tenant.

11. Jared Lively of Rein & Grossoehme CRE represented both landlord Maness Commercial Realty, LLC and tenant Jerusalem Grocery Store in the recent lease of 10.6KSF in Amherst Plaza at the NEC of 35th Avenue and Greenway Road in Phoenix.