By Colliers International

The medical office market in Greater Phoenix remains strong as population grows and companies relocate to the area. Demand for healthcare is growing, which is projected to drive demand for medical office space throughout 2021.

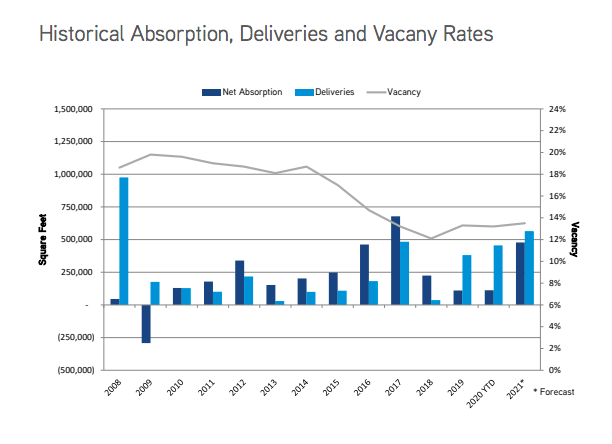

Net absorption of medical office space during fourth quarter reached 112KSF, making every quarter in 2020 a positive net absorption timeframe. During 2020, we posted a total of 48.6KSF in net absorption.

Vacancy of medical office space dropped to 13.2 percent at year-end. Available sublease space declined by 16.0 percent over-the-quarter and is 32.2 percent higher than year-end 2019. The total amount of sublease space available in the market equates to less than 1.2 percent of the medical office inventory. Central Scottsdale was hardest hit this past year with sublease space increasing 715 percent year-over-year. Downtown North posted the lowest vacancy at the end of 2020 with just 2.3 percent available.

Rental rates remained strong during fourth quarter, increasing 1.2 percent since third quarter and rising 5.3 percent year-over-year to finish 2020 at $22.28/SF.

The medical office market added 26.5KSF of new inventory during fourth quarter.

Investment sales volume gained momentum during fourth quarter, increasing 45.2 percent over-the-quarter, but decreasing 8.5 percent over-the-year to $66.5M. The median price/SF increased 18.4 percent during fourth quarter to $174. This median price falls below the year-end 2019 figure by 21.1 percent. Sales decreased 49.8 percent year-over-year in 2020 to $191.8M. Cap rates remain below 8 percent. (Source)