Sales Transactions

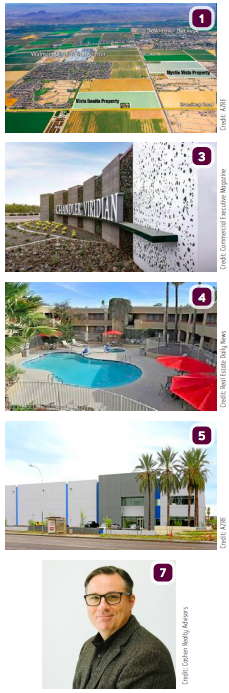

1. Walton has sold 290 acres in the Mystic Vista and Vista Bonita masterplans located in Buckeye for an undisclosed amount. MPC Developments, LLC has purchased 145 acres in the Mystic Vista community located at Apache Road and Southern Avenue. Villa Capri Mobile Home Park, LLC bought 125 acres consisting of two parcels of land in the Vista Bonita master plan located in the vicinity of Apache Road and Broadway Road.

1. Walton has sold 290 acres in the Mystic Vista and Vista Bonita masterplans located in Buckeye for an undisclosed amount. MPC Developments, LLC has purchased 145 acres in the Mystic Vista community located at Apache Road and Southern Avenue. Villa Capri Mobile Home Park, LLC bought 125 acres consisting of two parcels of land in the Vista Bonita master plan located in the vicinity of Apache Road and Broadway Road.

2. Landmark Dividend announced it has purchased a three-building, 184KSF, 16+ MW enterprise data center campus in Phoenix for an undisclosed amount. Landmark has engaged the JLL Data Center Solutions team in Phoenix as the exclusive leasing manager of the data center campus.

3. The last component of Chandler Viridian PRIMEGATE was just sold by WINLEE Development for $12.85M. The sale, which included both of the recently completed Thirsty Lion and Charles Schwab flagship buildings, consummates the phased sale of the four-building project for a total of $20.84M. Jamie Meddress and Chris Lind of Marcus & Millichap helped broker all of the project’s transactions. The buyer was undisclosed.

4. STORE Master Funding XVIII, LLC, an affiliate of STORE Capital Corporation, purchased the 55KSF America’s Rehab Campuses facility at 6944 E. Tanque Verde Road, Tucson, for $16.75M in a sale leaseback agreement.

5. Westcore acquired a 148.7KSF, Class A industrial warehouse at 4455 W. Camelback Road, Phoenix, for $12.4M. The seller, Dreamfoam Bedding, doing business as Brooklyn Bedding, occupies the entire building and will lease it back for a short period of time. Westcore was represented by Phil Haenel, Andy Markham, Mike Haenel and Will Strong of Cushman & Wakefield, while the seller was represented by Scott Backes and Rose Arck of Brydant Real Estate.

6. South Lind Square, LLC completed a 1031 exchange involving the purchase of the 46.8KSF Safeway at La Toscana Village, 110 N. Oracle Road, Tucson, for $10.75M. Intersection’s Mark Hoekstra and Rob Kerr represented the buyer. The Royston Group’s Greg Cortese advised the unnamed seller.

7. Cashen Realty Advisors’ recent closings included a $2.4M land sale to Math and Science Academy at the SEC of 15th Avenue and Baseline; a $2.1M 20.4KSF office building sale to Riley Smith Development at 500 E. Thomas; a $4.5M, 5.5 Acre land sale to Encore for a 200-unit multifamily development in Chandler; and a 2.1KSF retail building sale to LK2 Enterprises at 6101 N. 7th Street for $1.1M.

8. A private investor purchased Mirador Apartments, a 36-unit apartment community at 2424 E. Grandview Road, Phoenix, for $3.512M. Darrell Moffitt, an investment specialist in Marcus & Millichap’s Phoenix office, had the exclusive listing to market the property on behalf of the seller, a limited liability company, and procured the buyer.

Lease Transactions

9. Cashen Realty Advisors’ recent lease transactions include a $23.4M, 15-year 48.8KSF lease for C.M.B. III, L.L.C. at 13454 N. Black Canyon Highway (I-17) and a 10-year, $2M lease for SSVI, LLC at 3816 N. 7th Street.

10. Independent Electric Supply, Inc. leased 44.6KSF of industrial space at 777 E. MacArthur Circle in Tucson, from MacArthur Investments, LLC. Brandon Rodgers, SIOR, CCIM, Principal and Industrial Specialist with Cushman & Wakefield | PICOR, represented the landlord in this transaction. Mike Parker with CBRE Phoenix, represented the tenant.

NEWS TICKER

- [January 6, 2026] - Developers Must Work Differently to Counter Intensifying Project Opposition

- [January 6, 2026] - Political Group Pressing for Lucid Expansion Referendum

- [January 6, 2026] - Gilbert Considering Other Methods to Fund Transportation Projects

- [January 6, 2026] - Industry Professionals 01-06-26

- [January 6, 2026] - Commercial Real Estate 01-06-26

- [December 30, 2025] - Major Federal Defense Projects Moving Forward in Arizona

- [December 30, 2025] - Mesa DRB Discusses 170-Acre Data Center Project Plan

- [December 30, 2025] - ADOT Announces Major Projects for 2026