1. Two Marriott-branded hotels in Scottsdale have sold for a combined of $161M to Starwood Capital Group. Host Hotels & Resorts Inc. sold the 243-room Scottsdale Marriott Suites Old Town, 7325 E. Third Avenue, for $81M and sold the 266-room Scottsdale Marriott at McDowell Mountains, 16770 N. Perimeter Drive, for $80M.

1. Two Marriott-branded hotels in Scottsdale have sold for a combined of $161M to Starwood Capital Group. Host Hotels & Resorts Inc. sold the 243-room Scottsdale Marriott Suites Old Town, 7325 E. Third Avenue, for $81M and sold the 266-room Scottsdale Marriott at McDowell Mountains, 16770 N. Perimeter Drive, for $80M.

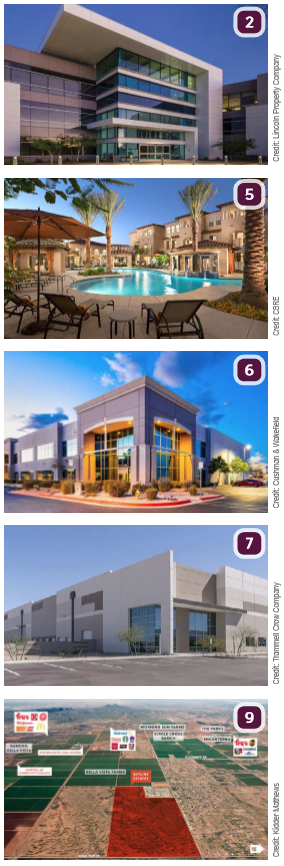

2. Innovatus Capital Partners LLC recently purchased Waypoint suburban Class A office campus for $107.6M, from Harvard Investments and Lincoln Property Company. Totaling four buildings at the borders of Mesa, Tempe and Scottsdale, Arizona, the project is the highest-priced office sale of the year in metro Phoenix. The seller was represented by Barry Gabel, Chris Marchildon and Will Mast of CBRE.

3. Mark-Taylor has expanded its luxury apartment portfolio by 485 new East Valley units with the acquisitions of Avant at Fashion Center in Chandler and Lakeside Drive in Tempe. Mark-Taylor will handle the management and leasing of both new communities. The sales price was not disclosed.

4. LaSalle Investment Management’s NAV-REIT, JLL Income Property Trust purchased Alta San Marcos, 273-unit apartment complex at Arizona Avenue and Chandler Boulevard, Chandler, for $71.75M. Steve Gebing and Cliff David, senior managing directors for Institutional Property Advisors, a division of Marcus & Millichap represented the seller, Wood Partners, and procured the buyer.

5. CBRE arranged the sale of the 224-unit multifamily community San Marquis on behalf of a venture between Sequoia Equities and Mark-Taylor Residential to Acacia Capital Corporation for $58.5M.

6. Albany Road Real Estate Partners purchased Quattro, a multi-tenant office building located at 4310-4350 E. Cotton Center Boulevard., Phoenix, for $43.5M from Buchanan Street Partners. Tracy Cartledge, Bob Buckley and Steve Lindley of Cushman & Wakefield’s Phoenix office negotiated the transaction on behalf of the seller.

7. Cohen Asset Management purchased the Tolleson Logistics Center, a 329KSF Class A industrial building at 200 N. 99th Avenue, for an undisclosed price. Cushman & Wakefield’s Will Strong represented the venture. Trammell Crow Company announced the sale.

8. ZH Multifamily purchased Scottsdale 5th Avenue, a 59-unit, garden-style multifamily property in Scottsdale and Oak Tree, a 76-unit, garden-style community in Phoenix, for a total of $13.5M. Ric Holway and Mark Forrester, Senior Managing Directors, and Dan Cheyne Senior Director of Berkadia’s Phoenix office represented the seller, Birch, LLC. Scottsdale 5th sold for $6.6M and Oaktree sold for $6.9M.

9. AREAD Management Inc., a residential developer, and Varde Partners, a private investment company, have purchased a 290-acre development site in San Tan Valley for $8.7M. The seller was Skyline & Quail, LLC. Kidder Mathews’ land broker, Brian Rosella, represented the seller. The development site is planned for Skyline Estates, a residential development planned for over 1,000 lots.

10. ABI Multifamily announce the $6.475M sale of The Tides at 40th, a 43-unit garden-style apartment community at 2620 N. 40th St.; Phoenix. ABI Multifamily VP Ryan Smith and Partner Eddie Chang represented both the buyer and seller who are private investment firms based in California.

10. ABI Multifamily announce the $6.475M sale of The Tides at 40th, a 43-unit garden-style apartment community at 2620 N. 40th St.; Phoenix. ABI Multifamily VP Ryan Smith and Partner Eddie Chang represented both the buyer and seller who are private investment firms based in California.

11. Scottsdale Airpark, LLC purchased a 16.9KSF building, featuring office space and an airport hangar in the Scottsdale Airpark for $3.3M. DAUM Commercial Real Estate Services’ Executive Vice President and Phoenix Co-Branch Manager Kirk Jenkins represented the buyer and executive vice president Steve Bodeman represented the seller, Kachina Investments, LLC.

12. CBRE announced the sale of three single-tenant properties located throughout Arizona leased to Freddy’s Frozen Custard and Steakburgers:

- Joe Compagno of CBRE in Phoenix represented JRI Management in the $3M sale of a 2.9KSF property at 1340 N. Litchfield Road, Goodyear to Li Family Trust.

- Joe Compagno of CBRE in Phoenix represented Barclay Daisy Mountain, LLC in the $2.8M sale of a 3.2KSF single-tenant retail property leased to Freddy’s at 39520 N. Daisy Mountain Drive, Anthem. Karraa N Daisy Mountain Drive Anthem purchased property.

- Joe Compagno of CBRE in Phoenix represented JRI Management in the $2.55M sale of a 3KSF at 2675 S. Beulah Boulevard., Flagstaff to Karraa S. Beulah Blvd Flagstaff, LLC.

13. Marcus & Millichap has announced the sale of Farnsworth Apartments, a 30-unit apartment property at 315-321 N. Higley Road, Mesa for $2.6M. Darrell Moffitt and Michael Burke, investment specialists in Marcus & Millichap’s Phoenix office, had the exclusive listing to market the property on behalf of the seller, an individual/personal trust. The buyer, an individual/personal trust, was also procured by Moffitt and Burke.

14. JB Holdings, LLC recently purchased a 21.4KSF office building at Pima Center, 8454 N. 90th Street, Scottsdale, for an undisclosed amount. The building, fully leased by Safeguard Security, was sold by CQR Holdings, LLC. The transaction was handled by Shawn Dooley and Kyle McGinley of Ross Brown Partners.

15. SOD Brookside, LLC and WRM Brookside, LLC purchased the hard corner PAD Building at the Shops at Oro Vista, a 15KSF building at 10390 N. La Canada Drive, Oro Valley, for $2.075M. Patrick Dempsey with HFF represented the seller, MRR Holdings, LLC. Phil Skillings and Ben Craney with NAI Horizon represented the investor.

16. Stockbridge Capital Group purchased a 6.35MSF Class A industrial property portfolio, including one property at 7037 W. Van Buren Street, Phoenix, from Westcore Properties for an undisclosed price.

Lease Transactions

17. NAI Horizon’s Isy Sonabend represented the tenant, Progressive Casualty Insurance Co, in a 64-month lease for 42.1KSF at 1395 N. Fiesta Drive, Gilbert. The landlord, AEI Fiesta, LLC, was represented by Evan Koplan with CBRE.

17. NAI Horizon’s Isy Sonabend represented the tenant, Progressive Casualty Insurance Co, in a 64-month lease for 42.1KSF at 1395 N. Fiesta Drive, Gilbert. The landlord, AEI Fiesta, LLC, was represented by Evan Koplan with CBRE.

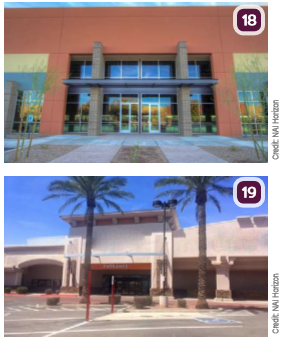

18. NAI Horizon’s Isy Sonabend represented the tenant, Progressive Casualty Insurance Co, in a 65-month lease for 25.2KSF at 339 E. Germann Road, Gilbert. The landlord, Reserve at San Tan 4, LLC, was represented by Mike Garlick with Newmark Knight Frank.

19. NAI Horizon represented the landlord, Val Vista Queen Creek LLC, and the tenant, United PF TOM LLC, in negotiating a long-term 24.3KSF lease for a new Planet Fitness at Vista Del Oro, 4874 S. Val Vista Drive, Gilbert. The transaction totaled $2.55M.

20. Pepperidge Farm, Inc. leased 15KSF of industrial space from Park Ajo Associates in the Park/Ajo Commerce Center, 3770 S. Park Avenue, Tucson. Cushman & Wakefield | PICOR Principals and Industrial Specialists handled the transaction. Ron Zimmerman represented the landlord; Russell W. Hall, SIOR, GSCS, and Stephen D. Cohen represented the tenant. Brian Borget with Cushman & Wakefield, Stamford, CT. also represented the tenant.

21. Florence Immigrant and Refugee Rights Project, Inc. leased 12KSF of office space at 120-140 N. Tucson Boulevard, Tucson, from Eria, LLC. Richard M. Kleiner, MBA, Stephen D. Cohen and Russell W. Hall, SIOR, GSCS, principals with Cushman & Wakefield | PICOR, represented the landlord. Brenna Lacey and Leah Bogen with VOLK Company represented the tenant.