By Roland Murphy for AZBEX

Add one more hotel to the more than 2,000 currently in the planning stages around the U.S.

The Gilbert Planning Commission/Design Review Board will hear a proposal this week from developer KWB Hotels to build a new five-story, 109-room Fairfield by Marriott Inn & Suites hotel on 1.7 acres at the SEC of Market Street and Val Vista Drive. Zoning for the site is Regional Commercial with a Planned Area Development overlay.

According to the Town staff report, the development will be “a single amenitized hotel building with an outdoor seating area/lounge. The proposed hotel building on the subject site will face east toward an existing hotel building (Home2 Suites). The subject site will share pedestrian and vehicle access with both the neighborhood hotel uses and a pair of pad sites to the west of the subject site.”

The conceptual plan calls for nine rooms on the first floor and 25 rooms on each of the remaining four floors. Planned amenities include a fitness center and a lobby market.

In 2016 the Planning Commission approved a design review for the Home2 Suites project mentioned above in conjunction with a planned Candlewood Suites hotel and a master site plan with three lots, including the currently proposed site, and a retail commercial development. The Home2 Suites hotel opened in 2018, but the Candlewood Suites component encountered delays due to a lack of perceived market demand and was eventually canceled in March 2020.

The new Fairfield Inn proposal closely follows the original plan for the Candlewood portion of the site development. Minor changes include shifting the building to the west to allow for a covered entrance and porte cochere and the relocation of a parking aisle to the east side of the building.

Planning staff has recommended approval with conditions for the site plan, landscaping, grading and drainage, elevations, floor plans, lighting and colors and materials.

KWB Hotels is the developer. The design firm is PK Architects. Atwell is the project engineer.

Project is Part of a National Trend

The Fairfield Inn proposal reflects a national trend in rebounding hotel development. Following a near collapse during and immediately after the COVID-19 pandemic, the U.S. hotel construction industry has come back with a vengeance, according to a recent article on GlobeSt.com.

Last July, an article on HotelManagement.net reported the pipeline expansion was well underway. Using data from the United States Construction Pipeline Trend Report from Lodging Econometrics, HotelManagement reported, “Projects scheduled to start in the next 12 months, at 2,009 hotels with 232,163 rooms, are up 9% year over year by projects and 9% year over year by rooms. Projects and rooms in early planning reached a record high in the second quarter, standing at 2,246 hotels with 258,191 rooms, up 26% year over year by projects and 15% year over year by rooms.”

GlobeSt’s May 2 article quoted RREAF Holdings’ Sr. Hospitality Asset Manager Greg Perry, who called the current hotel construction pipeline “robust.” Perry said, “Institutional investors have been fighting with their wallets over high quality, new construction hotels for the past five years and there is still too much money chasing too few deals.”

The same article quotes Afshin Kateb, CFO and Head of Hospitality Investments at Palladius Capital Management, who said hotels have proven to be a solid hedge against inflation “despite macroeconomic and capital markets volatility.”

Philip Ballard, chief communications officer & head of investor relations for Hotel Planner, said the strong hotel construction pipeline is an indicator that travel, tourism and hotels remain leading contributors to the post-pandemic economic recovery.

Despite the strong demand and robust pipeline, however, rising construction costs and the ongoing labor shortage have more than doubled the Construction-to-Opening average timeline, according to data from JLL.

Arizona and Gilbert Hotel Snapshot

Being a highly tourism-driven economy, Arizona suffered more hotel-related losses in the pandemic than many other areas. Total tourism-related losses in 2020 were estimated at $2B by the Arizona Lodging and Tourism Association. The American Hotel & Lodging Association reported Arizona hotel revenues decreased by $969M in 2021 and projected losses of $300M for the year as of mid-2022.

Fortunately for the industry, a combination of federal recovery spending, targeted promotion by various state offices and Glendale’s hosting of Super Bowl LVII combined to fuel a strong comeback and recovery. In March, CBRE predicted an 8.5% revenue per available room increase for 2023 and another 1% increase for 2024.

All the market yo-yoing in the past three years has impacted hotel construction. Many projects across the state were put on hold or canceled due to pandemic uncertainty. Now, however, Arizona reflects the national trend mentioned above in which hotel development is resurging with gusto.

The DATABEX Arizona construction project database combines hotels, resorts and casinos as a sub-sector under its Hospitality category. Not including the newly proposed Fairfield Inn, the database shows a total of 12 hotel-related projects in Gilbert since 2016. Of those, one has been canceled, four are in various stages of design, one is pending procurement/in negotiations, two are in pre-construction and four have been completed.

Excluding the canceled project, Gilbert’s total hotel estimated construction project valuation since 2016 totals $383.5M. It should be noted that those estimates are based on standard/SF development costs and are not updated in real time.

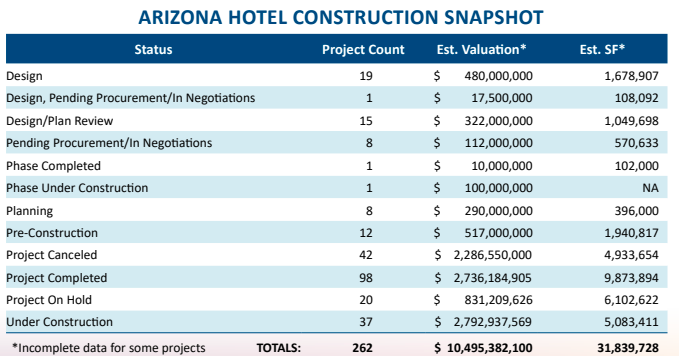

The statewide DATABEX Hotels/Resorts/Casinos numbers reflect a similar pattern of eager development, cautious pause and dramatic resurgence. Since 2016, the builders and developers have delivered 98 projects with estimated construction values of more than $2.7B and a total of nearly 10MSF built.

Twenty projects totaling more than 6MSF and holding total valuation estimates of more than $831M remain on hold.

The exciting news for the market, however, lies in the number of projects currently under construction. DATABEX shows 37 projects under construction totaling more than 5MSF and holding a total estimated valuation of nearly $2.8B.

Add to that another 35 projects in various stages of design totaling an estimated $819.5M and 2.8MSF, and it is easy to see why investors and developers are banking on a strong future for hotels in the state.