Sales Transactions

1. Heitman Capital Management purchased Aspire Tucson Student Housing, a 10-story tower at 950 Tyndall Avenue, Tucson, for $97M. Jaclyn Fitts, Executive Vice President, Student Housing with CBRE Dallas, William Vonderfecht, First Vice President, Student Housing, with CBRE Dallas, W. Michael Sandahl, Vice Chairman, Tucson Multifamily, and Casey Schaefer, First Vice President, Student Housing handled the transaction for the seller, Dinerstein Companies.

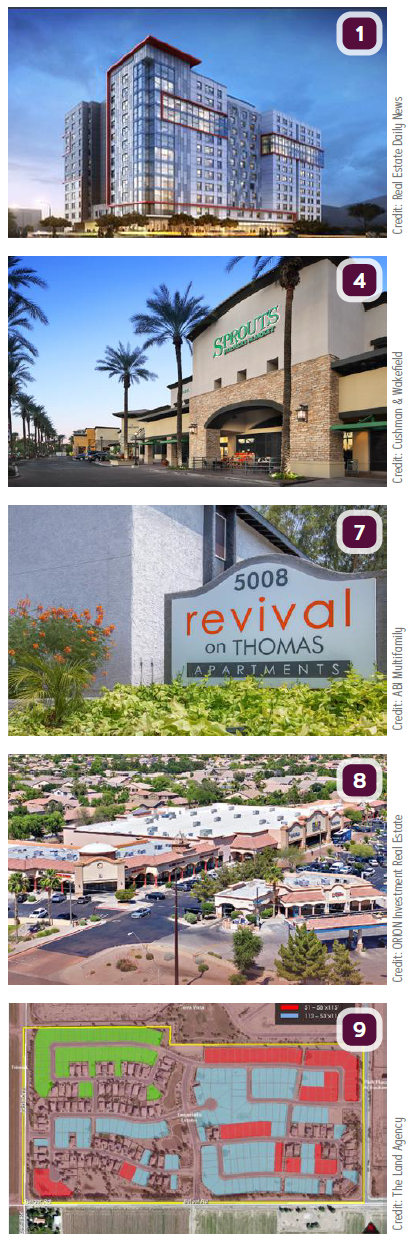

1. Heitman Capital Management purchased Aspire Tucson Student Housing, a 10-story tower at 950 Tyndall Avenue, Tucson, for $97M. Jaclyn Fitts, Executive Vice President, Student Housing with CBRE Dallas, William Vonderfecht, First Vice President, Student Housing, with CBRE Dallas, W. Michael Sandahl, Vice Chairman, Tucson Multifamily, and Casey Schaefer, First Vice President, Student Housing handled the transaction for the seller, Dinerstein Companies.

2. Liv Goodyear, a 326-unit multifamily asset in Goodyear, sold for $75.5M. Institutional Property Advisors (IPA) senior managing directors Steve Gebing and Cliff David represented the seller and procured the buyer, a Canadian private investor.

3. A fund sponsored by CBRE Global Investors has acquired a 393KSF industrial cross-dock facility located at 3333 South 7th St, Phoenix, for an undisclosed price. The acquisition is part of the fund’s broader strategy to acquire and lease up properties in key industrial markets across the U.S.

4. An entity formed by Global Retail Investors purchased The Shops at Gainey Village, a 138.5KSF Sprouts Farmers Market anchored urban village at the SEC of Scottsdale Rd and Doubletree Ranch Rd, for $69.7M. Michael Hackett and Ryan Schubert of Cushman & Wakefield’s Phoenix office negotiated the transaction on behalf of the seller, Gainey Village Retail Center, LLC.

5. Affiliates of West Coast Capital purchased a two-property portfolio totaling $68.35M. Cambric Corporate Center, a seven-building, 163.3KSF office complex at 1730-1880 East River Rd, Tucson, sold for $20.85M, and a large portion of the Williams Centre, a four-building, 363.2KSF office space at 5180-5285 East Williams Circle, Tucson sold for $47.5M,. Barry Gabel, Chris Marchildon, Bob Smith and Will Mast with CBRE in Phoenix represented the seller, affiliate entities of The Colton Company.

6. LP.PBV-2911 East Indian School Road purchased the Revival Biltmore apartment community, located at 2911 E Indian School Rd, Phoenix, for $31.25M. Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke of CBRE in Phoenix represented the buyer and the seller.

6. LP.PBV-2911 East Indian School Road purchased the Revival Biltmore apartment community, located at 2911 E Indian School Rd, Phoenix, for $31.25M. Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke of CBRE in Phoenix represented the buyer and the seller.

7. Tides Equity purchased Revival on Thomas, a 155-unit garden-style apartment complex at 5008 East Thomas Rd, Phoenix, for $21M. ABI Multifamily Partners’ Doug Lazovick and Eddie Chang, with support from Senior Managing Partners John Kobierowski, Alon Shnitzer and Rue Bax represented the buyer. The seller is a private investment firm based in Scottsdale.

8. Pecos Plaza, an 81.9KSF shopping plaza at 10202-1080 East Pecos Rd, Chandler, sold for $9.55M. Ari Spiro and Sean Stutszman of ORION Investment Real Estate managed the sale.

9. KB Homes and Lennar Homes purchased Marbella Ranch North, located north of the NWC of Glendale and El Mirage Roads, Maricopa County, for $8.7M. The Land Agency represented the homebuilders.

10. Grant Clover Commons, LLC purchased 74KSF of industrial space for $6.74M. The four-property portfolio sale, located at the SEC of the Grant Rd. interchange with Interstate 10 in Tucson, includes tilt-up constructed warehouse, manufacturing and showroom space. Cushman & Wakefield | PICOR Principals and Industrial Specialists handled the transaction. Stephen D. Cohen and Russell W. Hall, SIOR, GSCS, represented the seller, Sloat Family Partnership, LLLP; Robert C. Glaser, SIOR, CCIM, represented the buyer.

11. Sun Valley Plaza Holdings Inc. purchased Sun Valley Plaza, located at 7246-7336 E. Main St., Mesa, for $6.36M. The seller was Michael A. Pollack Real Estate Investments.

12. Boubek Family Trust purchased a two-story, 35.3KSF office property with underground parking at 702 E. Osborn Road, Phoenix, for $5.3M. Eric Wichterman and Mike Coover of Cushman & Wakefield represented the seller, Accelerated Capital Growth LLC.

13. Development Services of America purchased a best-in-class, one of a kind, 16.5KSF automotive showroom at 16066 N. 77th St., Scottsdale, for $3M. Michael Kitlica of Cushman & Wakefield represented the seller, 77 Scottsdale, LLC, and Allen Lowe of Lee & Associates represented the buyer.

14. A Denny’s at 1758 West Hunt Highway in San Tan Valley, sold for $2.875M. Mark Ruble, Chris Lind and Jamie Medress, investment specialists in Marcus & Millichap’s Phoenix office, had the exclusive listing to market the property on behalf of the seller, a limited liability company. The buyer, a limited liability company, was also procured by Lind, Medress and Ruble.

15. Linda Vista Luxury Rentals, LLC purchased 9.76 acres of vacant land located in the Oracle Vista Centre, 9645 – 9781 N. Oracle Rd., Oro Valley, for $2.6M. Richard M. Kleiner, MBA, Principal and Office Specialist with Cushman & Wakefield | PICOR, represented both the buyer and seller, Oracle Vista, Inc.

16. Palm Lane, a 16-unit apartment property located at 2022 North 36th St, Phoenix, sold for $2M. Paul Bay, investment specialist in Marcus & Millichap’s Phoenix office, had the exclusive listing to market the property on behalf of the seller.

Lease Transactions

17. ArmorWorks announced Monday it has signed a lease for 70KSF at the Lotus Project complex near Kyrene Road and Loop 202. Conor Commercial Real Estate is the developer of the complex.

18. La Cholla Family Medicine renewed their lease for 12KSF of medical office space located in La Cholla Medical Plaza, 6130 N. La Cholla Blvd., Suite 100 in Tucson, from HCPI / Utah, LLC. Richard M. Kleiner, MBA, Office pecialist with Cushman & Wakefield | PICOR, represented the landlord.