As part of its ongoing efforts to expand and modernize its offerings and facilities serving one of the Valley’s fastest-developing areas, the Phoenix-Mesa Gateway Airport Authority has issued a Request for Qualifications seeking a consultant or team to create a campus plan for a new terminal on the airport’s east side.

The full project description states: “Phoenix-Mesa Gateway Airport Authority is soliciting for a consultant/team to provide a campus plan to include building space programming, site layouts, costs estimates and financing options for a proposed new expandable commercial passenger terminal initially right-sized and located on the eastside of the Airport. The Gateway Tomorrow project will be guided by realistic commercial passenger activity forecasts, the current FAA-accepted/approved Airport Master Plan, and active participation from PMGAA staff, representatives from PMGAA member communities, and other key stakeholders. The Authority is interested in a flexible design that can easily/quickly be expanded to handle the forecasted demand after the initial phase is completed and an understanding of the operational needs of the Airlines that serve the facility.”

An April 20th press release from PMGA celebrated the best month in the airport’s history, saying, “Phoenix-Mesa Gateway Airport continued its streak of record-setting passenger activity by welcoming 239,160 total passengers during the month of March 2022. This is the highest monthly passenger total in the history of the Airport and surpasses the previous highwater mark set in March 2019 by almost 15,000 passengers. March represented the sixth record-setting month out of the last 10 in year-over-year passenger growth comparisons.”

The desired terminal facility will encompass a built area of 250KSF-300KSF and have a partial features list that includes:

- Multiple gates and hold rooms,

- Ticket counters,

- TSA offices and checkpoint areas,

- Administrative and operations office space with conference room areas,

- An Airport Control Center,

- Concessions and rental car counters,

- A rental car ready lot,

- Ground transportation and ride staging areas,

- Passenger, employee and support vehicle parking,

- A fuel farm and storage facility,

- An aircraft parking apron,

- Baggage claim facilities, and

- Roadway and infrastructure.

Submitting firms or teams should have experience in airport terminal design, airport masterplans and/or airport financial modeling.

PMGAA will host a pre-submittal meeting for interested firms at its administration building (5835 S. Sossaman Rd.) on May 11th. Questions and clarifications are due May 17th by 5 P.M., and RFQ submittals are due May 24th by 1 P.M. If the process advances to the interview stage, they will be conducted the week of June 20th.

PMGA Shows Aggressive Growth

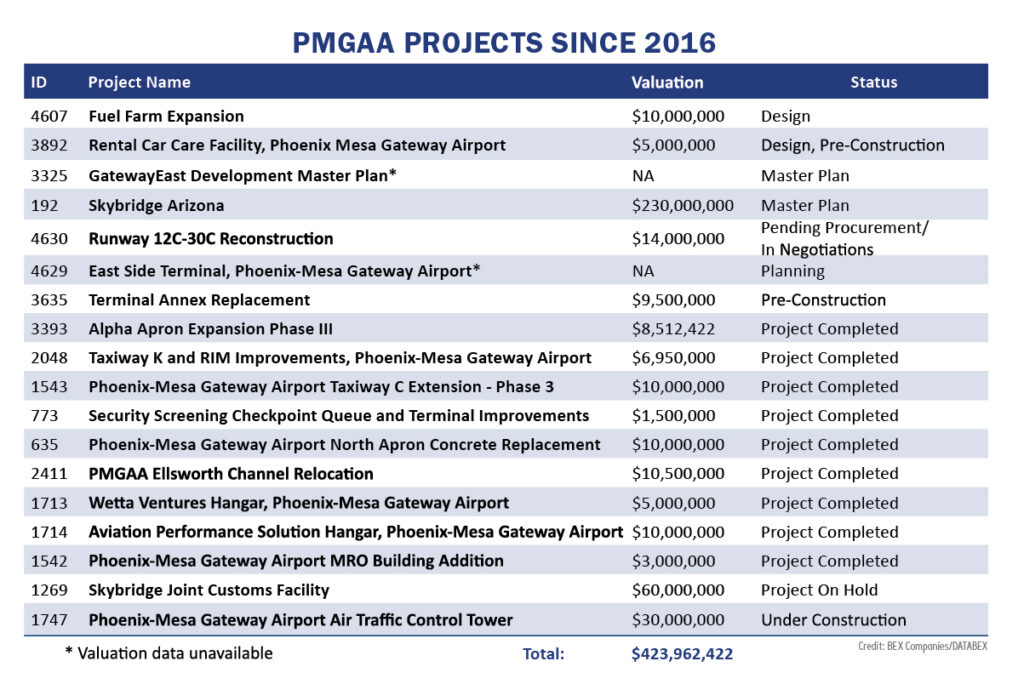

The Authority has been aggressive in its efforts to expand and modernize the airport in the last several years. Since its launch in 2016, DATABEX has input and tracked 18 PMGAA projects, including two master plans, with a known total valuation of nearly $425M. To date, half of those projects have been delivered.

Airport Fuels Entire Region

PMGA has been a key driver of growth in the overall 85212 ZIP Code, one of the Valley’s fastest developing areas. The airport, combined with freeway proximity and existing and expanding rail service, has been a major driver for private industrial development and the residential and commercial projects that support it.

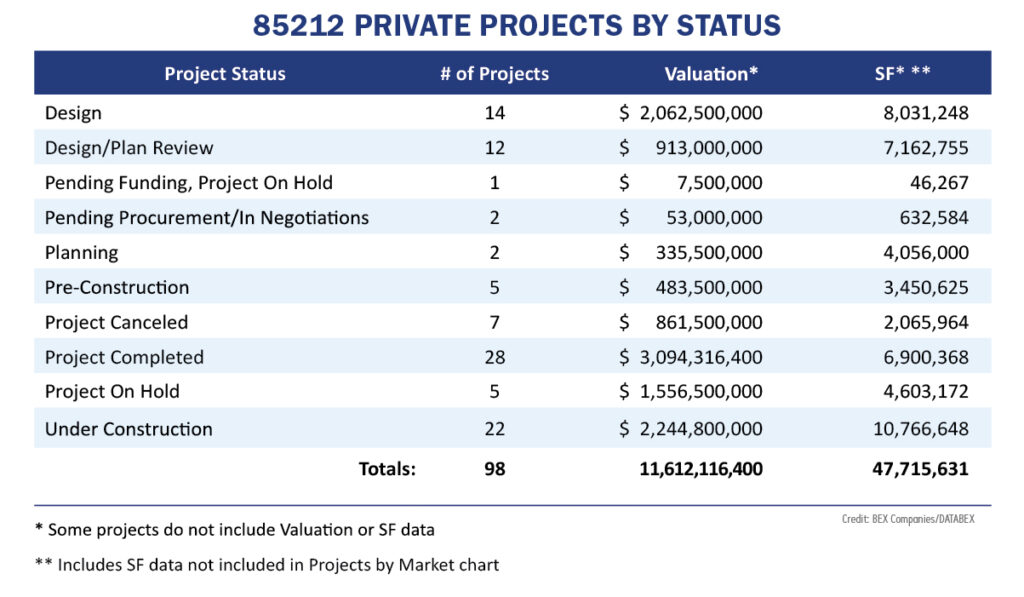

Not including master plans, DATABEX has input and tracked a total of 98 private developments in 85212 since 2016.

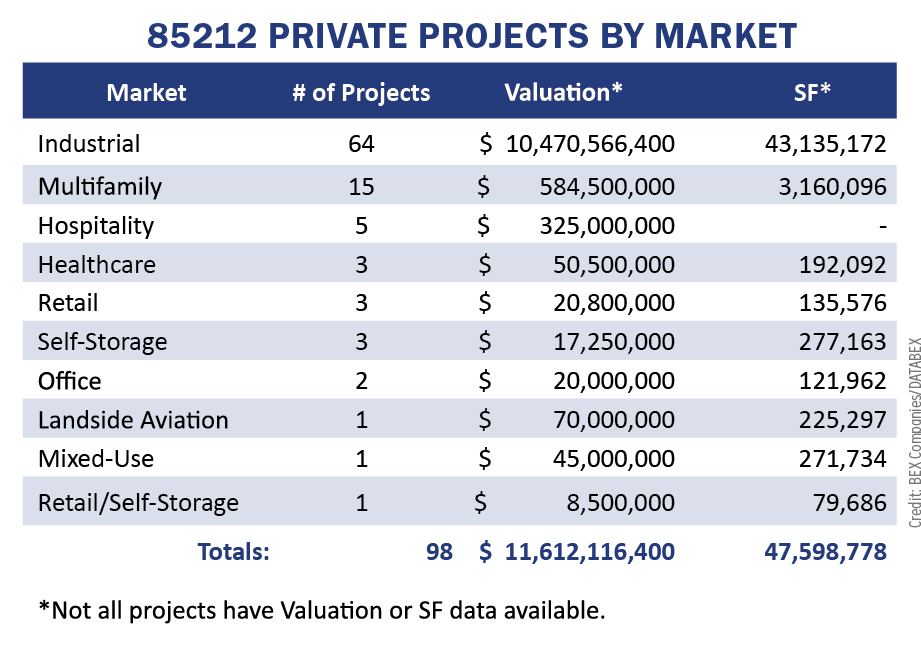

Not surprisingly, given the amount of available land at the start of the latest development push and the easy access to intermodal transportation options for products and materials, Industrial has been the primary project type in the area, accounting for 64 of the 98 projects tracked by DATABEX.

85212’s Industrial development makes it one of the leading ZIP Codes in the state, with known project valuations totaling nearly $10.5B and encompassing more than 43MSF of space.

While Industrial’s booming pace in the area far outpaces any other sector, that degree of growth in employment also fuels residential development to accommodate employees and their families. Not including one canceled project and one master plan with no supporting details, DATABEX has 15 Multifamily projects in various stages of development and across all types, including apartments/condos, Build-to-Rent, and senior living.

Even though the number of Multifamily projects is far eclipsed by the volume of industrial, the numbers are still impressive. Of the Multifamily projects with available data, planned Multifamily development in 85212 totals $721.5M in construction valuations for a total of 4,006 units. Of those, four projects have been completed, supplying 756 units at a cost of $127.5M. Two projects, totaling 473 units and $59M, are currently under construction.

In the world of economic development, it is rare to see actual synchronicity between public entities and infrastructure projects with private development across market sectors and needs.

The scale and pace of growth and modernization at PMGA and the scale and pace of growth and development in the immediately surrounding area cannot be said to be 100% in lockstep – that would be impossible without having time travelers or prophets on both private and public payrolls – but the harmony between the two sectors in and around 85212 goes far beyond the regular standard. Relying on the wisdom of the adage, “Past behavior is the best indicator of future performance,” industry watchers, such as myself, both hope and expect this type and degree of mutually beneficial symbiosis to continue for the foreseeable future.