Sales Transactions

1. MG Properties Group purchased Centra, a five-story, 223-unit podium-style multifamily property in Midtown Phoenix for $74.5M. Steven Nicoluzakis and David Fogler of Cushman & Wakefield represented the seller, FORE Property.

1. MG Properties Group purchased Centra, a five-story, 223-unit podium-style multifamily property in Midtown Phoenix for $74.5M. Steven Nicoluzakis and David Fogler of Cushman & Wakefield represented the seller, FORE Property.

2. APRA Capital purchased Sundown Village, a 330-unit multifamily property at 8215 N. Oracle Road, Tucson, for $54.45M, from HSL Properties. Hamid Panahi, Steve Gebing and Cliff David of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller and procured the buyer.

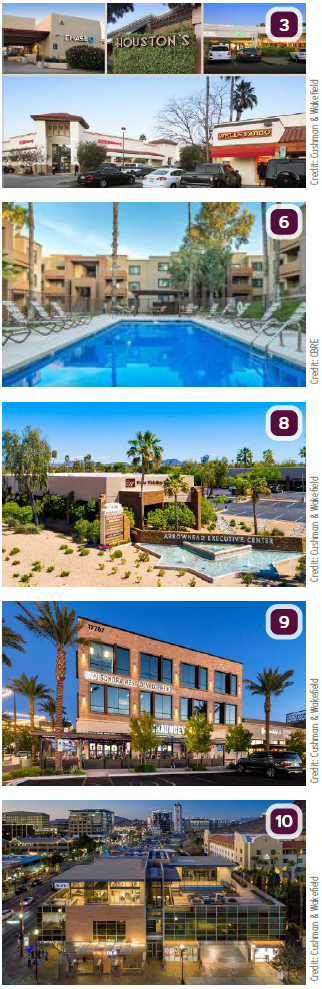

3. Federal Realty Investment Trust purchased The Shops at Hilton Village, a 92.7KSF trophy shopping center at the NEC of Scottsdale Road and McDonald Drive, Scottsdale, for $37.5M, from an affiliate of RED Development. The seller was represented by Michael Hackett and Ryan Schubert with Cushman & Wakefield in Phoenix. RED has retained a minority ownership interest in the property and will continue to lease and manage the project.

4. Capital Allocation Partners purchased two apartment communities, the 134-unit Sakara Tempe and the 36-unit Sakara Villas at Tempe, for $30.5M total, from GoodLife Housing Partners. Cliff David and Steve Gebing of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller and procured the buyer.

5. Andover Properties, LLC (dba Storage King USA), acquired a two-property portfolio, located at 4068 E. Fort Lowell and 5650 W. Coca Cola Place, Tucson, for $30.3M. Combined, the two properties total over 200,000 NRSF across 1,750 storage units.

6. EQ Exeter Property Group purchased a three-building office and industrial property at 1890 & 1900 S. Price Road and 3200 W. Germann Road, Chandler, for an undisclosed amount. Originally a build-to-suit for Amkor Technology, the property features one two-story 41.6KSF office building, a three-story 76.4KSF office building, and a 123.7KSF industrial building. CBRE’s Barry Gabel, Chris Marchildon and Will Mast represented the seller, Digital Realty Trust. EQ Exeter Property Group plans to reposition the existing buildings.

7. Clear Capital purchased Urban Park Apartments, a 104-unit multifamily property at 948 E. Devonshire Avenue, Phoenix, for $20.8M. Newmark Knight Frank’s Managing Director Chris Canter, Senior Managing Director Brett Polachek and Executive Managing Director Brad Goff represented the seller, Allante Properties.

8. Woodside Health purchased Arrowhead Executive Center, a 99.1KSF multi-tenant office complex at 17235 N. 75th Avenue, Glendale, for $18.2M. Cushman & Wakefield’s Steve Lindley represented the seller, Holualoa Companies. Bill Cook and Perry Gabuzzi of Plaza Companies provided market leasing advisory.

9. Ronal, LLC purchased Chauncey Lane Marketplace, a newly constructed Class A mixed-use office/retail property at 17757 & 17767 N. Scottsdale Road, Scottsdale, for $17.4M, from Chauncey Retail Partners, LLC. Cushman & Wakefield’s Eric Wichterman and Mike Coover brokered the transaction.

10. Nicola Wealth Real Estate purchased a 22.2KSF Class A mixed-use office property at 425 S. Mill Avenue, Tempe, for $16.7M, from Wexford Developments. Cushman & Wakefield’s Steve Lindley, Eric Wichterman and Mike Coover brokered the transaction.

11. An undisclosed buyer purchased approximately 173 acres off State Route 89A west of Sedona for $14.75M, from Ingrid Hills. Ed Pennington and Jeanette Sauer were the agents for the seller. Sedona broker Roy Grimm represented the land’s new owners.

12. MIG Real Estate purchased First Commons, a 95 percent leased, two-building industrial project at 4635 W. McDowell Road, Phoenix, for $10.75M. Tracy Cartledge and Robert Buckley with Cushman & Wakefield represented the seller, Enright Capital.

13. A California-based buyer purchased The Hardy luxury townhomes, a 20+ unit multifamily development at 909 W. 2nd Street, Tempe, for $10M. Linda Fritz-Salazar and Angelessa Ritchie of ORION Investment Real Estate represented the buyer. The seller, Pacific Rim Property Investments Ltd., was also the builder/developer that completed the luxury townhome project in 2020.

13. A California-based buyer purchased The Hardy luxury townhomes, a 20+ unit multifamily development at 909 W. 2nd Street, Tempe, for $10M. Linda Fritz-Salazar and Angelessa Ritchie of ORION Investment Real Estate represented the buyer. The seller, Pacific Rim Property Investments Ltd., was also the builder/developer that completed the luxury townhome project in 2020.

14. MAR Group purchased EoS Fitness, a 38KSF net-leased property at 1727 W. Ranch Road, Tempe, for $9.628M. Mark Thiel, senior managing director investments in Marcus & Millichap’s San Diego Del Mar office, procured the buyer and had the exclusive listing to market the property on behalf of a private preferred developer for EOS Fitness. Ryan Sarbinoff, regional manager and broker of record in Marcus & Millichap’s Phoenix office, assisted in closing this deal.

15. Andrew Fosberg, Dylan Brown and Chris Ackel with CBRE brokered the $4.671M sale of Community Medical Services, a long-term, absolute triple-net leased medical office with excess land at 2806 W. Cactus Road, Phoenix. The buyer and seller were not disclosed.

16. A San Diego investor purchased the 22.8KSF Pep Boys Supercenter at 4491 E. Speedway, Tucson, for $3.75M. Simon Assaf with Matthews Real Estate Investment Services of Phoenix handled the transaction. The seller was not disclosed.

17. Art Hasan purchased Mountain Top Village Apartments, a 36-unit apartment complex at 4850 S. White Mountain Road, Show Low, for $3.65M, from Maurice and Beverly Stewart. Managing Director, Neil Sherman CCIM and Dana Hearon from Sperry Commercial – Insignia CRE in Phoenix represented both the buyer and the seller.

18. Jack Berg Family Limited Partnership purchased the 4.1KSF True Health Medical building at 4828 S. Val Vista Drive, Chandler, for $2.3M, in a single-tenant NNN investment sale. SVN|Desert Commercial Advisors’ Director of Retail Leasing and Sales Investments, Rommie Mojahed, represented the seller, True Health Holdings, LLC.

19. Miedema Produce, Inc. purchased +/- 80 acres located at the NWC of Bethany Home Road and Citrus Road for an undisclosed amount. The property is currently being planned for 228 single-family homesites. Brad Kuiper, Howard Weinstein, and Patty Lafferty of The Land Agency represented the buyer.

20. Landsea Homes Corporation closed on 247 homesites at Bentridge in Buckeye for an undisclosed amount. Construction on the new homes is slated to begin in 2022.

Lease Transactions

21. Silver Mountain Mining Operations Inc. leased 12.4KSF from SN Investment Properties LLC at 10861 N. Mavinee Drive. The space will be primarily offices with some storage capacity to support the mining operations. Paul Hooker, with PICOR, represented the tenant and Jesse Blum and Ian Stuart, with CBRE, represented the landlord.