Sales Transactions

1. A private party purchased Copper Falls, a newly constructed, 240-unit multifamily asset in Glendale, for $72M. Steve Gebing and Cliff David, Executive Managing Directors with Institutional Property Advisors (IPA), a division of Marcus & Millichap, procured the buyer and represented the seller, P.B. Bell.

1. A private party purchased Copper Falls, a newly constructed, 240-unit multifamily asset in Glendale, for $72M. Steve Gebing and Cliff David, Executive Managing Directors with Institutional Property Advisors (IPA), a division of Marcus & Millichap, procured the buyer and represented the seller, P.B. Bell.

2. IHP Capital Partners and Värde Partners have formed a joint venture (JV) to acquire the remaining 3,721 acres of land for development within Vistancia, a 7,100-acre mature master-planned community in Peoria, for $68M. In April, IHP Capital Partners bought 429.75 acres at the SWC of Loop 303 and Lone Mountain Parkway in Peoria for about $17.683M and the joint venture bought the remaining empty land from Vistancia Residential LLC for about $50.32M.

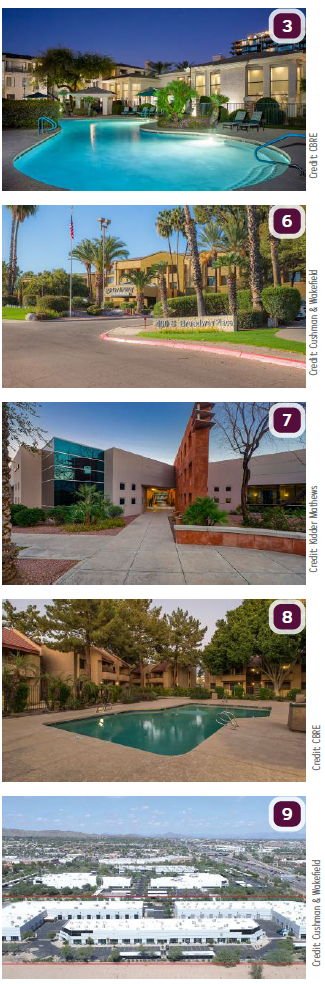

3. Sunroad Enterprises purchased The Paragon at Kierland, a 276-unit multifamily community in North Scottsdale, for an undisclosed amount. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter and Matt Pesch represented the seller, Sentinel Real Estate Corporation.

4. ZMR Capital purchased Tides on 25th, a 240-unit apartment community at 15620 N. 25th Avenue, Phoenix, for $40.6M. Newmark Knight Frank’s Senior Managing Director Brett Polachek, Executive Managing Director Brad Goff and Managing Director Chris Canter represented the seller, Tides Equities.

5. Shea Homes purchased land in Mesa just south of the popular Cadence at Gateway master-planned community at the SWC of Crismon and Williams Field Roads, for $36.48M. The deal closed June 1st, with Nate Nathan and Courtney Buck of Nathan & Associates Inc. brokering the 141-acre land transaction.

6. A joint venture between Harrison Street and Stellar Senior Living purchased Broadway Proper, a 232-unit independent and assisted living community in Tucson for an undisclosed amount, from Lytle Enterprises. The Cushman & Wakefield team involved in the transaction included Vice Chairman Richard Swartz, Executive Managing Director Jay Wagner, Managing Director Aaron Rosenzweig, Director Dan Baker, and Associate Bailey Nygard.

7. The Kidder Mathews team of Senior Vice President Michael Dupuy and Vice President Rachael Thompson represented the undisclosed seller in the disposition of three medical office buildings in the West Valley for a total of $32.85M. The deals included:

8. Everest Holdings purchased Country Villa, a 130-unit multifamily community at 950 N. Gilbert Road, Gilbert, for $25.95M. CBRE’s Tyler Anderson, Sean Cunningham, Asher Gunter and Matt Pesch represented the seller, ColRich Group.

9. Westmount Realty Capital, LLC purchased Mountain Vista Commerce Center, a 134.7KSF flex industrial and office complex in Ahwatukee Foothills for $17.4M, from Northstar Commercial Partners. Cushman & Wakefield’s Eric Wichterman, Mike Coover, Steve Lindley, Bob Buckley and Tracy Cartledge represented the seller. Adam Tolson of Lee & Associates provided market leasing advisory.

10. Emmerson Holdings purchased 1,160 acres of land southwest of Warren and Papago Road outside of Maricopa, for $11.6M, from Miedema Produce Inc. The Land Agency represented the seller.

11. Equity Land Group recently closed on three separate properties for a combined purchase of $10M. Equity Land Group purchased six acres located at Glendale Avenue and Loop 101. It then added in a ten-acre plot located near the corner of Camelback Road and North Litchfield Road, as well as seven acres in Buckeye, off Miller Road and the I-10 Freeway.

12. Denali National Trust bought 3.82 acres of land at 7301 E. Helm Road, Scottsdale, for $6.158M, from Windrose Square LLC.

12. Denali National Trust bought 3.82 acres of land at 7301 E. Helm Road, Scottsdale, for $6.158M, from Windrose Square LLC.

13. Johnson Family Trust purchased a portion of the former Grant Road Lumber Contractor Yard, 3361 E. 36th Street, Tucson, for $3.55M. The deal includes 77.6KSF feet of structures including a 13.3KSF office building, a 7.5KSF office/warehouse, and 56.9KSF of warehouses and canopy type storage structures. Dean Cotlow with Cotlow Company self-represented the seller, CA 36th Street American, LLC, and Ken Hulbert with Daum Commercial Real Estate Services represented the buyer. Property was fully leased at time of sale leased to NPL Construction Co.

14. A private investor purchased Madison on Maryland, a 13-unit apartment property at 6502 N. 12th Street, Phoenix, for $3.185M. Paul Bay and Christian Trujillo with Marcus & Millichap’s Phoenix office had the exclusive listing to market the property on behalf of the seller, a private investor. Bay procured the buyer.

15. A private investor purchased V on 26th, a 11-unit apartment property at 4241 N. 26th Street, Phoenix, for $2.75M. Paul Bay, first vice president investments in Marcus & Millichap’s Phoenix office, procured the buyer. The seller was undisclosed.

16. 1401 E. Adelaide Dr., LLC purchased Village Green Townhomes, a 25-unit, garden-style apartment community at 1401 E. Adelaide Drive, Tucson, for $2.4M. James P. Robertson Jr., MBA, CCIM, Associate Broker: Investment & Commercial Brokerage and Omer Kreso both with Realty Executives Arizona Territory represented the buyer. The seller was represented by Laura Grijalva and Ed Garcia with Grijalva Realty.

17. Verma Land purchased a 7.2-acre commercial land parcel located off of Interstate 10 and Miller Road, Buckeye, for $2.35M. Nick Miner, CCIM and J.T. Taylor of ORION Investment Real Estate represented the seller, Schmitzer Family Trust, while Samil Lallian of HomeSmart represented the buyer.

18. An undisclosed buyer purchased RISE Services, Inc., an 8.9KSF net-leased property at 12129 W.Bell Road, Surprise, for $2M. Chris Lind and Mark Ruble, investment specialists in Marcus & Millichap’s Phoenix office, had the exclusive listing to market the property on behalf of the seller, a limited liability company.

Lease Transactions

19. Integrity Capital LLC obtained $2.65M refinance loan for Steel Partnership Warner & Lindsay to lease a 17.3KSF retail center located in Gilbert at 911 S. Lindsay Road and 861 E. Warner Road. The retail center was built in 2006 and houses multiple businesses and 69 plots for on-site parking.