By Roland Murphy for AZBEX

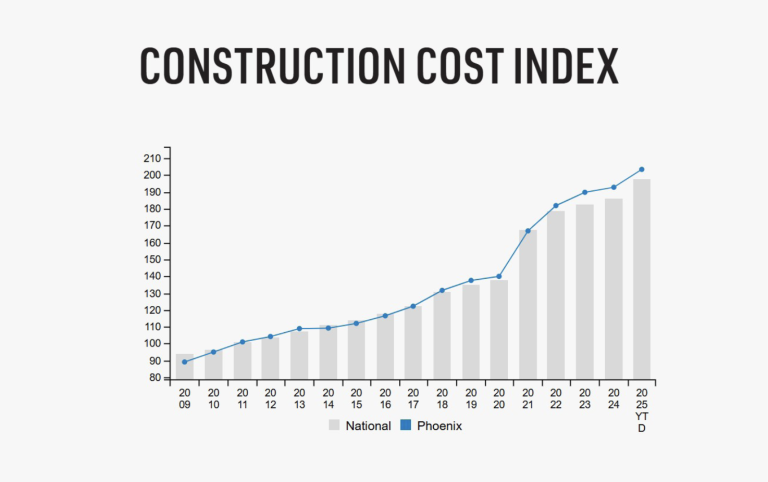

Mortenson’s Q3 2025 Cost Index for Phoenix shows the metro has experienced a slight increase in construction costs but is holding steady in the face of market pressures.

The report notes contractors are reporting consistent bidding activity, and owners are demonstrating the confidence to move previously delayed projects forward. Supply chains are stabilizing, and price volatility has relaxed across major trades.

The overall environment is cautious but guardedly hopeful, the report says. Planning activity is up in the Commercial and Institutional sectors, and starts were up in September.

Across the country, costs increased 1.16% over Q2 and 6.6% year-over-year. All of Mortenson’s regional offices saw modest cost increases in Q3. Salt Lake City’s 1.65% was the largest. Portland and Chicago reported 0.78%, tying for the smallest reported increase.

Phoenix’s increase of 1.42% over the quarter put it in second place. The metro saw an increase of 5.9% over the last 12 months.

Construction employment remained stable, Mortenson said, although data was unavailable for September because of the government shutdown.

“Construction material costs remain elevated,” the report said, “amid a gradually stabilizing but volatile global supply chain, affected by economic uncertainty, tariffs, and fluctuating demand. Steel and copper continue to experience notable, upward price swings.”

Even though costs are largely stabilizing, the design pipeline continues to experience pressure. In September, the AIA/Deltek Architecture Billings Index fell to 43.3, suggesting future project starts may continue to take “a measured pace.”

The report concludes by saying, “Looking ahead, overall construction conditions are expected to remain steady through the remainder of 2025. Input cost volatility has eased, and lead times are improving, though certain commodities and global supply chains still face elevated uncertainty. Labor availability continues to vary by region and trade, though wage growth has moderated from earlier peaks. Competitive bidding persists in several markets, helping to keep escalation in check. While select sectors such as manufacturing and data centers continue to drive demand, most markets are tracking at a consistent pace. Barring major policy or supply disruptions, the outlook for nonresidential construction remains broadly stable.”